FXQuasar EA is an EA that operates on AUDUSD pair.

It employs 6 trading logics and executes trades very aggressively.

Live performance of FXQuasar EA (forward test results)

The target currency pair of FXQuasar EA is AUDUSD.

AUSUSD forward test results have been released.

It has a very nice upward sloping profit curve. An EA that uses the martingale method draws a beautiful profit curve like this.

FXQuasar EA trading strategy

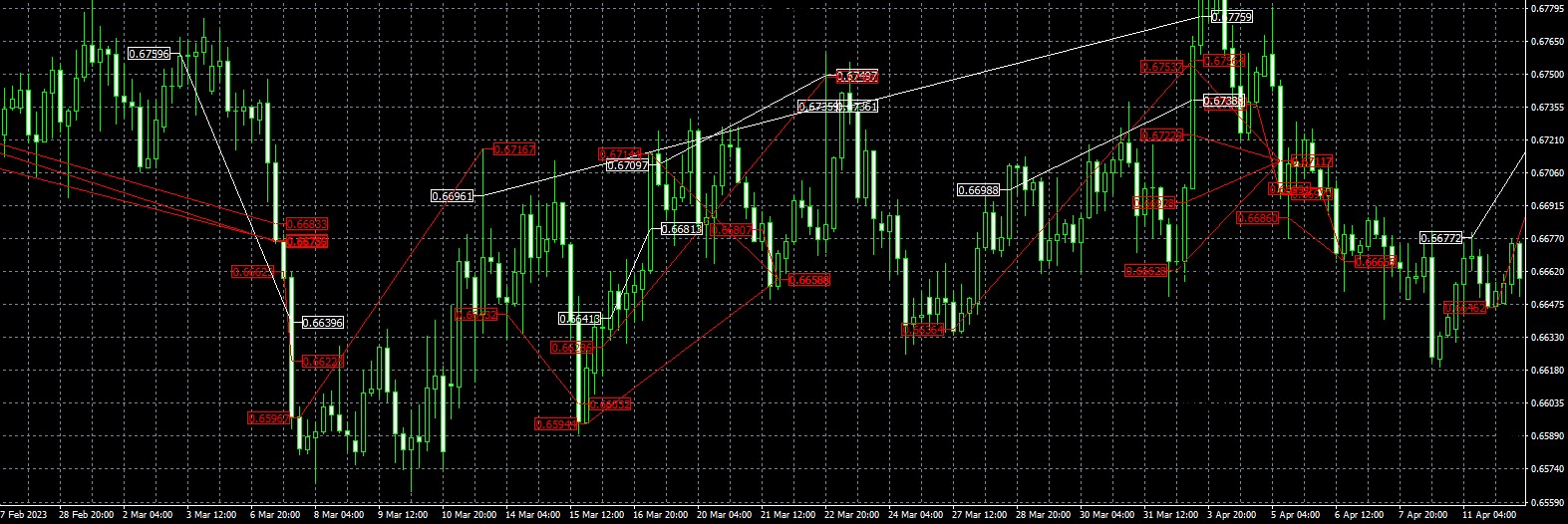

From the MT4 trading history chart below, you can see that FXQuasar EA has complex trading logic.

■AUDUSD 4 hours Chart White=Buy entry Red=Sell entry

It may hold short and long positions at the same time.

In addition, stop loss and take profit may be set for a single position, or multiple positions may be held by grid trading.

The v sales site describes its trading strategy as follows.

“This EA incorporates 6 different sessions. 3 of these sessions are traded using only long (buy) positions, and the remaining 3 use short (sell) positions. .”

That is, three trade logics are applied to sell and buy entries.

As a result of analyzing the trading history of this EA, there are probably three trading logics (sessions) as follows.

- Trade with a single position without increasing lot size

- Trade by increasing the lot size after a loss in a single position (Martingale)

- Trade while increasing lot size with multiple positions (grid & martingale)

Trade by increasing lot size after loss (Martingale)

One of the trading strategies of FXQuasar EA is Martingale. After a loss occurs, triple the lot size and execute the trade.

Reference article:Martingale EA Risks and Benefits | Is it profitable?

If a trade that triples the lot size is successful, it will recover the loss of the previous trade.

■Trade history with 3x lot size

| Open Date | Close Date | Symbol | Action | Units/Lots | Open Price | Close Price | Pips | Profit |

| 02/06/2023 20:00 | 02/08/2023 10:21 | AUDUSD | Sell | 0.2 | 0.68704 | 0.69904 | -120 | -239.52 |

| 02/08/2023 20:00 | 02/13/2023 03:27 | AUDUSD | Sell | 0.6 | 0.6934 | 0.6894 | 40 | 243.79 |

For this pattern, the stop loss is set at 120 pips and the take profit is set at 40 pips.

Even if this EA has a loss of 120 pips, if the EA immediately succeeds in taking a profit of 40 pips with 3x lot size, the account will receive a profit equivalent to 120 pips. That is, the account will receive a profit equal to the previous loss.

Grid & Martingale Trade

FXQuasar EA also executes trades that combine grid trades and martingales.

In the MT4 trading history chart below, you can see how after holding a short position, it opens three additional short positions as the price rises.

Eventually the price falls and it closes all positions and takes profits.

■AUDUSD 4 hours Chart White=Buy entry Red=Sell entry

The table below shows the history of trades that combine grid trading and martingale.

| Open Date | Close Date | Symbol | Action | Units/Lots | Open Price | Close Price | Pips | Profit |

| 04/03/2023 14:48 | 04/05/2023 10:41 | AUDUSD | Sell | 2.94 | 0.67537 | 0.67117 | 42 | 1233.83 |

| 04/03/2023 13:50 | 04/05/2023 10:41 | AUDUSD | Sell | 1.74 | 0.67229 | 0.67117 | 11.2 | 194.31 |

| 04/03/2023 10:39 | 04/05/2023 10:41 | AUDUSD | Sell | 1.02 | 0.66928 | 0.67117 | -18.9 | -193.11 |

| 04/03/2023 07:00 | 04/05/2023 10:41 | AUDUSD | Sell | 0.6 | 0.66628 | 0.67117 | -48.9 | -293.6 |

When opening an additional position, the lot size will be 1.7 times the previous position.

Also, the timing to open an additional position is when the price moves unfavorably by 30 pips from the previous position.

First entry timing

Each of the three trade logics has a different entry logic.

It can be an entry in the direction of the trend, or it can be an entry in the opposite direction to the trend.

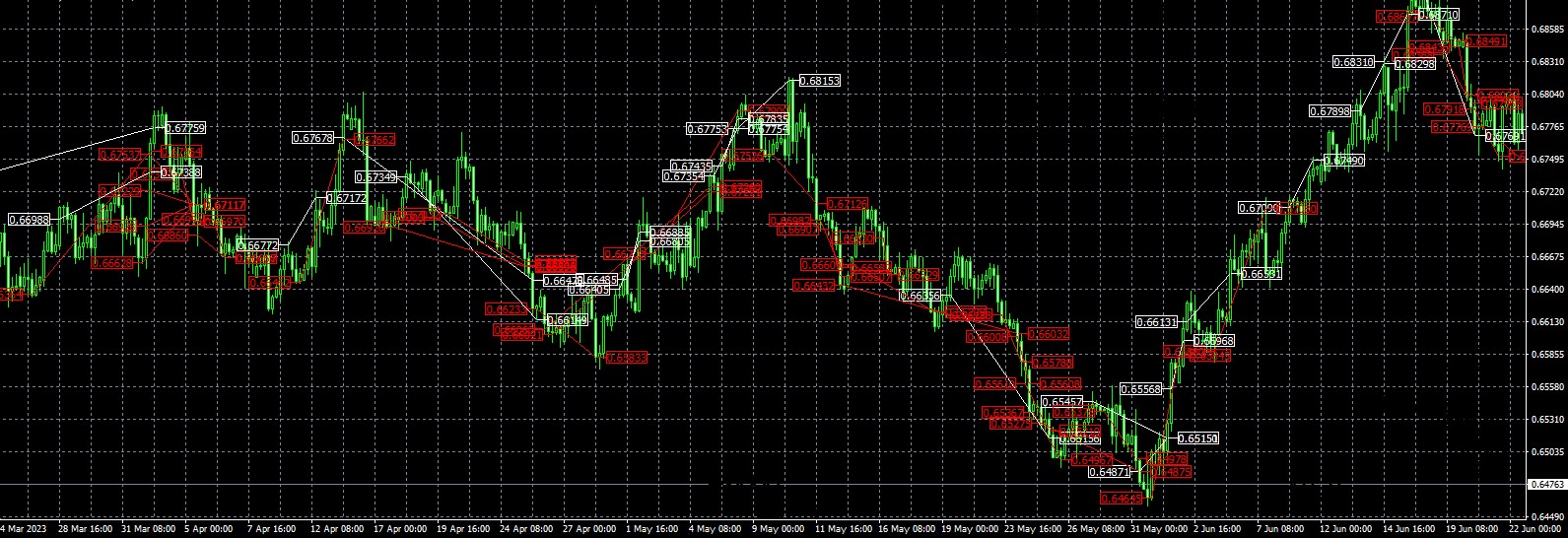

From the long-term MT4 trading history chart below, you can see in which direction this EA is entering.

■AUDUSD 4 hours Chart White=Buy entry Red=Sell entry

Each of the three uses a different entry logic.

If anything, it seems that there are many cases where the entry is in the direction of a short-term trend.

From the long-term MT4 trading history chart below, you can see that sell entries are made when the trend is down, and buy entries are made when the trend turns to up.

■AUDUSD 1 hour Chart White=Buy entry Red=Sell entry

Backtest results of FXQuasar EA

Vendors publish two types of backtests: 35% risk and 100% risk.

The difference between the two is the initial lot size. The larger the lot size, the higher the rate of return, but the larger the drawdown.

■AUDUSD 100% Risk

| Test start | 2015/1/2~ |

| Test end | 2021/09/25 |

| Operation period | 80months |

| Initial deposit | 1,000 |

| Operational lot size | Adjusted by balance |

| Final balance | 3,426,803 |

| Total net profit | 3,425,803 |

| Rate of return (overall) | 342680.3% |

| Monthly rate of return (compound interest) | 10.7% |

| Monthly rate of return (simple interest) | – |

| Relative drawdown | 92.6% |

| Maximum drawdown (amount) | 1,104,381 |

| Profit factor | 1.81 |

| Winning rate | 74.6% |

| Total trades | 1362 |

■AUDUSD 35% Risk

| Test start | 2015/1/2~ |

| Test end | 2021/09/25 |

| Operation period | 80months |

| Initial deposit | 1,000 |

| Operational lot size | Adjusted by balance |

| Final balance | 29,764 |

| Total net profit | 28,764 |

| Rate of return (overall) | 2976.4% |

| Monthly rate of return (compound interest) | 4.3% |

| Monthly rate of return (simple interest) | – |

| Relative drawdown | 38.2% |

| Maximum drawdown (amount) | 6,678 |

| Profit factor | 1.82 |

| Winning rate | 74.5% |

| Total trades | 1362 |

Please note that the backtesting period of FXQuasar EA is approximately 7 years (80 months), which is relatively short for a backtesting period.

100% risk backtesting is very profitable. However, the drawdown has occurred to the point where the account balance is almost 0.

This is a very high risk situation, so it is very dangerous to trade in this 100% risk state.

Vendor of FXQuasar EA

FXQuasar EA is sold by the same vendor as his FXSTABILIZER, Forex Truck, etc.

The basic strategy of the EA they sell is a combination of grid trading and martingale.

Generally, the EAs they sell support multiple currency pairs, but FXQuasar EA only supports one currency pair: AUDUSD.

FXQuasar EA executes unique trades among the EAs they sell.

Conclusion of FXQuasar EA

FXQuasar EA trades through 6 different sessions.

Apply three trade logics to sell and buy entries respectively.

The six sessions work completely independently, so there is the possibility of executing many trades at the same time.

This EA is highly profitable because it executes multiple trades at the same time.

However, each of the three trading logics has high risks.

The trade logic of tripling the lot size after a loss will cause a huge loss to the account if consecutive losses occur.

If a major trend occurs, a combination of grid and martingale trades will leave the position stranded, resulting in significant equity losses.

If the three trading logics can complement each other, it will produce good results.

This EA trades frequently, so if profits accumulate, the balance will increase and there is a possibility that it can withstand equity losses.

However, if three trading logics generate losses at the same time when the account balance is low, a huge loss will occur to the account.

Users should be aware of this risk before purchasing and using the EA.

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

Hello brother Expert freee