- Trend following type EA.

- Results on real accounts are no longer good.

- WallStreet ASIA, which is currently recommended on sales sites, is a scalping EA that targets a very small price range.

WallStreet Forex Robot (EA)Basic Information

| Price | $227 |

| Currency Pair | EURUSD, AUDUSD, EURJPY, USDJPY, USDCAD, USDCHF Recommended currency pairs differ depending on the time, and the current recommended pair can be confirmed in the member area after purchasing EA. |

| Time Frame | 15M |

| Trading Method | Scalping |

| Terminal | MT4 |

| Money Back Guarantee | 60-day money back guarantee on EA purchase price. No refund conditions |

WallStreet Forex Robot is a trend-tracking automated trading system (EA) that works with multiple currency pairs.

It is also equipped with features such as “broker countermeasures” and “automatic update function.”

Also, when you purchase “premium version”, you will get the following versions of the EA for free: Trading logic differs greatly depending on the version.

- Wall Street “Asia”

- Wall Street “Recovery Pro”

- Wall Street “Gold Trader”

- Wall Street “Crypto”

Profitability / Drawdown

■2.0 Evolution Version Test Result

Test Period:2018/1/2 – 2020/4/30

In version 2.0, results from real accounts were published.

However, a large drawdown occurred in April 2020, and the test has now ended.

Sold by the same vendor, the FOREX DIAMOND EA has shown good forward test performance in real accounts. FOREX DIAMOND EA is better.

WallStreet Forex Robot’s basic strategy is trend following.

Trend-following EAs may reach a stagnation period.

If you are not good at stagnation periods, a martingale EA such as FXSTABILIZER may be more suitable. Martingale-based EAs have very high profit margins, and because there is no loss cut, there are no stagnation periods, and the profit curve is upward.

On the other hand, Martingale EA can cause a relatively large drawdown with his single shot. In other words, it’s high risk and high return.

There is no answer as to which is correct: Martingale method or trend following.

A trend-following EA that moves while incorporating stop-loss cuts may be mentally easier because the risk of a large drawdown in one shot is low.

There is no correct answer as to which is more advantageous: martingale or trend following.

However, a trend-following EA that operates with a loss cut may be mentally easier because the risk of a large drawdown in one shot is low.

Trading Method Analysis-Entry

The entry point for WallStreet Forex Robot is the retracement at the trend market.

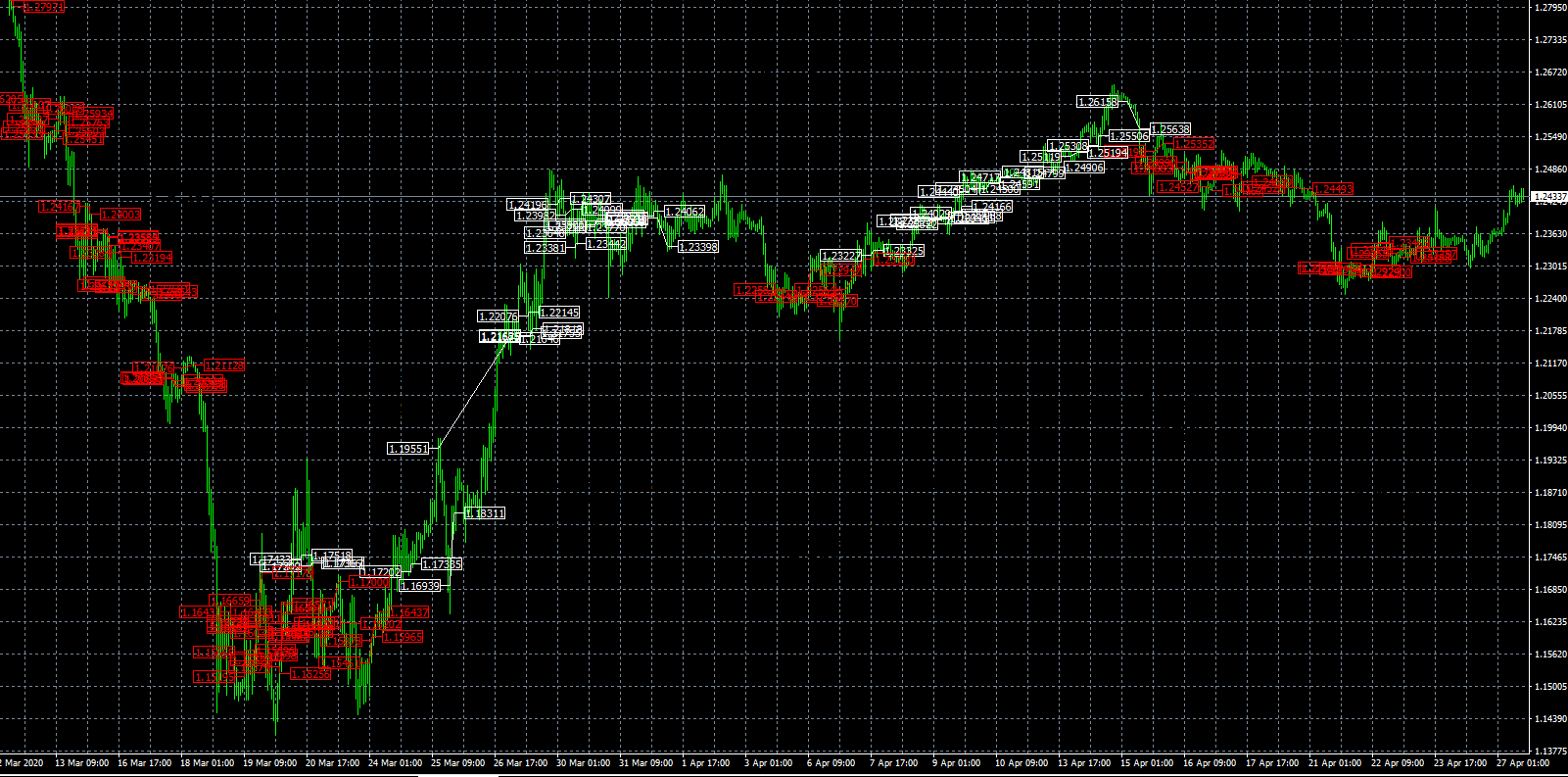

In the MT4 trading history chart below, you can see that we have positions only in the direction of the trend.

■EURUSD 1H White=BUY Red=SELL

Also, in the MT4 trading history chart below, which expanded in a short time frame, you can see that it waits for retracements at trend market before making entries.

↓Buy entry in an uptrend

■GBPUSD 15M White=BUY Red=SELL

↓Sell entry in a downtrend

■GBPUSD 15M White=BUY Red=SELL

The entry in the retracement at the trend market is often used in manual trading. Therefore, it will be an entry point that manual traders can sympathize with.

Trading Method Analysis-Take Profit / Stop Loss

Take profit and loss cut are not executed with fixed pips distance. It is executed by the EA internal logic.

Therefore, the exit pips distance varies depending on the situation.

Regarding take profit, it is often within 10 pips. Sometimes 20-30pips.

Categorized into Scalping or Day Trading EA.

Regarding loss cut, 10 to 30 pips are common. The maximum may be about 70 pips.

Loss cut has a larger pips distance than Take Profit.

The MT4 transaction history chart below shows a loss cut of about 30 pips after winning about 10 pips on Sell entries

■EURUSD 15M White=BUY Red=SELL

Loss cut has a larger pips distance than take profit, but it is an EA that aims to make long-term profit by high winning rate.

It can ruin the profit of several winning trades with one loss. However, it should be regarded as an EA that aims to accumulate profits with a high winning rate and increase the balance in the long run.

Even if the loss cut is executed small, there is no point if it does not make a profit in the long run. It is all harmony that matters, and this EA is profitable so there is no problem.

However, those who use this EA from now on should be aware that loss cut is larger than take profit.

Trading Method Analysis-Frequency

In the forward test, it has been running for about 27 months and has traded about 2200 times in total for all currency pairs. In other words, it is calculated as 80 transactions per month and 4 transactions per day.

It can be said that the trading frequency is high.

The number of transactions for each currency pair is as follows.

■ Number of transactions / acquired pips / profit and loss by currency pair (as of April 27, 2020 / version2.0)

| Currency pair | Number of transactions | Percentage of transactions | Earned Pips | P & L (A $) |

| GBPUSD | 1006 | 46% | 1,443 | 400.02 |

| USDCAD | 555 | 25% | 322 | -21.86 |

| EURUSD | 377 | 17% | 973 | 442.28 |

| USDJPY | 161 | 7% | 235 | 19.82 |

| XAUUSD | 81 | 4% | 4,871 | 6 |

| USDCHF | 24 | 1% | -43 | -29.37 |

| XAGUSD | 3 | 0% | 105 | 16.8 |

| AUDUSD | 2 | 0% | 212 | 34.68 |

| 合計 | 2,209 | 100% | 8,118 | 868 |

Looking at the number of transactions, you can see that GBPUSD accounts for nearly 50% of the total. Next are the pairs of USDCAD and EURUSD.

On the other hand, the most profitable one is the EURUSD pair.

It trades with precious metal pairs such as XAU (gold) and XAG (silver), but the number of transactions is small and the effect on profit and loss is limited.

The currency pairs recommended for operation vary depending on the period, and you can check the recommended pairs from the members area of the official website after purchase.

Looking at the profit and loss for each currency pair, most of the profit is generated by GBPUSD, EURUSD pair.

However, the ups and downs may be reversed next time for each currency pair, so it may be better to operate according to the vendor’s recommended currency pair in terms of profit and loss leveling.

Special Function

WallStreet Forex Robot a scalping EA that targets relatively small pips distances, so results may be affected by broker spreads and slippage. Therefore, it is a major premise to operate with a good broker with a narrow spread.

There are poor brokers out there, and they deliberately widen spreads, generate slippage, and do stop-loss hunting. Running an EA on such a poor broker can result in no profit.

As a measure against brokers, Wall Street Forex Robot has the following functions.

There is no other EA that has such a comprehensive countermeasure function. It is an EA with excellent features.

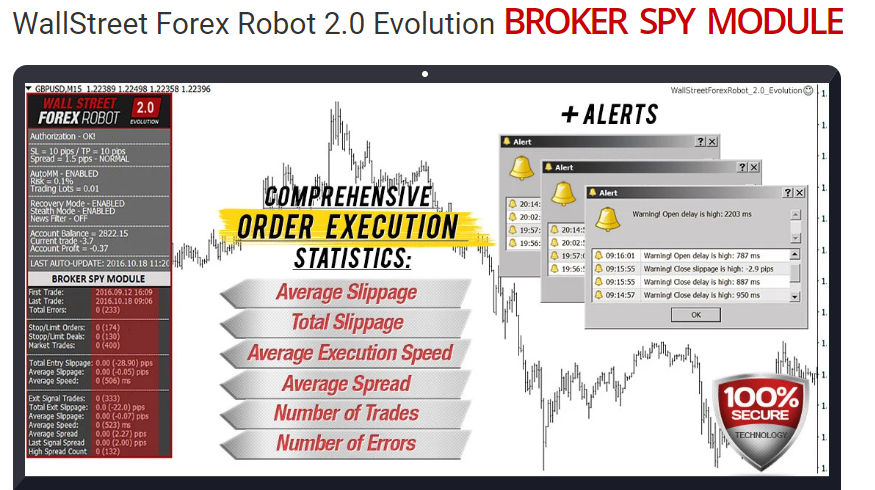

BROKER SPY MODULE

WallStreet Forex Robot has a function called BROKER SPY MODULE. It is a special function that Venter developed for 2000 hours.

Performance of brokers’ spreads, execution speeds, slippages, etc. can be recorded and confirmed on the MT4 chart.

Since this information is visualized, if there are many unnatural errors or the execution speed is too slow, you can take measures such as changing the broker.

Broker Protection System

This function prevents the broker from being notified of Stop Loss and Take Profit limit prices.

Prevent brokers from manipulating prices to reach stop losses and deliberately losing traders (stop loss hunting).

High-Spread / Slippage Protection System

It can avoid entry if spread is widening or slippage is larger than the value specified in the parameter.

As with any broker, when the market moves rapidly spreads widen and slippage occurs.

WallStreet Forex Robot protects against unexpected losses with spread and slippage protection.

Explanation of Each Version

If you purchase WallStreet Forex Robot , you can get “Recovery Pro”, “ASIA” and “GOLD Trader”.

Each version is briefly described below.

WallStreet Recovery Pro

This type of EA also experienced a large drawdown and the test ended.

Recovery Pro is basically a trend-following EA like the default version.

The trading frequency is higher in his default version, but the entry point is often the same.

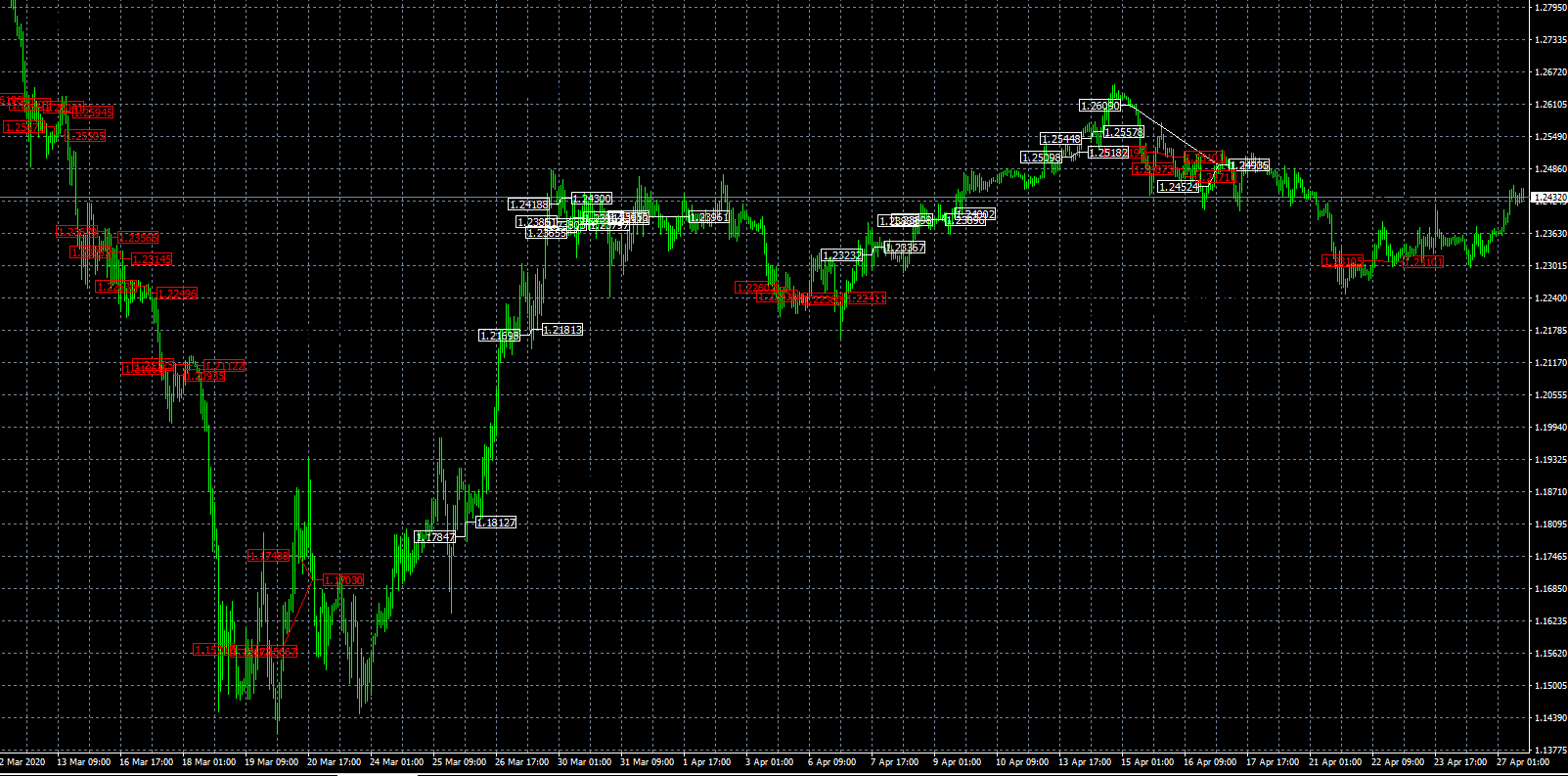

The two charts below show the “default version” and “Recovery Pro” trading history for the same currency pair simultaneously.

These are essentially the same entry points, but you can see that the default version trades more frequently.

■Recovery Pro (GBPUSD 1H White=BUY Red=SELL)

■2.0 Evolution (GBPUSD 1H White=BUY Red=SELL)

The decisive difference between the two is that if it have floating losses, 2.0 Evolution will execute loss cuts, while Recovery Pro make additional entries with several times the lot size, that is, a recovery trade.

(How many times the lot size of additional entry is multiplied can be specified by a parameter. In the forward test, additional entry is made with 4 times the lot size.)

In other words, martingale is adopted.

In the MT4 transaction history chart below, additional a entry are made after the price moves unfavorably after the Buy entry. Profit was made by price reversal.

■Recovery Pro (GBPUSD 30M White=BUY Red=SELL)

I have never failed in a recovery trade in the forward test. However, if it fails, a relatively large drawdown will occur.

It is important to recognize that it is a high risk and high return.

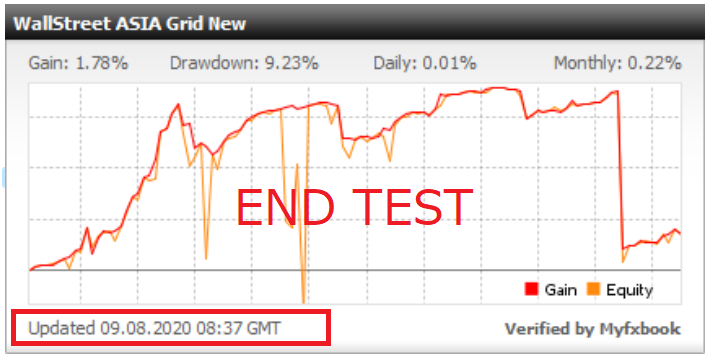

WallStreet ASIA GRID

This type of EA also experienced a large drawdown and the test ended.

The Asia session runs from approximately 22:00 PM to 8:00 AM MT4 server time (GMT + 2/3).

The Asian session tends to be a range market, and WallStreet ASIA GRID conducts scalping trades during this time.

Enter regardless of the Asian session and make profits with grid trading.

Since it is not a martingale, the lot size will not increase when additional entries are made.

However, grid trading involves making additional entries without making loss cuts and waiting for the market to reverse, so it is a relatively high-risk setup.

In the MT4 trading history graph below, you can see how grid trading is profitable.

■ASIA GRID(GBPUSD 1H White=BUY Red=SELL)

WallStreet GOLD Trader

GOLD Trader is a version specialized for XAUUSD (gold) trading.

The trade logic is almost the same as the normal version. Entry by trend follow and execute loss cut

■GOLD Trader (XAUUSD 1H White=BUY Red=SELL)

The forward test period is still short, but there are expectations for the future.

Forward Test Environment

The forward test environment of WallStreet Forex Robot2.0 is a real account.

But for now, testing of WallStreet ASIA, the vendor’s most popular offering, is being done on demo accounts.

The trading environment is different between demo and real.

Even if the price movements appear to be the same, there are differences in execution such as slippage. Therefore, even with the same EA, the results in the demo and in reality may differ.

WallStreet ASIA targets very short pip distances, so you should choose a broker with low spreads and commissions.

Back Test Result(2.0 Evolution)

| Test Period | 1999/1/5~ | 2016/12/1 |

| 214month | ||

| Initial Deposit | 2,000 | |

| Lot Size | 【FIX】1.0 lot | |

| Final Balance | 166,600 | |

| Total Profit | 164,600 | |

| Total Return Rate | 8330.0% | |

| Monthly Return Rate(compound) | 2.1% | |

| Monthly Return Rate(simple) | 38.5% | |

| Maximum Drawdown(Relative) | 88.2% | |

| Maximum Drawdown(Amount) | 5,292 | Initial balance ratio 264.6% |

| Profit Factor | 1.41 | |

| Winning Rate | 79.8% | |

| Total number of transactions | 2483 | |

It is dangerous to rely solely on the results of backtests and operate on a real account. It is best to use the information as reference information only.

The fact that backtesting has been carried out over a long period of time is commendable.

The average monthly interest rate (simple interest calculation) is also very high, close to 40%. Profit rate is more than 10 times higher than forward testing.

However, please note that an 88% drawdown occurs when operating a fixed 1.0 lot with a balance of 2000 USD.

This is not because the EA logic itself is high risk, but the problem is that the lot size is too large compared to the balance.

The absolute value of the maximum drawdown is $5292, which is more than twice the initial balance.

Therefore, it is too risky to operate with the same lot size as backtesting.

It is safe to keep the lot size at a ratio of about 1/10 of the backtest.

(0.1 lot with a balance of $2000, 0.05 lot with a balance of $1000, 0.01 lot with a balance of $200)

Based on backtest results, the maximum drawdown can be kept to about 25%.

Although the rate of return will decrease, the average monthly interest rate (simple interest calculation) is about 3.8%, which is still a good value.

Summary of WallStreet Forex Robot

WallStreet Forex Robot has various trading types.

In version 2.0, the forward test results for real accounts were poor. Publication on the vendor’s sales page has ended.

On the sales site, an Asian session scalping EA called “WALLSTREET ASIA” is recommended.

However, with scalping EA, the results of real accounts are significantly different from the results of demo accounts and backtests. This is the weakness of scalping EA.

Good results cannot be confirmed with a real account.

Anyone considering purchasing this EA should be aware of this.

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

I really like this

Now how do I trade am based in Kenya kindly?and what’s the cost of the trade robot.

Thanks for your comment.

Are you referring to the WallStreet Forex Robot (EA)?

Or are you referring to the free EAs listed on our website?

The price to get our EA is free. However, it can only be run on brokers that we specify.

For more information, please refer to the account opening steps on the product page.

Is it possible to open an account with HFMarkets, XM.com, etc. in your area of Kenya?

Sincerely,

Interested