FX Fortnite EA is a grid trading EA that trades in both buy and sell directions at the same time.

It is a high risk EA as it holds a large number of positions.

| Price | $149 |

| License | 1 account per license |

| Currency pair | EURCHF |

| Terminal | MT4 |

| Money back guarantee | 30 Day Money-Back Guarantee |

Live performance (forward test results) of FX Fortnite EA

You can see that there is a discrepancy between the account balance and equity. This is because this EA does not set a stop loss and continues to hold a large amount of positions.

Equity may not be reflected correctly on FXBlue.

In reality, a slightly larger equity drawdown may have occurred.

Trading strategy of FX Fortnite EA

The trading method of FX Fortnite EA is grid trading.

This EA will open additional positions if the price moves unfavorably from the first position. Continue to hold the position until the total position becomes profitable.

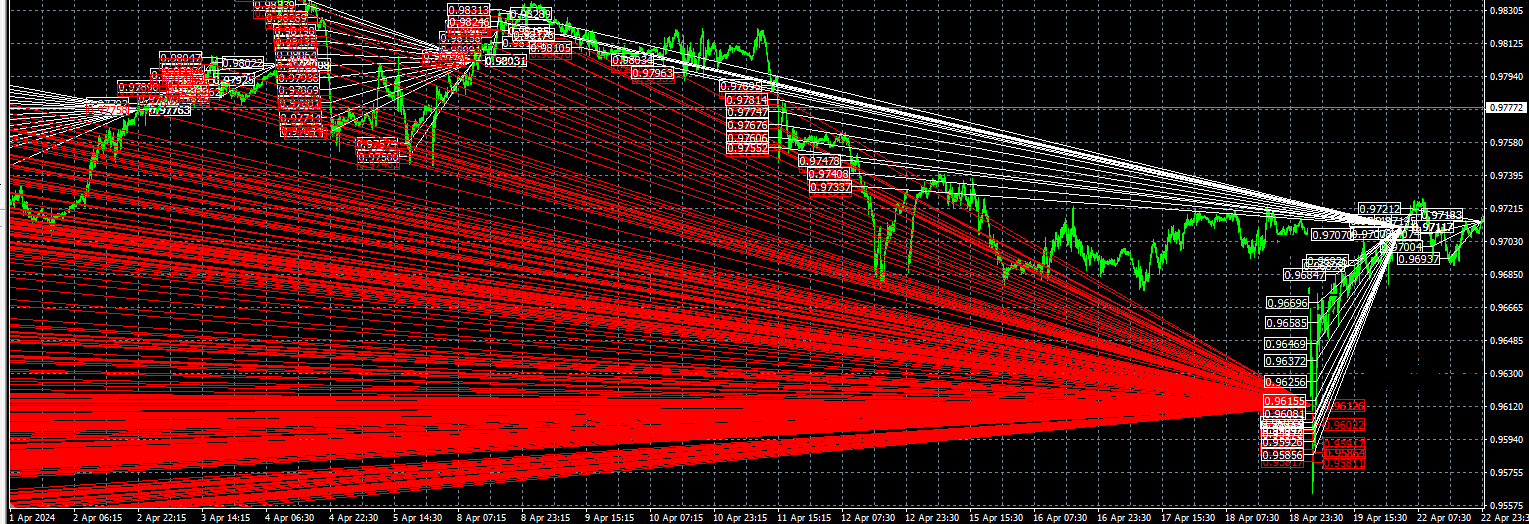

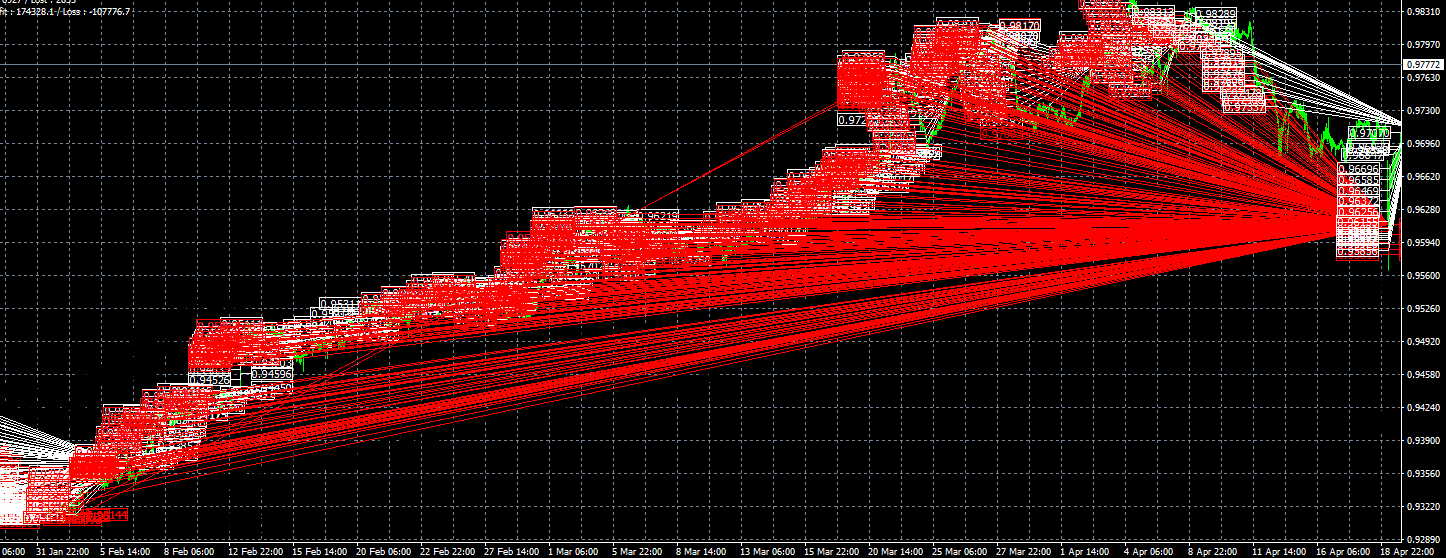

The MT4 trading history chart below shows this EA executing grid trades.

■EURCHF 1 minute chart White=Buy entry Red=Sell entry

The chart image above is a 1 minute time frame. You can see how this EA aggressively opens positions.

Grid for both buy and sell directions

FX Fortnite EA opens positions in both buy and sell directions.

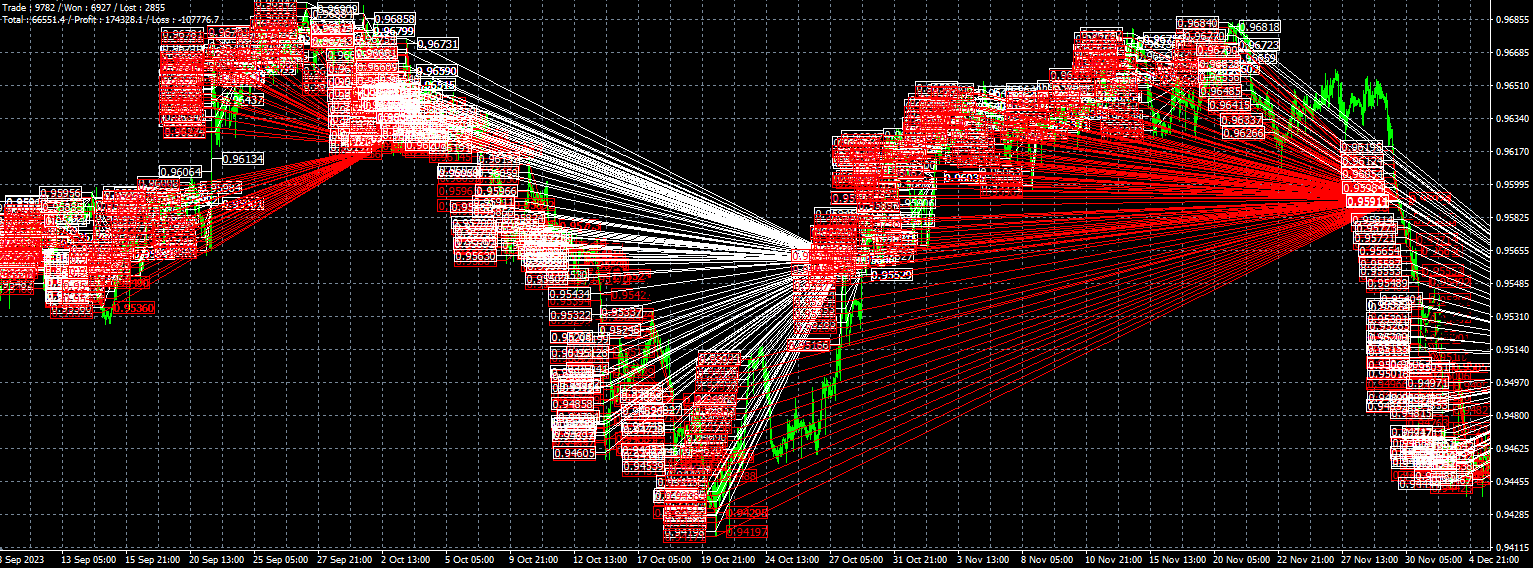

The MT4 trading history chart below shows a situation in which profits are earned from grid trades in the buy direction while holding a large amount of sell positions.

■EURCHF 15 minute chart White=Buy entry Red=Sell entry

Large number of positions

A typical grid trading EA leaves an interval of about 50 to 100 pips from the previous position.

On the other hand, FX Fortnite EA opens additional positions at intervals of 5 pips to 10 pips.

Therefore, it holds a very large amount of positions.

The table below is an excerpt from a series of trade history of the FX Fortnite EA.

You can see that buy positions are opened one after another at intervals of about 7 pips.

| Open time | Close time | Symbol | Lots | Buy/sell | Open price | Close price | Pips interval from previous position |

| 2022/08/22 17:27 | 2022/08/23 10:42 | EURCHF | 0.01 | Buy | 0.95970 | 0.95851 | 7.0pips |

| 2022/08/22 18:39 | 2022/08/23 10:42 | EURCHF | 0.01 | Buy | 0.95900 | 0.95851 | 7.2pips |

| 2022/08/22 19:45 | 2022/08/23 10:42 | EURCHF | 0.01 | Buy | 0.95828 | 0.95851 | 9.3pips |

| 2022/08/23 8:21 | 2022/08/23 10:42 | EURCHF | 0.01 | Buy | 0.95735 | 0.95851 | 7.4pips |

| 2022/08/23 9:28 | 2022/08/23 10:42 | EURCHF | 0.01 | Buy | 0.95661 | 0.95851 | 7.1pips |

| 2022/08/23 9:34 | 2022/08/23 10:42 | EURCHF | 0.01 | Buy | 0.95590 | 0.95851 |

Lot size does not increase

As you can see from the lot size in the table above, the FX Fortnite EA does not increase the lot size of additional positions.

In other words, this EA does not use the martingale method.

FX Fortnite EA dangers and risks

This EA opens additional positions with a very small pips width, so it holds a large number of positions.

From the MT4 trading history chart below, you can see that it holds a large number of positions.

■EURCHF 1 hour Chart White=Buy entry Red=Sell entry

It may seem like a crazy trade, but this is the feature of this EA.

The MT4 trading history chart below shows that this EA is holding a large amount of short positions in an uptrend.

■EURCHF 1 hour Chart White=Buy entry Red=Sell entry

If the price continues to rise, unrealized losses on a large number of short positions will increase significantly, and the account will eventually go bankrupt.

In this way, if a trending market occurs and the price continues to rise or fall, a large amount of positions will be left behind and a large equity drawdown will occur.

If the trend continues for a long period of time, the account balance may drop to 0 all at once.

Nor Martingale does not necessarily reduce risk

As already explained, the FX Fortnite EA does not increase the lot size of additional positions.

In other words, this EA does not use the martingale method.

Not using martingales does not necessarily reduce risk.

By increasing the lot size of additional positions through martingale, profits can be made from relatively small price reversals.

On the other hand, this EA does not use martingale, so it cannot make a profit unless the price reverses significantly.

This leads to holding positions for a long period of time.

Therefore, the biggest weakness of this EA is that the trend market continues for a long time and the price continues to move in either direction.

Backtest results of FX Fortnite EA

EURCHF High Risk Setting

| Test start | 2020/1/2~ |

| Test end | 2020/09/09 |

| Operation period | 8months |

| Initial deposit | 1,000 |

| Operational lot size | Adjusted by balance |

| Final balance | 6,185 |

| Total net profit | 5,185 |

| Rate of return (overall) | 618.5% |

| Monthly rate of return (compound interest) | 25.6% |

| Monthly rate of return (simple interest) | – |

| Relative drawdown | 32.2% |

| Maximum drawdown (amount) | 1,332 |

| Profit factor | 1.58 |

| Winning rate | 78.3% |

| Total trades | 6891 |

EURCHF Middle Risk Setting

| Test start | 2020/1/2~ |

| Test end | 2020/09/09 |

| Operation period | 8months |

| Initial deposit | 1,000 |

| Operational lot size | Adjusted by balance |

| Final balance | 2,060 |

| Total net profit | 1,060 |

| Rate of return (overall) | 206.0% |

| Monthly rate of return (compound interest) | 9.5% |

| Monthly rate of return (simple interest) | – |

| Relative drawdown | 37.7% |

| Maximum drawdown (amount) | 987 |

| Profit factor | 1.62 |

| Winning rate | 71.6% |

| Total trades | 2164 |

EURCHF Low Risk Setting

| Test start | 2020/1/2~ |

| Test end | 2020/09/09 |

| Operation period | 8months |

| Initial deposit | 1,000 |

| Operational lot size | Adjusted by balance |

| Final balance | 1,531 |

| Total net profit | 531 |

| Rate of return (overall) | 153.1% |

| Monthly rate of return (compound interest) | 5.5% |

| Monthly rate of return (simple interest) | – |

| Relative drawdown | 19.5% |

| Maximum drawdown (amount) | 299 |

| Profit factor | 2.01 |

| Winning rate | 65.0% |

| Total trades | 614 |

The vendor of this EA has published backtest results for three settings.

Please note that the backtest was only run for 8 months.

This suggests that long-term trading will not yield good results.

Eight-month backtest results are not very helpful.

Vendor of FX Fortnite EA

Probably sold by the same vendor as Forex Enigma EA.

Forex Enigma EA is also an EA that trades on EURCHF pairs.

Conclusion of FX Fortnite EA

This EA grid trades very aggressively in both buy and sell directions at the same time. As a result, profits accumulate quickly.

However, because they hold an insane amount of positions, if a trending market occurs, their account will experience a huge drawdown. If the trend market continues, the account balance will be 0.

It may be fine for short-term use, but long-term use should be avoided.

The vendor has only run backtests for 8 months. If it is an EA that can withstand long-term operation, it should publish long-term backtest results.

Users should be aware of the risks and dangers of this EA before purchasing and using it.