ZenTrader EA By :

This EA is built to capture breakout opportunities in the USDJPY market with robust risk management and compounding features. It provides stable trading without martingale or grid systems, making it suitable for both beginners and advanced traders.

| Currency Pair | USDJPY |

| Time frame | H1 |

| Terminal | MT5 |

| Trading Style | No Martingale & No Grid |

Forward test is not conducted.

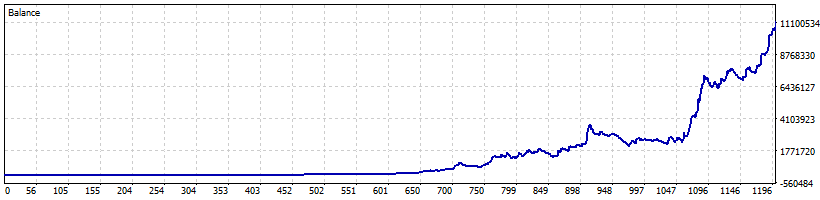

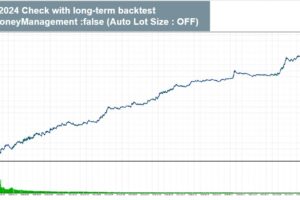

Backtesting

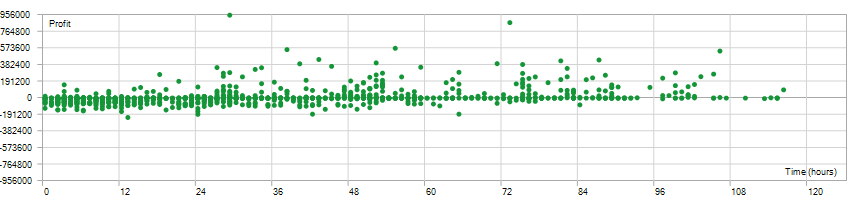

Test Period:2006.01.08 - 2024.10.05 (6845 days)

| Total Gain | 2243455.6% |

| Yearly Gain | 70.6% |

| Monthly Gain | 4.5% |

| Daily Gain | 0.15% |

| Relative Drawdown | 54.1% |

| Profit Factor | 1.68 |

| Currency | USD |

| Final Balance | 11217777.91 |

| Initial Deposit | 500 |

| Total Net Profit | 11217277.91 |

| Total Trades | 1199 |

| Ttimeframe | H1 |

Download This Free EA (ZenTrader EA)

Description

Target Currency Pair and Time Frame

The target currency pair is USDJPY (US Dollar/Japanese Yen)

The time frame is 1 hour. This EA can be operated with a small amount of capital, and is designed to aim for long-term asset growth by utilizing the compound interest function.

Main Features of the EA

This EA has the following features to achieve solid risk management and efficient profit pursuit:

- No Martingale/No Grid Trade: We do not adopt high-risk martingale or grid trade, and set individual stop losses for all positions. This allows you to avoid excessive risk and trade stably.

- Breakout Entry: Detects market breakouts and enters at the appropriate time. Based on the trade direction (long), secure a position at a time when high volatility is expected.

- Supports compound interest operations: The compound interest function automatically adjusts the trading lot according to the increase in funds, allowing you to efficiently grow your assets.

- Thorough risk management: Utilizing stop loss, trailing stop, and automatic closing at a specified number of bars using the ATR (average true range), you can minimize losses and secure profits.

Overview of trading strategy

The EA manages trading as follows:

Entry method

A breakout entry is made based on the high price of the last 20 periods, and the entry point is determined using a formula that takes the ATR range into account.

Exit Method

- Stop Loss: Approximately 2.3 times the ATR (20 periods)

- Take Profit: Position profit target is 7% from the entry price

- ATR Trailing Stop: As profits expand, the stop loss is raised based on the ATR.

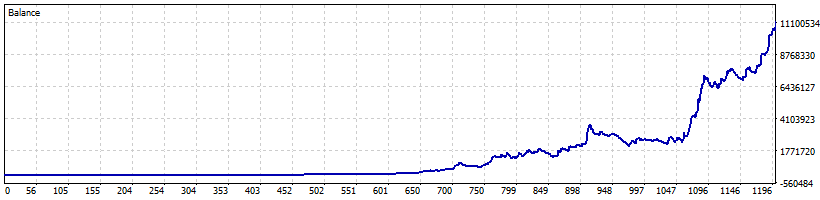

- Position Management on Friday: To avoid market risk, all positions are automatically closed at the specified time (server time) on Friday.

Details of Parameter Settings

EA parameters are customizable and include the following settings:

Money Management Parameters

EA is equipped with a flexible money management function, which allows you to adjust the trading lot size while managing risk.

- UseMoneyManagement: When the money management function is enabled, the trading lot size is automatically adjusted according to the account balance. This enhances risk management and optimizes trade size in response to increases and decreases in funds.

- mmRiskPercent: Risk tolerance percentage when money management is enabled. It can be adjusted according to risk tolerance.

- mmLotsIfNoMM: Specifies the fixed lot size used when money management is disabled. Even if you do not use money management, you will trade with a stable lot size.

Exit setting under specific conditions

This EA also supports flexible exit setting under specific conditions.

- ExitOnFriday: Set whether to close all positions on Friday. This setting is for reducing risk in preparation for the market close on Friday.

- FridayExitTime: Specify the position closing time on Friday in 24-hour notation to protect your funds from unexpected risks.

Summary

This EA is designed to capture breakouts in the USDJPY market, and to aim for large profits even with small amounts of capital by utilizing solid risk management and compound interest functions. It uses no martingale and no grid trading to provide a stable trading environment. This EA is suitable for a wide range of traders, from beginners to advanced traders.

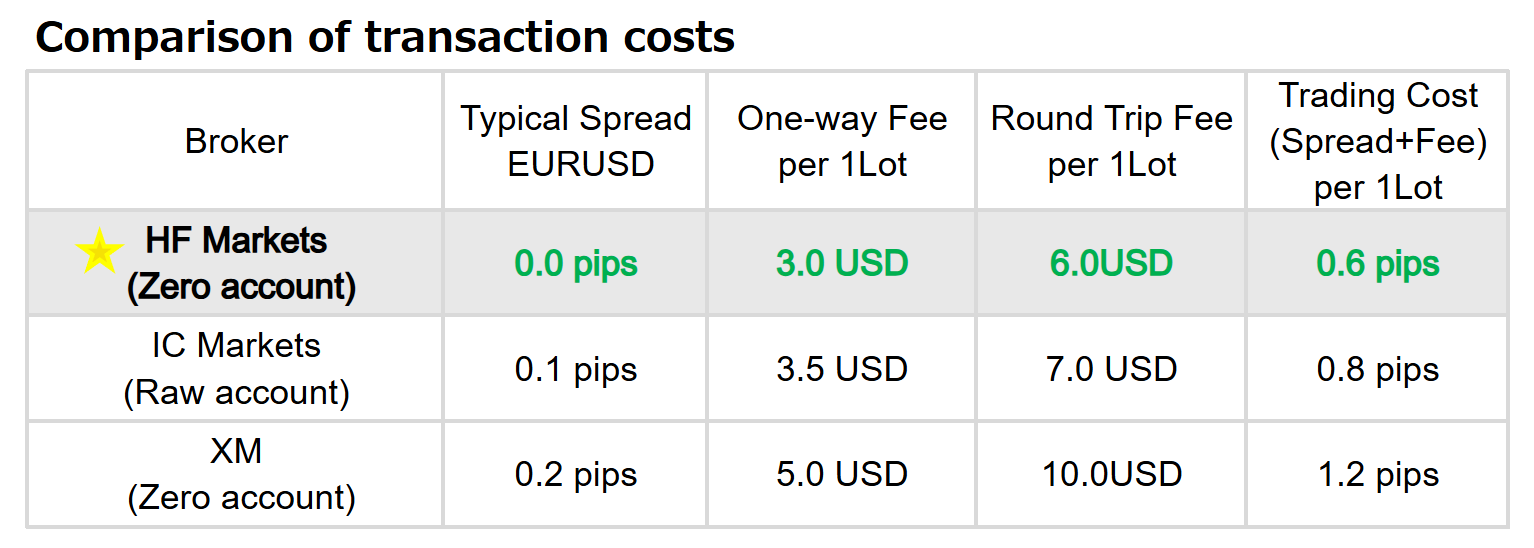

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4695) |

||||||||||||

Settings |

||||||||||||

| Expert: | ZenTrader | |||||||||||

| Symbol: | USDJPY | |||||||||||

| Period: | H1 (2006.01.08 - 2024.10.05) | |||||||||||

| Inputs: | CustomComment=strategy1 | |||||||||||

| MagicNumber=11111 | ||||||||||||

| BiggestRangePeriod1=10 | ||||||||||||

| MoveSL2BECoef1=4.5 | ||||||||||||

| Period1=20 | ||||||||||||

| PriceEntryMult1=0.2 | ||||||||||||

| ProfitTarget1=5.0 | ||||||||||||

| StopLossCoef1=3.15 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=5.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.1 | ||||||||||||

| mmMaxLots=200.0 | ||||||||||||

| mmMultiplier=1.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=20:40 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 500.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 116129 | Ticks: | 454652 | Symbols: | 1 | |||||||

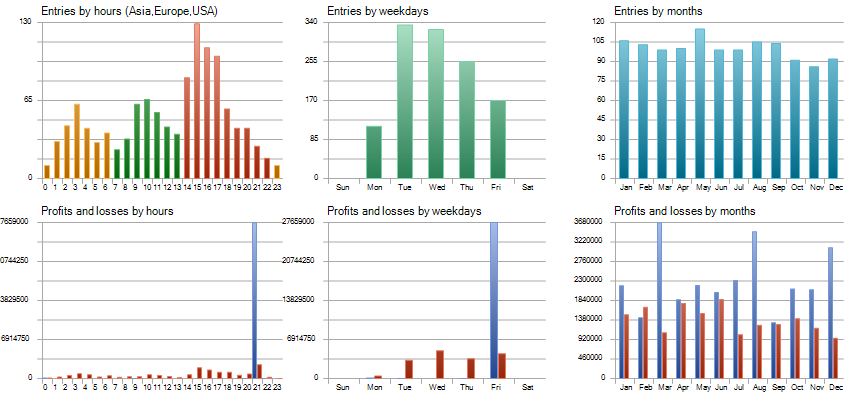

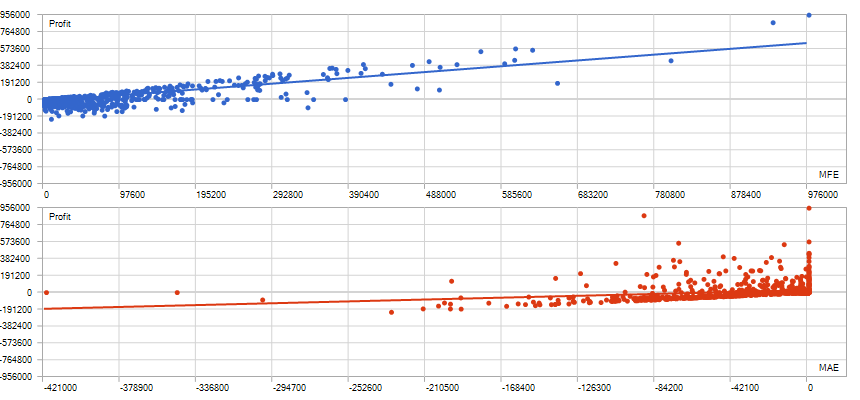

| Total Net Profit: | 11 217 277.91 | Balance Drawdown Absolute: | 114.32 | Equity Drawdown Absolute: | 118.03 | |||||||

| Gross Profit: | 27 784 768.46 | Balance Drawdown Maximal: | 1 609 400.35 (43.35%) | Equity Drawdown Maximal: | 1 685 588.98 (44.48%) | |||||||

| Gross Loss: | -16 567 490.55 | Balance Drawdown Relative: | 48.77% (3 272.76) | Equity Drawdown Relative: | 54.08% (3 885.64) | |||||||

| Profit Factor: | 1.68 | Expected Payoff: | 9 355.53 | Margin Level: | 616.80% | |||||||

| Recovery Factor: | 6.65 | Sharpe Ratio: | 1.25 | Z-Score: | 0.67 (49.71%) | |||||||

| AHPR: | 1.0106 (1.06%) | LR Correlation: | 0.78 | OnTester result: | 0 | |||||||

| GHPR: | 1.0084 (0.84%) | LR Standard Error: | 1 474 045.75 | |||||||||

| Total Trades: | 1199 | Short Trades (won %): | 584 (39.38%) | Long Trades (won %): | 615 (41.79%) | |||||||

| Total Deals: | 2398 | Profit Trades (% of total): | 487 (40.62%) | Loss Trades (% of total): | 712 (59.38%) | |||||||

| Largest profit trade: | 955 319.22 | Largest loss trade: | -222 576.70 | |||||||||

| Average profit trade: | 57 052.91 | Average loss trade: | -23 268.95 | |||||||||

| Maximum consecutive wins ($): | 7 (14 824.99) | Maximum consecutive losses ($): | 11 (-660 455.81) | |||||||||

| Maximal consecutive profit (count): | 1 458 644.98 (5) | Maximal consecutive loss (count): | -700 334.34 (8) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 2 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

| Correlation (Profits,MFE): | 0.80 | Correlation (Profits,MAE): | 0.24 | Correlation (MFE,MAE): | -0.1821 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:00:01 | Maximal position holding time: | 116:00:03 | Average position holding time: | 34:47:51 | |||||||

|

||||||||||||

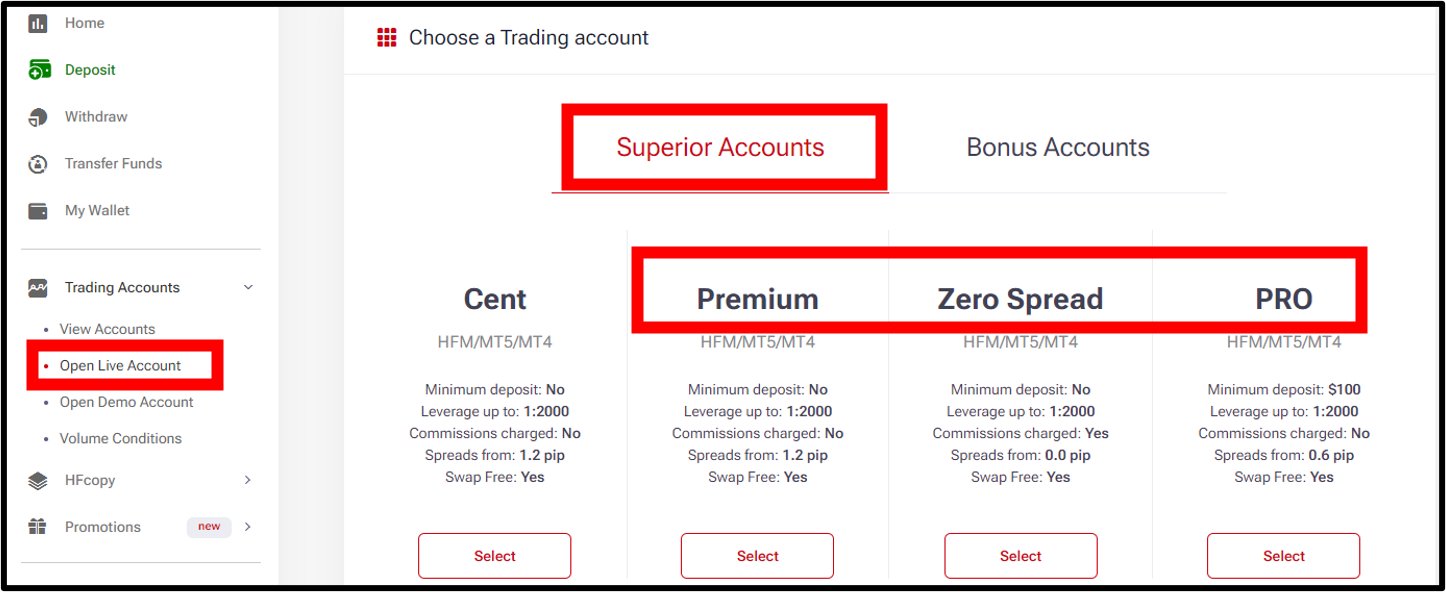

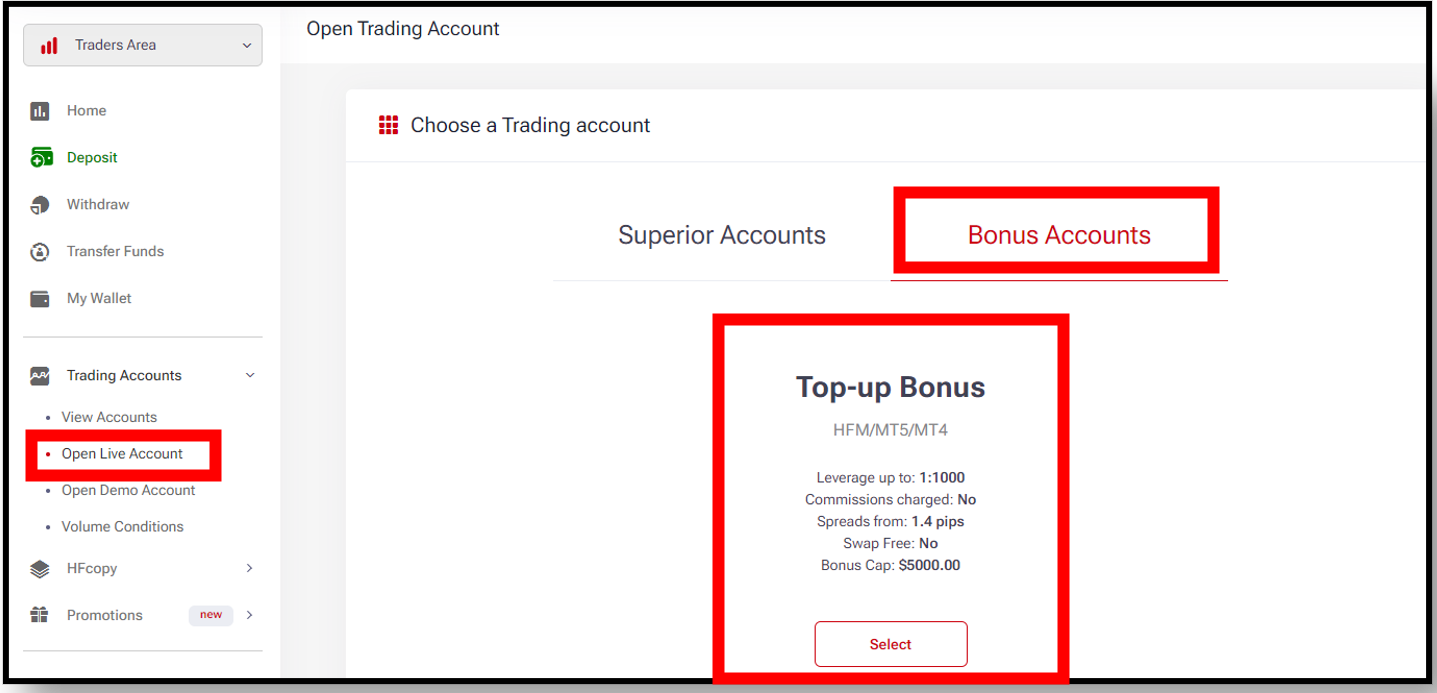

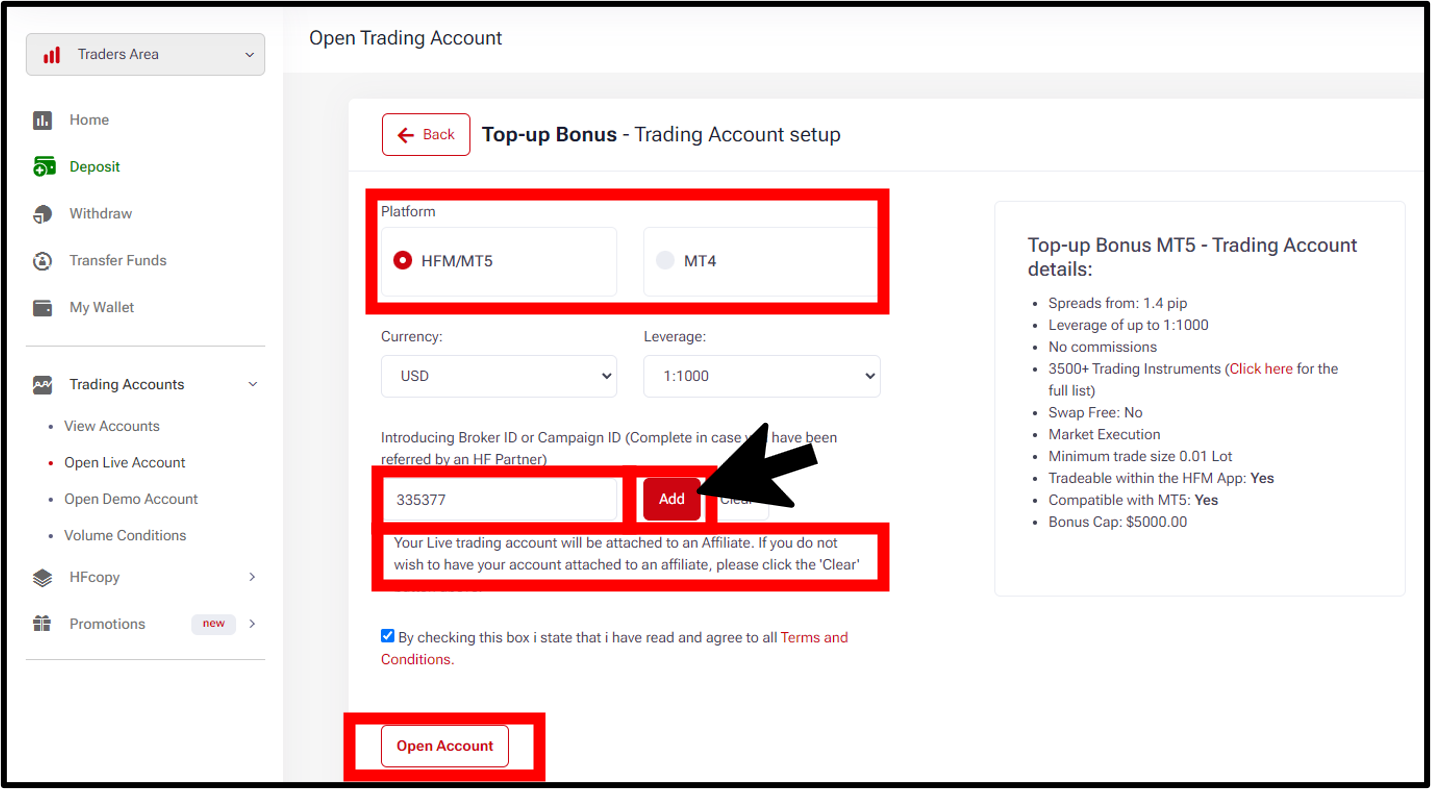

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Reviews

There are no reviews yet.