- Martingale EA

- High profit rate in forward test

- Target for large pips with swingtrade

FXHELIX (EA) Basic Information

| Price | $249 |

| Currency Pair | AUDUSD |

| Time Frame | H1 |

| Trading Method | Martingale |

| Terminal | MT4 |

| Leverage | 1:50 or more |

| Minimum Deposit | $ 240 per 0.01 lot |

| Money Back Guarantee | The vendor offers 30 days money back guarantee. Only when the EA is operated according to the vendor’s recommended settings and drawdown of 40% or more occurs. |

It is an EA of the same type as FXSTABILIZER and FOREX TRUCK EA sold by the same vendor.

FXHELIX EA is an ultra-high risk EA that trades more aggressively than these.

Targeted pips are wide and hold positions for days to weeks. It holds both BUY and SELL positions together (hedging).

Also, the FXHELIX martingale logic is relatively complex. The price and lot size of additional entries will change depending on the market situation.

It is a popular EA because it shows high profitability in the forward test.

Profitability / Drawdown

Broker:FXOpen(Real Account)

Start Date:July 4, 2018

The maximum drawdown is 52%, slightly higher. On the other hand, it has survived forward test for about two years and has shown high profitability. The average monthly rate of return (compound interest) is about 10%.

Starting with balance of $ 2100, it has grown about eight times to about $ 18,000 in about two years.

Although you can specify the maximum drawdown with parameters, it should be recognized that the expected rate of return may be reduced if large loss occurs in the future.

Trading Method Analysis-Entry

Martingale EA is generally a contrarian.

On the other hand, FXHELIX is Market Follower.

Near the trend line (resistance line, support line), enter in the opposite direction aiming for price rebound is general method.

FXHELIX is the opposite. enter in the direction of the current price movement near the resistance and support lines.

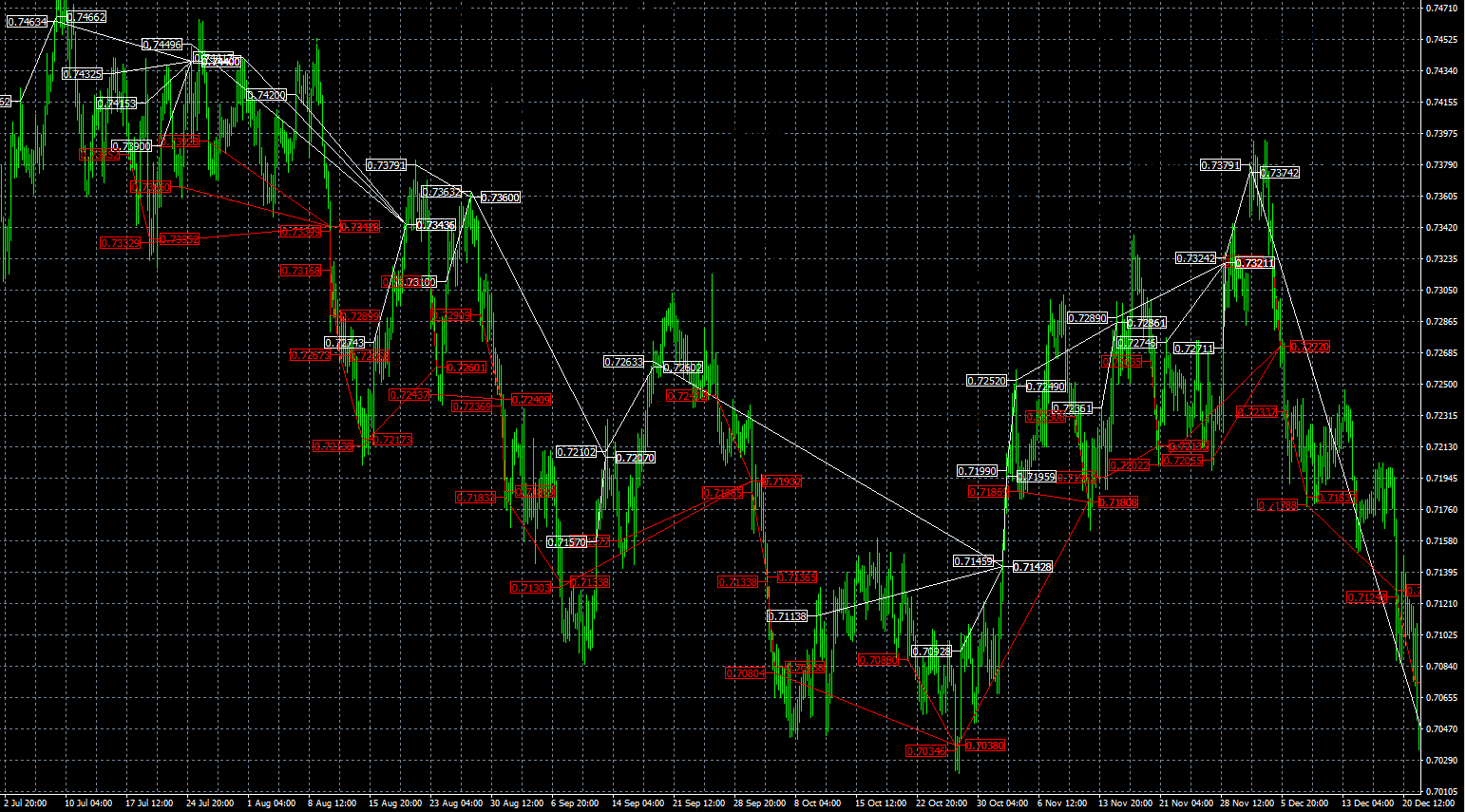

You can see that in the MT4 trading chart below.

■AUDUSD 1H White=BUY Red=SELL

FXHELIX holds both BUY and SELL positions simultaneously.

The line connecting the trading history looks like trendline. This is a distinctive method.

FXHELIX’s winning pattern seems to be that;

・Make first entry in the direction of current price movements near the support or resistance line.

・Make additional entry with increased lot size after floating loss occur.

・Close all positions when make floating profit by total positions.

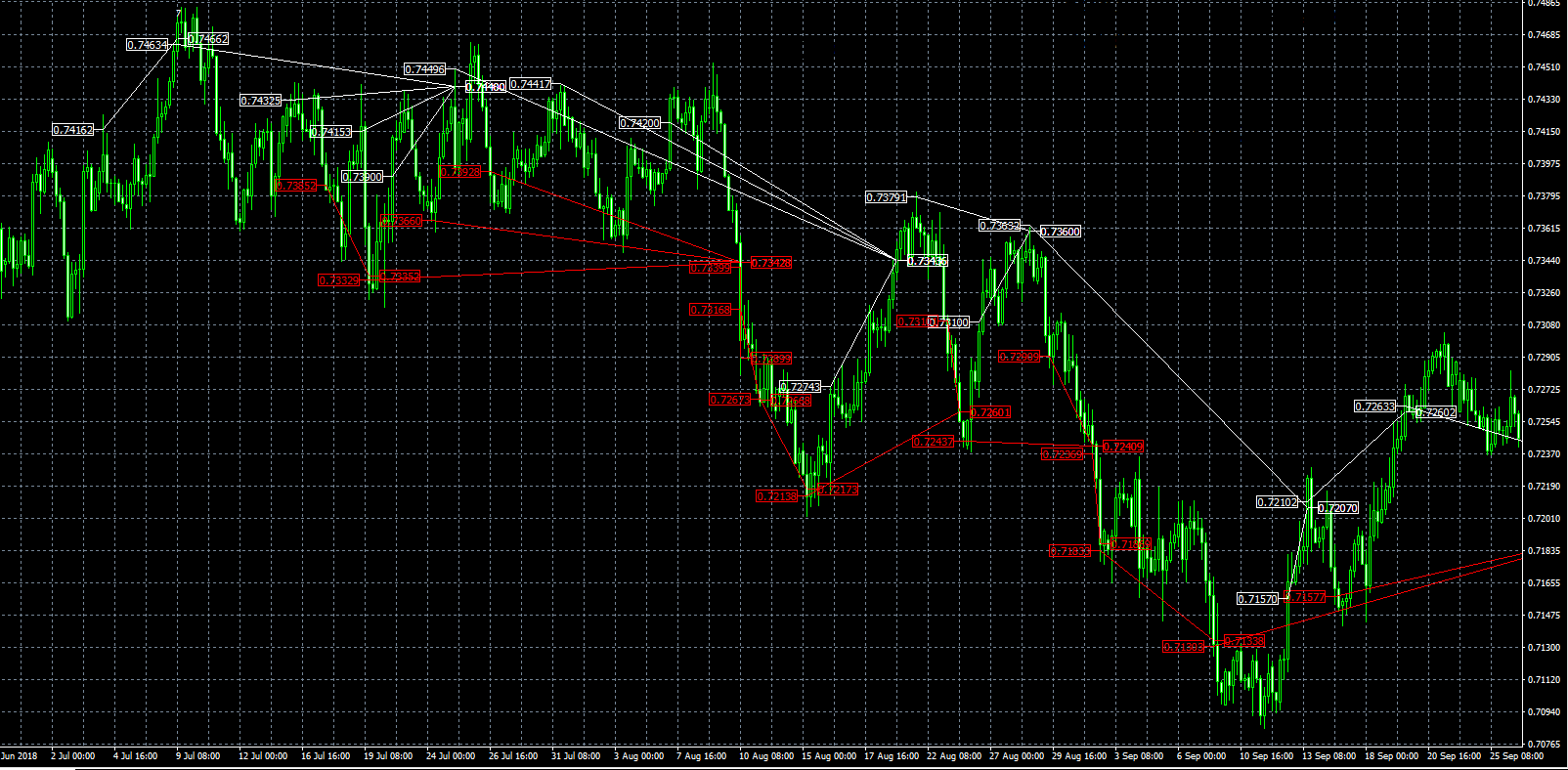

For reference, below is 4H MT4 transaction history chart.

■AUDUSD 4H White=BUY Red=SELL

■AUDUSD 4H White=BUY Red=SELL

Trading Method Analysis- Additional Entry

The timing for additional entries by FXHELIX’s martingale is not fixed pips distance.

FXHELIX make additional entries, after confirming that the market price has reversed in favorable direction.

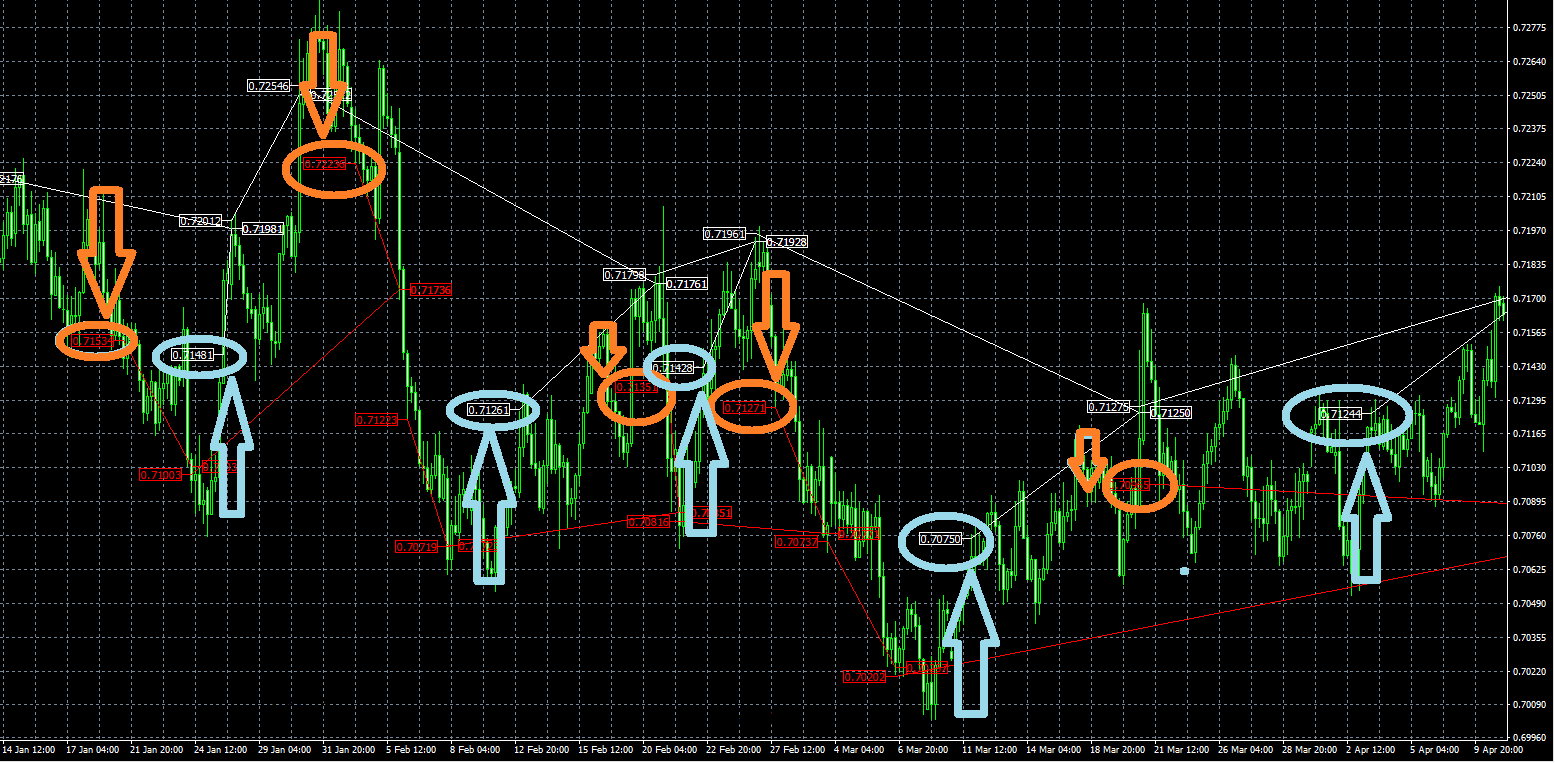

In the MT4 trading history chart below, plotted circles on additional entry points (SELL is orange, BUY is blue).

■AUDUSD 4H White=BUY Red=SELL

You can see that FXHELIX make additional entries after waiting for the market to reverse in favorable direction.

Trading Method Analysis- Increased Lot Size

Generally, martingale EAs will increase the lot size at fixed rate (2x, 3x, etc.) with each additional entry.

On the other hand, FXHELIX does not increase the lot size at fixed rate, and decide lot size according to the pips distance from the previous entry.

The larger the distance from the previous entry, the larger the lot size of the next position.

The table below is example of pips distance from the previous entry and lot size increase.

(1) In the table below, all additional entry prices are within 31pip from the previous entry. And lot size has not increased significantly.

| Open Date | Buy/Sell | Pips distance from previous entry |

Size | Lot Ratio |

| 2018.07.09 10:00 | Buy | 0.10lot | ||

| 2018.07.16 04:33 | Buy | 30.9pips | 0.11lot | ×1.1 |

| 2018.07.19 04:30 | Buy | 17.2pips | 0.11lot | ×1.0 |

| 2018.07.20 15:34 | Buy | 25.3pips | 0.16lot | ×1.5 |

| Open Date | Buy/Sell | Pips distance from previous entry |

Size | Lot Ratio |

| 2018.09.07 15:32 | Sell | 0.15lot | ||

| 2018.09.14 19:06 | Sell | 27.4pips | 0.16lot | ×1.1 |

| 2018.09.27 04:38 | Sell | 85.5pips | 0.47lot | ×2.9 |

(3)In the table below, the second entry is 149.5pip away from the previous entry, which is 3.4 times lot size from the previous entry.

On the other hand, the third entry is only 21pips away from the previous entry, and is about half lot size of the previous entry.

| Open Date | Buy/Sell | Pips distance from previous entry |

Size | Lot Ratio |

| 2018.09.19 17:42 | Buy | 0.15lot | ||

| 2018.10.10 02:30 | Buy | 149.5pips | 0.51lot | ×3.4 |

| 2018.10.26 19:00 | Buy | 21.0pips | 0.28lot | ×0.5 |

In this way, the lot size of the additional entry is determined by the distance from the previous entry.

Trading Method Analysis- Pips distance of Exit

After the first entry and get 50 pips floating profit, this EA take profit.

it is targeting such large pips.

On the other hand, if this EA have floating loss in the positions, wait for the market to reverse and then open additional positions.

Trading Method Analysis- Frequency

Since it only supports one AUDUSD currency pair and hold positions for few days to few weeks, the trading frequency will be low.

The total number of trades is 170 in 21 months, which means that one entry will be made in 2-3 days.

Forward Test Environment

FXHELIX’s forward test environment is a real account.

The trading environment differs between demo account and real account.

Even though the price movements look the same, there are differences in the execution such as slippage. So even if the same EA, the results may be different between demo and real.

FXHELIX targets large pips, so it is expected that the results will not change significantly between demo and real.

In the first place, the results with real account is open to the public, so it can be considered that it has been proven that profits can be made with real accounts.

Back Test Result

It is dangerous to believe in only the backtest results, and good to use it as reference information.

■[RiskLimit] setting=35%

| Start Date | 2016-01-04 | 2019-05-01 |

| 39months | ||

| Initial Balance | 10,000 | |

| Lot Size | Adjust according to balance (start from 0.37lot) |

|

| Final balance | 931,760 | |

| Total profit | 921,760 | |

| Total rate of return | 9317.6% | |

| Monthly rate of return (compound) | 12.3% | |

| Monthly rate of return (single) | – | |

| Relative max drawdown | 95.8% | |

| Maximal drawdown | – | |

| Profit factor | 2.02 | |

| Profit trades (% of total) | 72.1% | |

| Total trades | 416 | |

■[RiskLimit] setting=100%

| Start Date | 2016-01-04 | 2019-05-01 |

| 39months | ||

| Initial Balance | 10,000 | |

| Lot Size | Adjust according to balance (start from 0.14lot) |

|

| Final balance | 931,760 | |

| Total profit | 921,760 | |

| Total rate of return | 9317.6% | |

| Monthly rate of return (compound) | 12.3% | |

| Monthly rate of return (single) | – | |

| Relative max drawdown | 95.8% | |

| Maximal drawdown | – | |

| Profit factor | 2.02 | |

| Profit trades (% of total) | 72.1% | |

| Total trades | 416 | |

RiskLimit = 100% setting is not recommended because the maximum drawdown is 95.8%, which is dangerous.

It is better to operate with RiskLimit = 35% setting.

With this setting started at 0.14 lots with a balance of $ 10,000

The vendor’s recommendation is a minimum 0.01 lot for $250 to run this EA .

However, $ 250 is too small and dangerous.

Even with 0.01 lots, it is better to prepare balance of about $ 1000.

Parameter Settings

| AutoRisk | When activated, the lot size is automatically set according to the balance based on the following “MaxDrawDown” parameter. When false is selected, the first entry is made with the lot size entered in “Manual Lot”. |

||

| RiskLimit | Specifies the balance to be used for trading when “Auto Risk” is enabled. | ||

| Lot | When “Auto Risk” is disabled, the initial entry will be made with the lot size entered here. | ||

| Slippage | Allowable slippage value | ||

| Drawdown control | Balance protection function. If you select true, a stop loss will occur when the drawdown specified in “Risk Limit” occurs. If you select “false”, stop loss does not work. | ||

| NFA | Normally you can leave it as “false”. US regulated (NFA) brokers must use FIFO (first in, first out) and only need to be “true” for NFA regulated brokers, but you can usually leave it as “false”. |

||

Summary of FXHELIX (EA)

It is a popular EA because it shows a very high rate of return in the forward test.

The price and lot size of the additional entry are decided according to the market situation, so it feels reasonable.

However, since it is a martingale EA that operates with floating loss, it is recommended to use it after recognizing the possibility of large drawdown.

(You can control the maximum drawdown with the “Risk Limit” and “Drawdown control” parameters. Even if large drawdown occurs, there is no problem if it win in total.)

If the balance of the account is very small, there is high possibility that this EA can not bear floating loss. Therefore, it is desirable to operate with balance of $ 1000 or more.

Recommended Broker for FXHELIX

Some brokers offer 100% deposit bonuses that double your balance.

Martingale EA like FXHELIX operates with floating loss, so it is advantageous to have as many account balance as possible and it will operate stably. On the contrary, if the balance is small, the risk of large loss is high.

Therefore, the deposit bonus of Forex brokers is definitely good service to use.

Especially, the 100% bonus of “XM (XM Trading) Standard Account“ will cover the floating loss even if the equity balance reaches 0. (Other brokers only have the advantage of be able to open large position, and the bonus disappears when the equity balance reaches 0.)

With a deposit of $ 500, you can trade twice as much as $ 1000, and the maximum leverage is 888 times, which is the most advantageous operating environment for FXHELIX.

In addition to the double deposit bonus, you can also get an account opening $30 bonus at XM.

* To receive a 100% deposit bonus + $30 account opening bonus, select “Standard Account (1lot = 100,000)”. Bonus cannot be received with Zero account.

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.