EURUSD Simple Breakout Strategy EA (Free) By :

This EA is designed for EURUSD trading on 1-hour charts, focusing on breakout strategies. It features risk management, a compounding option, and ATR-based logic. Suitable for small capital, it balances steady profits with minimized risks, making it ideal for long-term wealth growth.

| Currency Pair | EURUSD |

| Time frame | 1H |

| Terminal | MT5 |

| Trading Style | No Martingale & No Grid |

Forward test is not conducted.

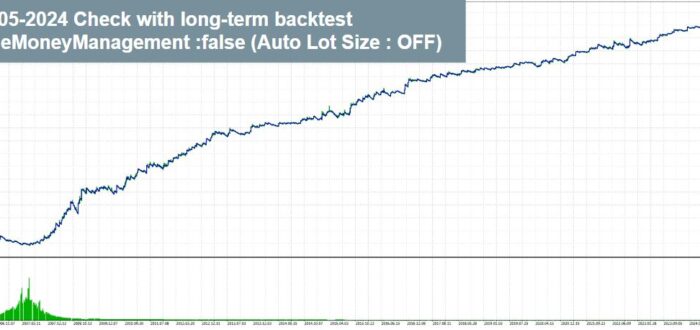

Backtesting

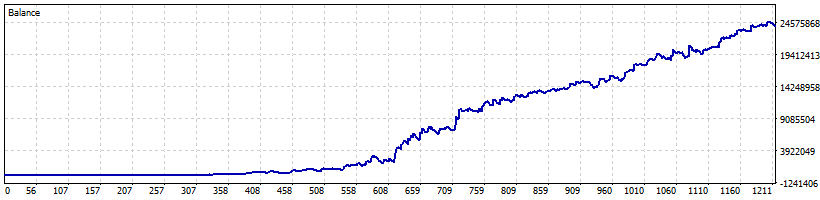

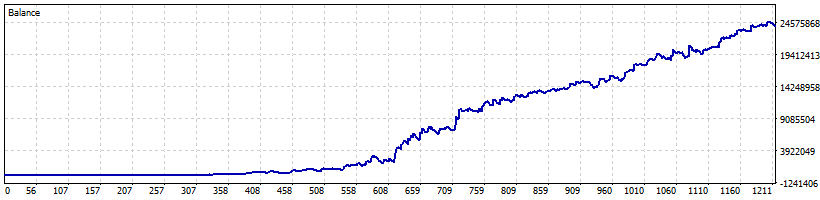

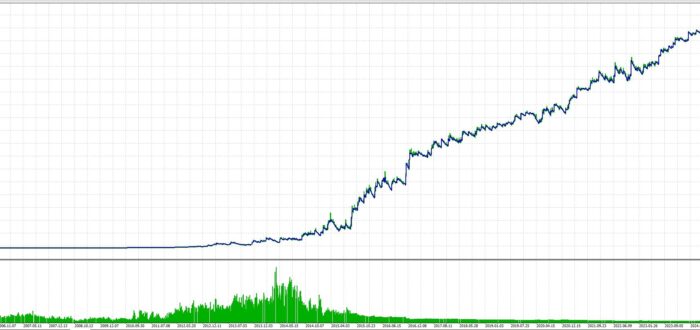

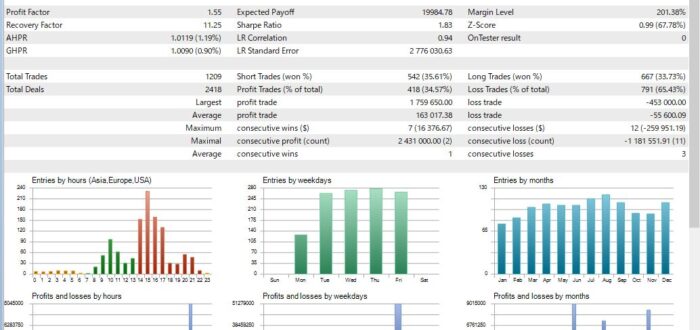

Test Period:2006.01.02 - 2024.10.05 (6851 days)

| Total Gain | 4832318.7% |

| Yearly Gain | 77.6% |

| Monthly Gain | 4.8% |

| Daily Gain | 0.16% |

| Relative Drawdown | 67.8% |

| Profit Factor | 1.55 |

| Currency | USD |

| Final Balance | 24162093.36 |

| Initial Deposit | 500 |

| Total Net Profit | 24161593.36 |

| Total Trades | 1209 |

| Ttimeframe | H1 |

Download This Free EA (EURUSD Simple Breakout Strategy EA (Free))

Description

Target Currency Pair and Timeframe

The target currency pair is EURUSD (Euro/US Dollar).

The timeframe used is 1-hour charts. This EA can be operated with a small initial investment and is equipped with an efficient compounding feature. To enable the compounding feature, set the parameter “UseMoneyManagement” to true. It is designed to focus on risk management while aiming for long-term profitability.

Main Features of the EA

This EA emphasizes risk management and includes features designed to efficiently and steadily target profits. Below are its main features:

- No Martingale or Grid Trading: The EA does not use high-risk martingale or grid trading. All positions have individual stop-loss settings to avoid excessive risk.

- Compounding Feature: Enables compounding with settings. Lot sizes are automatically adjusted based on the account balance, maximizing capital efficiency. It allows traders to target significant profits even with small initial capital.

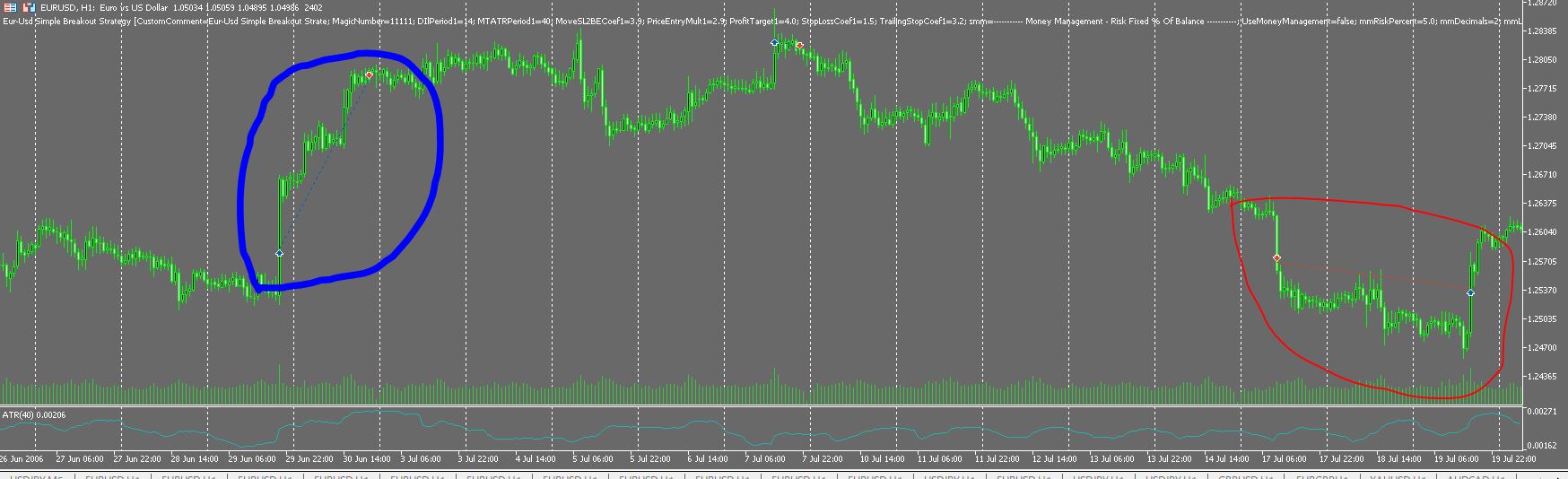

- Breakout Detection: Trading logic triggered by breakouts is implemented. Trades are entered during periods of increased market volatility to aim for substantial profits.

- Win Rate of 30–40%: Instead of excessively pursuing a high win rate, the EA leverages a superior risk-reward ratio, keeping losses small while aiming for large profits.

Overview of the Trading Strategy

This EA employs an entry strategy triggered by breakouts. The entry logic for “Buy” and “Sell” trades is symmetrical, enabling adaptability to dynamic market conditions.

Indicators Used

- Directional Indicators (DI+ / DI-): Used to analyze the direction of price movements.

- ATR (Average True Range): Measures volatility and is used to set entry prices and stop-loss levels.

Logic Overview

Entry signals are generated when specific market conditions are met. Specifically, the timing when DI+ and DI- decrease is identified as a sign of a breakout, triggering entries. Positions are managed as follows:

- Entry Points: Entries are based on price levels derived from ATR.

- Stop Loss and Profit Taking: Uses ATR-based stop losses and trailing stops.

- Automatic Stop Loss: All positions have stop-loss settings as part of comprehensive risk management.

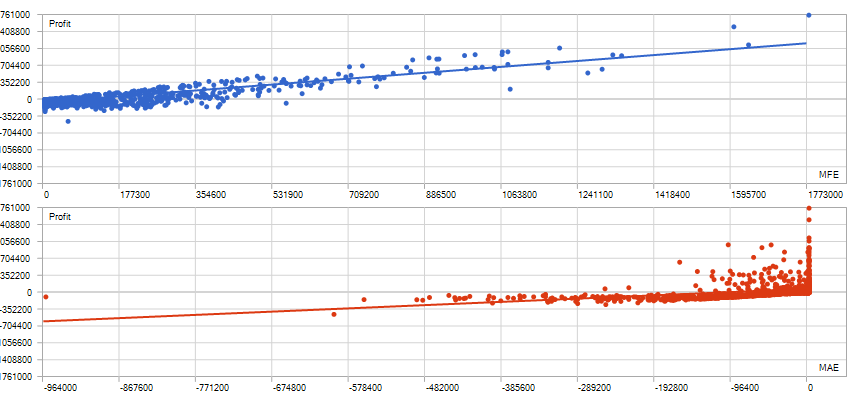

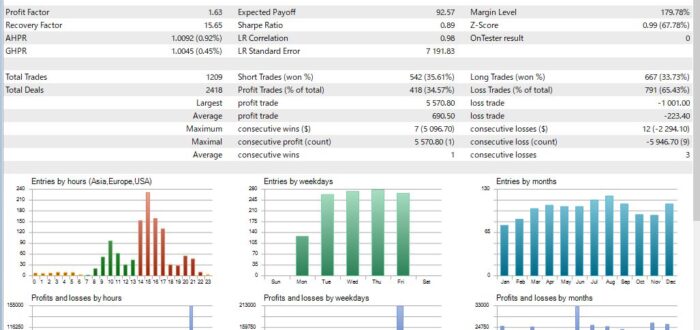

Backtest Results Analysis

Backtest period: H1 (2006.01.02 – 2024.10.05)

The following results are based on enabling the “UseMoneyManagement” parameter (set to true):

- Total Profit: Starting with an initial deposit of $500, the total profit during the backtest period was $24,161,593. This demonstrates the potential to achieve significant profits even with small initial capital.

- Profit Factor: A high value of 1.55 indicates that profits outweigh losses.

- Recovery Factor: An impressive 11.25, showcasing excellent recovery capability from significant drawdowns.

- Drawdown: The maximum relative drawdown was 67.76%. With the “UseMoneyManagement” parameter enabled, trade sizes are adjusted dynamically based on account balance, leading to larger profits but also higher drawdowns. Lowering the “mmRiskPercent” parameter can reduce drawdowns but may also limit profits.

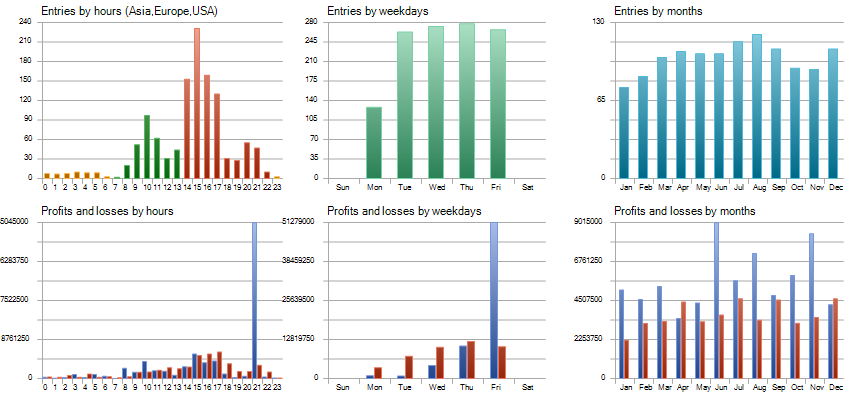

- Number of Trades: A total of 1,209 trades were executed, with an average of approximately 5.5 trades per month, indicating a moderate trading frequency.

- Win Rate: 33.73% for long trades and 35.61% for short trades. Although the win rate is not high, this highlights the EA’s focus on minimizing losses while pursuing large profits.

- Consistency: Maximum consecutive wins: 7; maximum consecutive losses: 12. Risk management is effectively implemented.

- Sharpe Ratio: A solid 1.83, indicating attractive risk-adjusted returns.

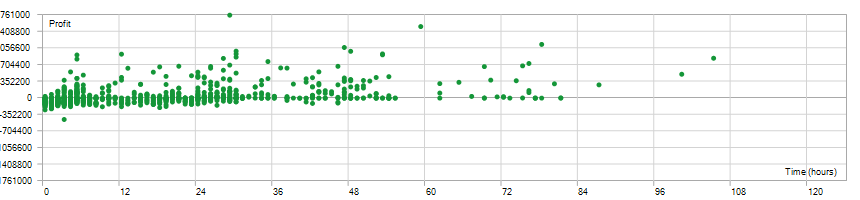

- Average Position Holding Time: Approximately 14 hours and 5 minutes, suitable for short-term strategies.

- Profit Opportunity Distribution: Balanced profit opportunities for both short and long trades, ensuring adaptability in different market directions.

Insights from the Results

- A high recovery factor and profit factor indicate potential for stable long-term profitability.

- While the win rate is modest at around 35%, the high risk-reward ratio helps cover losses and amplify profits.

- The average position duration of 14 hours makes it suitable for day or swing trading.

These results affirm the EA’s capability for minimizing risks while focusing on long-term wealth accumulation.

Parameter Settings

This EA provides flexible parameter settings, allowing users to customize it based on their trading style and risk tolerance.

- DI Period (DIPeriod1): Period for DI calculation used in entry conditions.

- ATR Period (MTATRPeriod1): Period for ATR calculation used in volatility assessment.

- ProfitTarget: Sets the profit target as a percentage, e.g., 4%.

- StopLossCoef1: Multiplier for stop-loss values based on ATR, e.g., 1.5.

- TrailingStopCoef1: Distance for trailing stops, e.g., 3.2 times ATR.

- ExitOnFriday: Closes positions automatically on Fridays.

- FridayExitTime: Sets the closing time on Fridays (e.g., 20:40).

Money Management Parameters

The EA includes robust money management features to adjust trade sizes while maintaining risk control.

- UseMoneyManagement: Enables the feature to automatically adjust trade lot sizes based on account balance, enhancing risk management and optimizing trade size according to the capital.

- mmRiskPercent: Risk tolerance level when money management is enabled, adjustable to suit individual preferences.

- mmLotsIfNoMM: Specifies a fixed lot size when money management is disabled, ensuring consistent trade sizes.

Conclusion

This EA efficiently captures breakouts in the EURUSD market while minimizing risks, supporting long-term wealth accumulation. With its compounding feature and robust risk management, it is suitable for both novice and experienced traders. Its flexible trading strategies adapt to market conditions, enabling traders to pursue significant profits even with small initial capital.

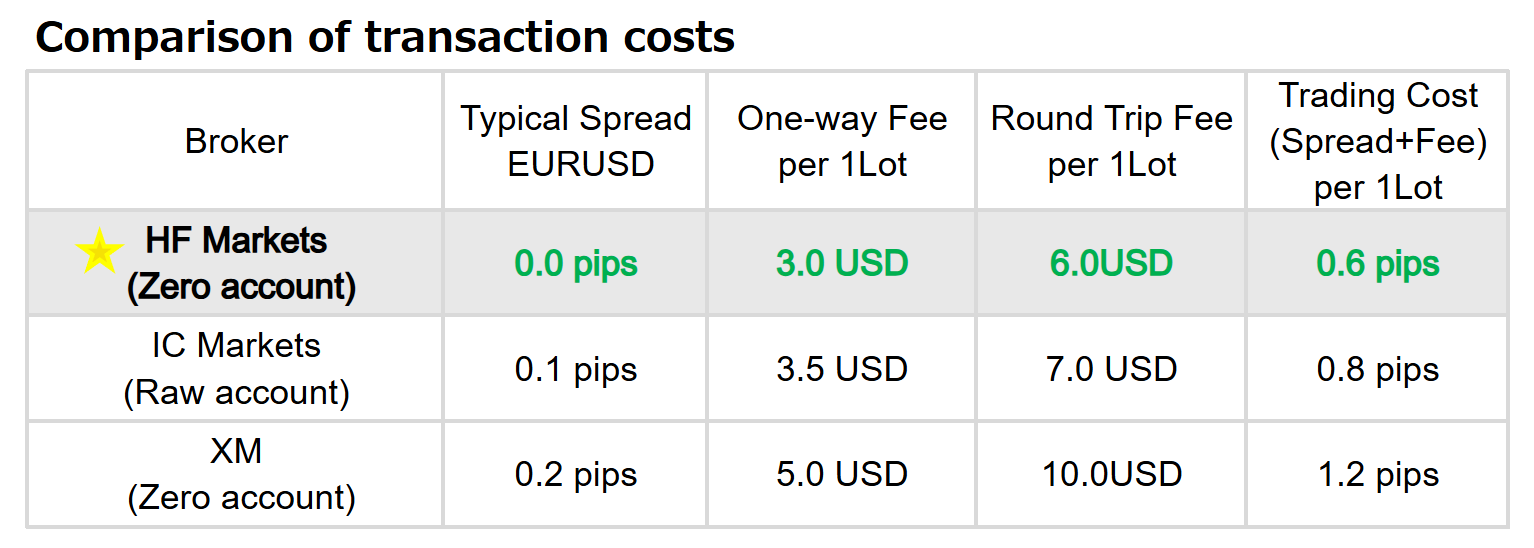

True 0.0 Spread Broker Cut Trading Costs Dramatically

The HF Markets Zero Account delivers a true 0.0 spread on major pairs (like EURUSD). With a one-way fee of only 3.0 USD per lot (6 USD round trip), it offers unbeatable low-cost trading compared to other brokers. Our free EA performs best when paired with the finest broker.

| Broker | Typical EURUSD Spread | One-way Fee per Lot | Round Trip Fee per Lot | Effective Trading Cost |

|---|---|---|---|---|

| HF Markets (Zero account) | 0.0 pips | 3.0 USD | 6 USD | 0.6 pips |

| IC Markets (Raw account) | 0.1 pips | 3.5 USD | 7.0 USD | 0.8 pips |

| XM (Zero account) | 0.2 pips | 5.0 USD | 10 USD | 1.2 pips |

- Swap-Free: Available on all accounts so you can trade without worrying about extra costs.

- Leverage 1:2000: Enjoy flexible trading with top-tier leverage.

- Sleek Platform: An intuitive, user-friendly trading environment.

By registering with HF Markets through our special link, you'll secure the best trading conditions to fully benefit from our free EA.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4699) |

||||||||||||

Settings |

||||||||||||

| Expert: | Eur-Usd Simple Breakout Strategy | |||||||||||

| Symbol: | EURUSD | |||||||||||

| Period: | H1 (2006.01.02 - 2024.10.05) | |||||||||||

| Inputs: | CustomComment=Eur-Usd Simple Breakout Strate | |||||||||||

| MagicNumber=11111 | ||||||||||||

| DIlPeriod1=14 | ||||||||||||

| MTATRPeriod1=40 | ||||||||||||

| MoveSL2BECoef1=3.9 | ||||||||||||

| PriceEntryMult1=2.9 | ||||||||||||

| ProfitTarget1=4.0 | ||||||||||||

| StopLossCoef1=1.5 | ||||||||||||

| TrailingStopCoef1=3.2 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=5.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=1.0 | ||||||||||||

| mmMaxLots=500 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=20:40 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 500.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 116268 | Ticks: | 455049 | Symbols: | 1 | |||||||

| Total Net Profit: | 24 161 593.36 | Balance Drawdown Absolute: | 150.96 | Equity Drawdown Absolute: | 165.81 | |||||||

| Gross Profit: | 68 141 265.75 | Balance Drawdown Maximal: | 1 600 900.00 (7.87%) | Equity Drawdown Maximal: | 2 148 000.00 (24.91%) | |||||||

| Gross Loss: | -43 979 672.39 | Balance Drawdown Relative: | 64.38% (630.95) | Equity Drawdown Relative: | 67.76% (702.32) | |||||||

| Profit Factor: | 1.55 | Expected Payoff: | 19 984.78 | Margin Level: | 201.38% | |||||||

| Recovery Factor: | 11.25 | Sharpe Ratio: | 1.83 | Z-Score: | 0.99 (67.78%) | |||||||

| AHPR: | 1.0119 (1.19%) | LR Correlation: | 0.94 | OnTester result: | 0 | |||||||

| GHPR: | 1.0090 (0.90%) | LR Standard Error: | 2 776 030.63 | |||||||||

| Total Trades: | 1209 | Short Trades (won %): | 542 (35.61%) | Long Trades (won %): | 667 (33.73%) | |||||||

| Total Deals: | 2418 | Profit Trades (% of total): | 418 (34.57%) | Loss Trades (% of total): | 791 (65.43%) | |||||||

| Largest profit trade: | 1 759 650.00 | Largest loss trade: | -453 000.00 | |||||||||

| Average profit trade: | 163 017.38 | Average loss trade: | -55 600.09 | |||||||||

| Maximum consecutive wins ($): | 7 (16 376.67) | Maximum consecutive losses ($): | 12 (-259 951.19) | |||||||||

| Maximal consecutive profit (count): | 2 431 000.00 (2) | Maximal consecutive loss (count): | -1 181 551.91 (11) | |||||||||

| Average consecutive wins: | 1 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

| Correlation (Profits,MFE): | 0.86 | Correlation (Profits,MAE): | 0.36 | Correlation (MFE,MAE): | 0.1054 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:00:01 | Maximal position holding time: | 105:00:03 | Average position holding time: | 14:05:45 | |||||||

|

||||||||||||

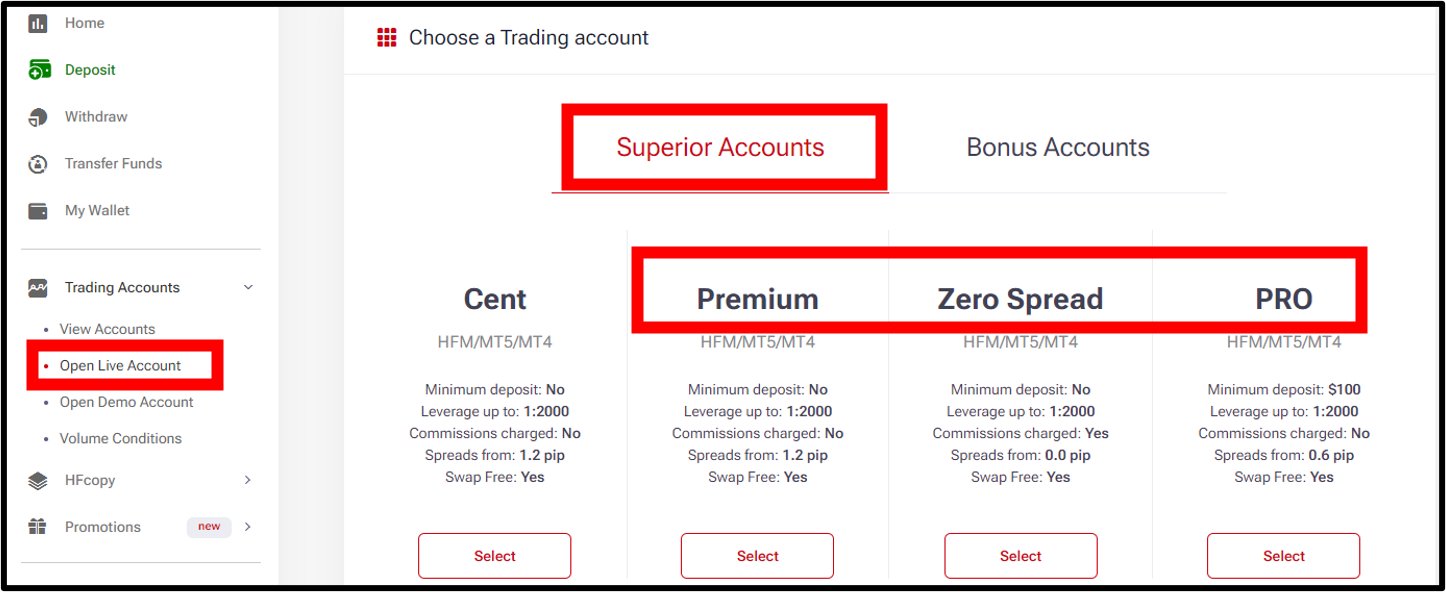

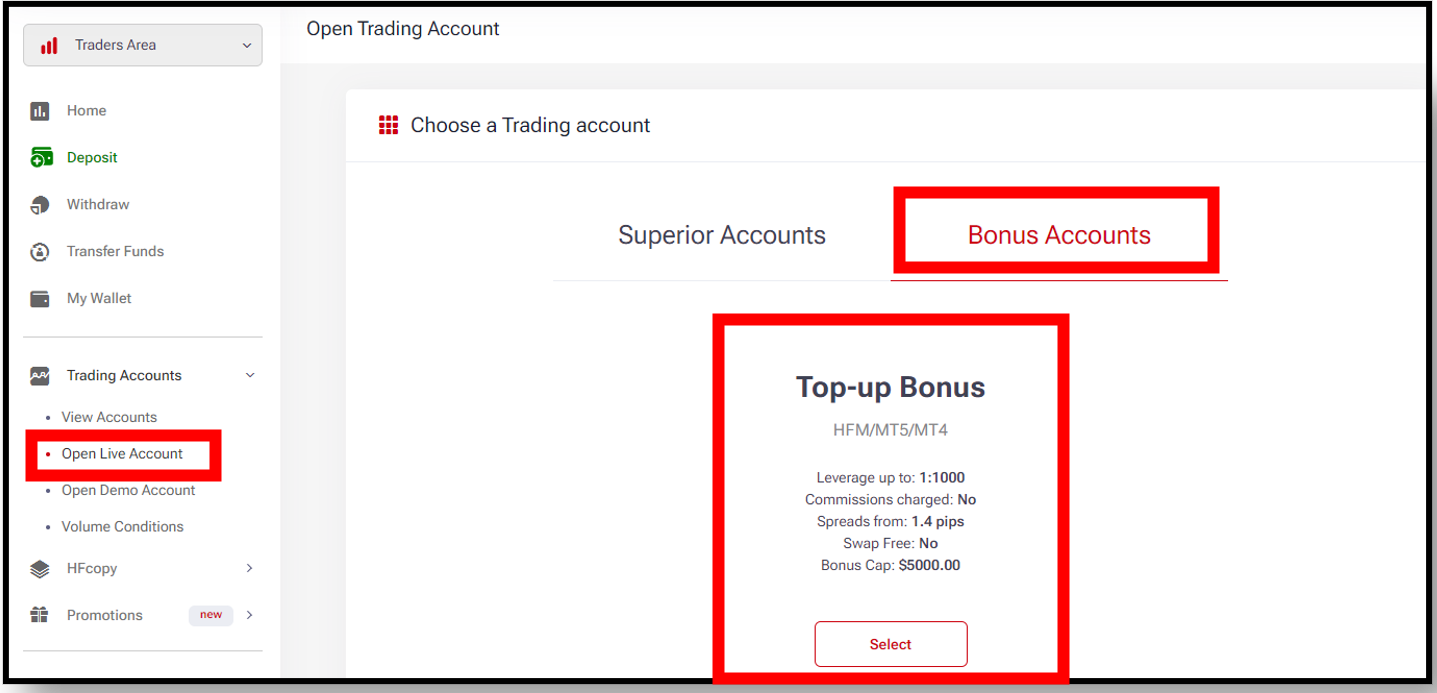

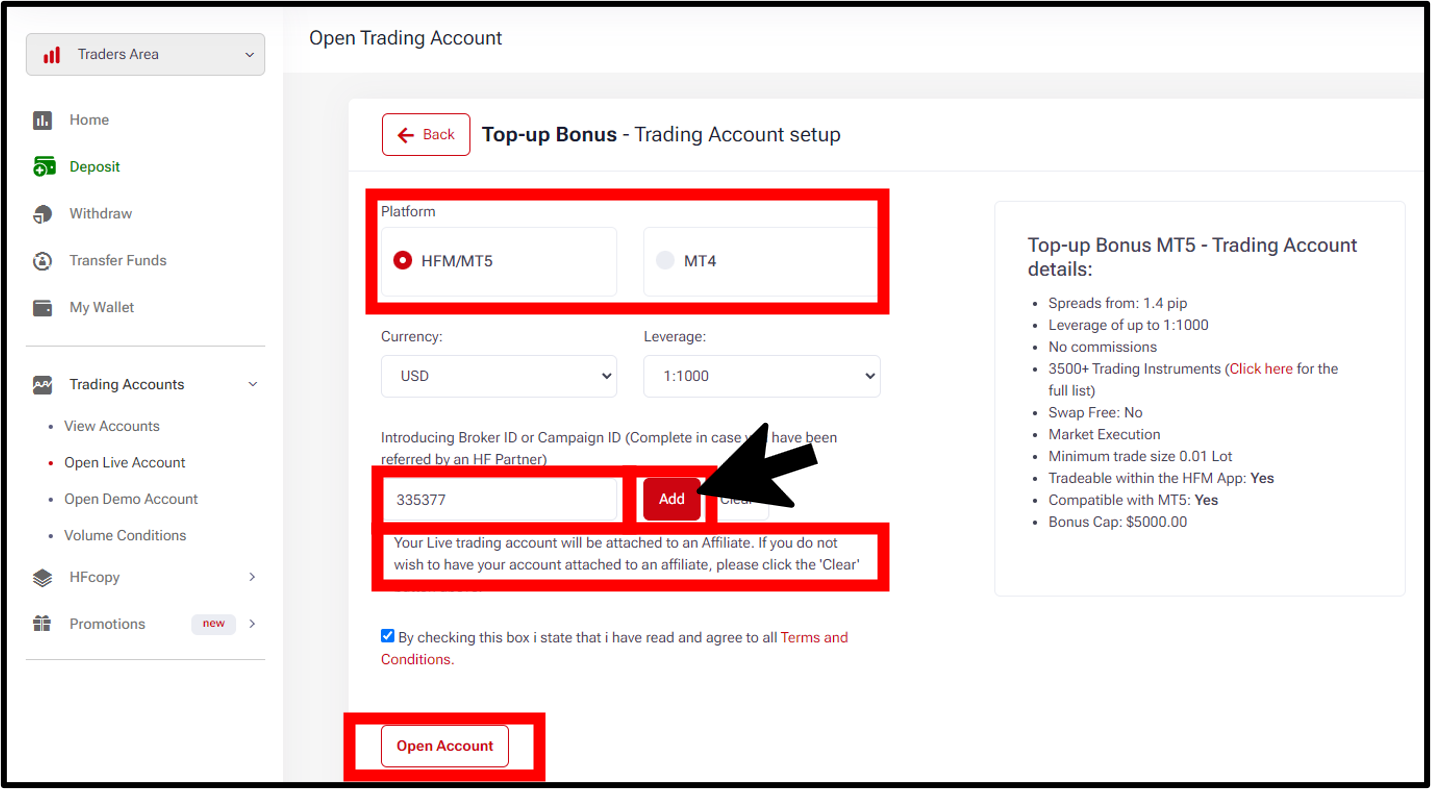

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Reviews

There are no reviews yet.