Multi Currency Portfolio EA (Free) By :

A robust multi-currency EA for EURUSD & USDJPY with no Martingale/Grid. Uses Heiken Ashi & Bollinger Bands for stable, risk-controlled growth, auto-lot sizing.

| Currency Pair | EURUSD,USDJPY |

| Time frame | 1H |

| Terminal | MT5 |

| Trading Style | No Martingale & No Grid |

Forward test is not conducted.

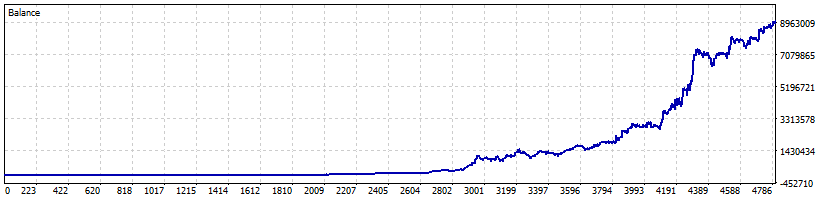

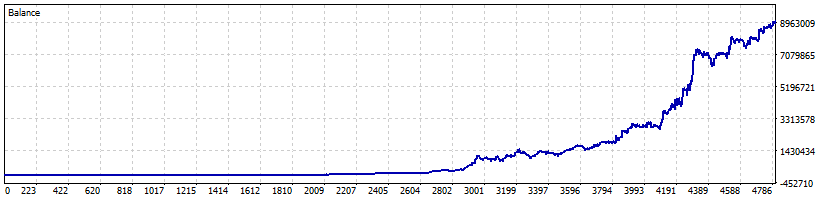

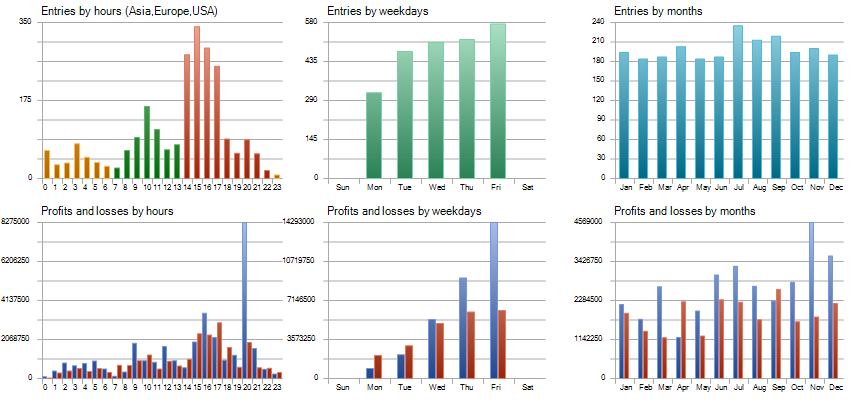

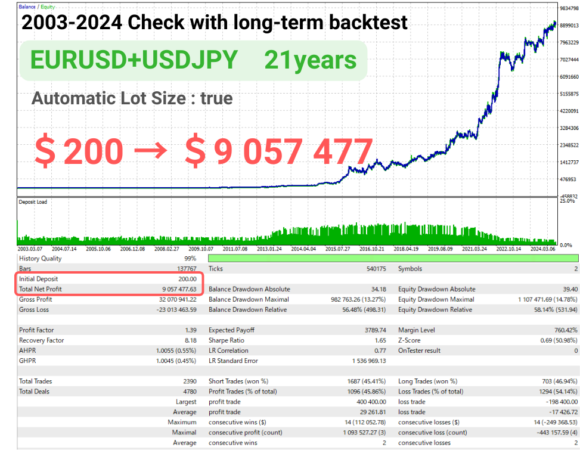

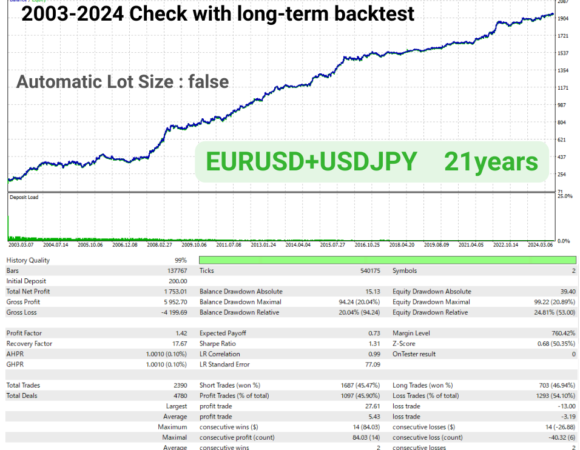

Backtesting

Test Period:2003.01.06 - 2025.03.20 (8109 days)

| Total Gain | 4528738.8% |

| Yearly Gain | 62% |

| Monthly Gain | 4% |

| Daily Gain | 0.13% |

| Relative Drawdown | 58.1% |

| Profit Factor | 1.39 |

| Currency | USD |

| Final Balance | 9057677.63 |

| Initial Deposit | 200 |

| Total Net Profit | 9057477.63 |

| Total Trades | 2390 |

| Ttimeframe | H1 |

Download This Free EA (Multi Currency Portfolio EA (Free))

Description

EA Overview: Multi-Currency Trading for EURUSD and USDJPY

This Expert Advisor (EA) is designed to trade the major currency pairs EURUSD and USDJPY simultaneously, leveraging a multi-currency approach to maximize robustness. Despite operating on different currency pairs, it maintains the same parameters, demonstrating its high level of reliability. Whether you are a beginner or an experienced trader, this EA aims to provide stable, long-term trading performance by focusing on thorough risk management.

Key Features

No Martingale, No Grid, and Strict Risk Control

This EA does not use high-risk methods such as Martingale or Grid strategies. These methods can lead to substantial drawdowns during losing streaks or sudden market movements. Instead, this EA sets a Stop Loss (SL) for every position to limit risk and ensure disciplined, systematic trading.

Symmetric Logic for Both Buy and Sell

The core logic is symmetrical, meaning it applies the same rules to both long (buy) and short (sell) trades. This design ensures the EA can adapt to various market conditions, whether the trend is bullish or bearish.

Less Than 50% Win Rate but Emphasizes Risk-Reward

Rather than aiming for a high win rate, this EA focuses on limiting the risk per trade and seeking larger profits compared to losses (i.e., a favorable risk-reward ratio). By setting a tight Stop Loss and allowing profits to run, the EA strives for consistent gains over the long term, even if the win rate is below 50%.

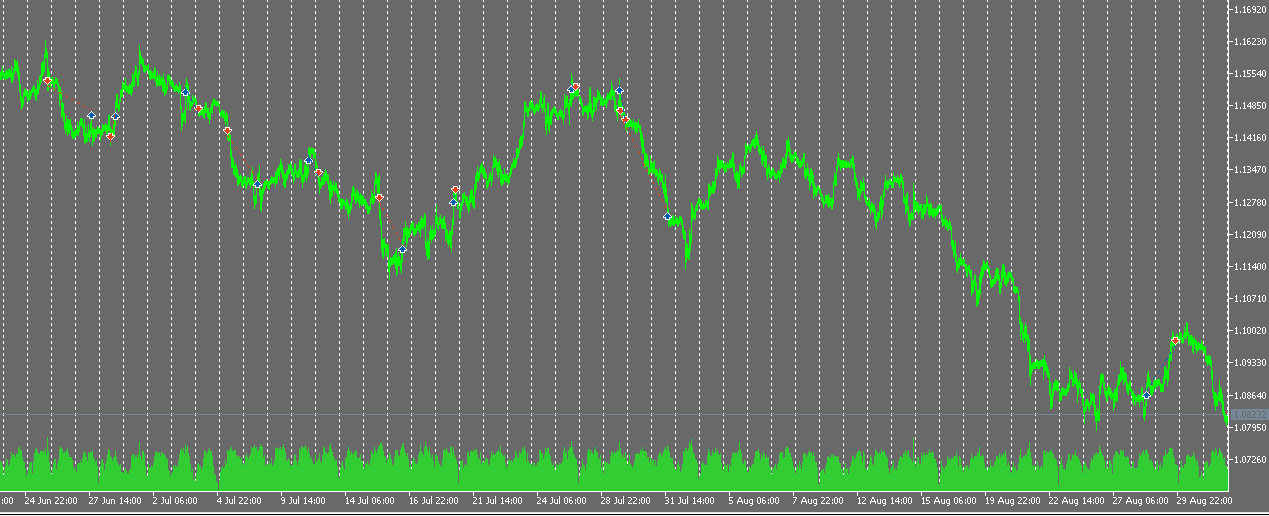

Heiken Ashi and Bollinger Bands for Entry Signals

The EA combines the Heiken Ashi indicator for identifying market trends and the Bollinger Bands for gauging volatility. This combination helps determine optimal entry points and avoids over-trading by adapting to different market environments.

Parameter Setup and TradingPair Configuration

The EA will automatically trade the currency pairs specified in the TradingPair parameter. You can list multiple pairs separated by commas, allowing true multi-currency operation. If your broker uses suffixes for currency pairs (e.g., EURUSDb, USDJPYb), make sure to include the suffix when entering the pair names.

- Example (standard pairs):

EURUSD,USDJPY - Example (suffix pairs):

EURUSDb,USDJPYb

Simply attach the EA to the 1-hour chart of EURUSD. It will then manage trades for all currency pairs listed in the TradingPair parameter without the need to open multiple charts.

Auto Lot Size for Compound Growth

The EA includes a parameter called Auto Lot Size (set “true” or “false”). When set to true, the lot size is automatically adjusted based on the account balance, enabling compound growth. Over a long period of operation, this feature can potentially grow a small initial balance into substantial profits by continually reinvesting gains.

Balance for 0.01Lot (If AutoLotSize = true)

This parameter works only when Auto Lot Size is set to true. It specifies how much balance is required to open 0.01 lots. For example, if you set this to 120 on a USD account:

- A balance of 120 USD would open 0.01 lots.

- A balance of 240 USD would open 0.02 lots.

- A balance of 3600 USD would open 0.30 lots.

In this way, the lot size scales with your account balance, maintaining a consistent risk percentage over time.

Summary: A Reliable EA for Long-Term Trading

This EA stands out for its risk-controlled approach without using Martingale or Grid strategies, ensuring that every position has a predefined Stop Loss. By employing Heiken Ashi and Bollinger Bands, the EA adapts to various market conditions, handling both buy and sell trades with symmetrical logic. Although the win rate may be under 50%, the focus on risk-reward allows for smaller losses and larger profits, targeting consistent gains in the long run.

Moreover, the ability to trade multiple currency pairs with the same settings showcases its robustness. The Auto Lot Size feature further enhances growth potential through compounding, especially when left running for an extended period. Whether you aim for steady account growth or portfolio diversification, this EA is designed to meet your trading needs.

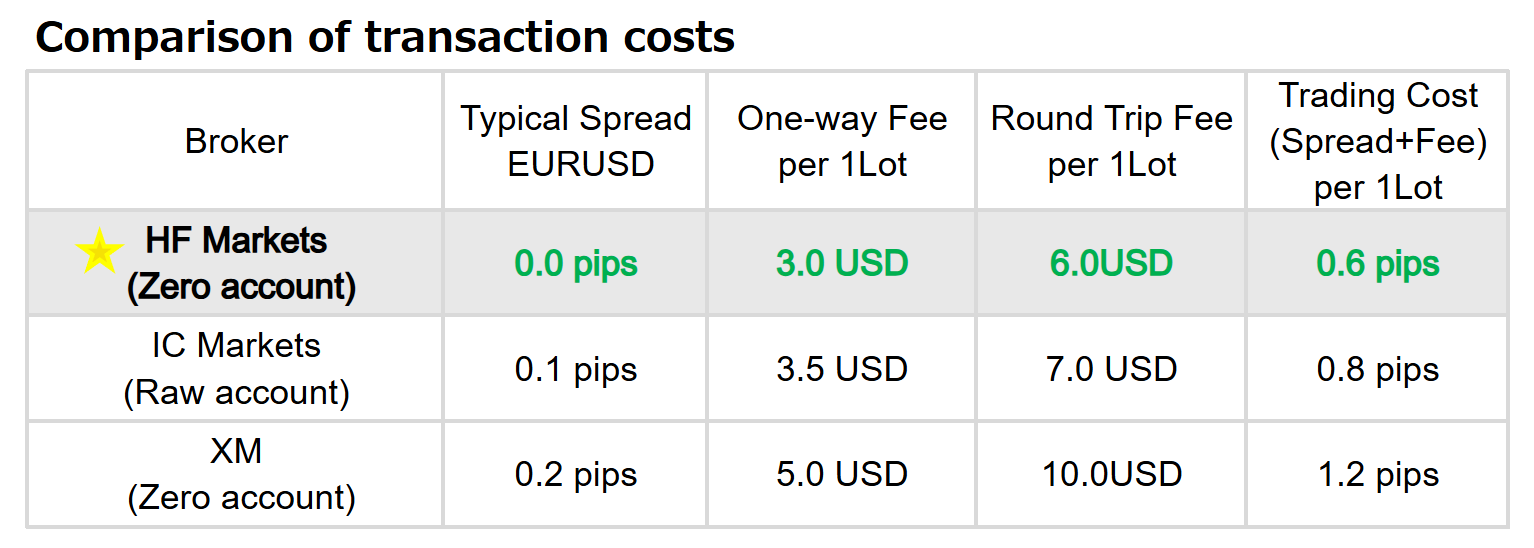

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4885) |

||||||||||||

Settings |

||||||||||||

| Expert: | Multi-Currency Portfolio_Free | |||||||||||

| Symbol: | EURUSD | |||||||||||

| Period: | H1 (2003.01.06 - 2025.03.20) | |||||||||||

| Inputs: | MagicStart=111111 | |||||||||||

| MM=true | ||||||||||||

| Per_USD_001Lot=120 | ||||||||||||

| Lot_Fixed=0.1 | ||||||||||||

| pair=EURUSD,USDJPY | ||||||||||||

| L1_tp=///-----L1_TakeProfit | ||||||||||||

| L1_TP_Pecent=1.8 | ||||||||||||

| L1_sl=///-----L1_StopLoss | ||||||||||||

| L1_SL_Pecent=0.9 | ||||||||||||

| L1_trls=///-----TrailStop | ||||||||||||

| L1_TS_ATRPeriod=65 | ||||||||||||

| L1_TS_ATRMult=2.5 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 200.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 137767 | Ticks: | 540175 | Symbols: | 2 | |||||||

| Total Net Profit: | 9 057 477.63 | Balance Drawdown Absolute: | 34.18 | Equity Drawdown Absolute: | 39.40 | |||||||

| Gross Profit: | 32 070 941.22 | Balance Drawdown Maximal: | 982 763.26 (13.27%) | Equity Drawdown Maximal: | 1 107 471.69 (14.78%) | |||||||

| Gross Loss: | -23 013 463.59 | Balance Drawdown Relative: | 56.48% (498.31) | Equity Drawdown Relative: | 58.14% (531.94) | |||||||

| Profit Factor: | 1.39 | Expected Payoff: | 3 789.74 | Margin Level: | 760.42% | |||||||

| Recovery Factor: | 8.18 | Sharpe Ratio: | 1.65 | Z-Score: | 0.69 (50.98%) | |||||||

| AHPR: | 1.0055 (0.55%) | LR Correlation: | 0.77 | OnTester result: | 0 | |||||||

| GHPR: | 1.0045 (0.45%) | LR Standard Error: | 1 536 969.13 | |||||||||

| Total Trades: | 2390 | Short Trades (won %): | 1687 (45.41%) | Long Trades (won %): | 703 (46.94%) | |||||||

| Total Deals: | 4780 | Profit Trades (% of total): | 1096 (45.86%) | Loss Trades (% of total): | 1294 (54.14%) | |||||||

| Largest profit trade: | 400 400.00 | Largest loss trade: | -198 400.00 | |||||||||

| Average profit trade: | 29 261.81 | Average loss trade: | -17 426.72 | |||||||||

| Maximum consecutive wins ($): | 14 (112 052.78) | Maximum consecutive losses ($): | 14 (-249 368.53) | |||||||||

| Maximal consecutive profit (count): | 1 093 527.27 (3) | Maximal consecutive loss (count): | -443 157.59 (4) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 2 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

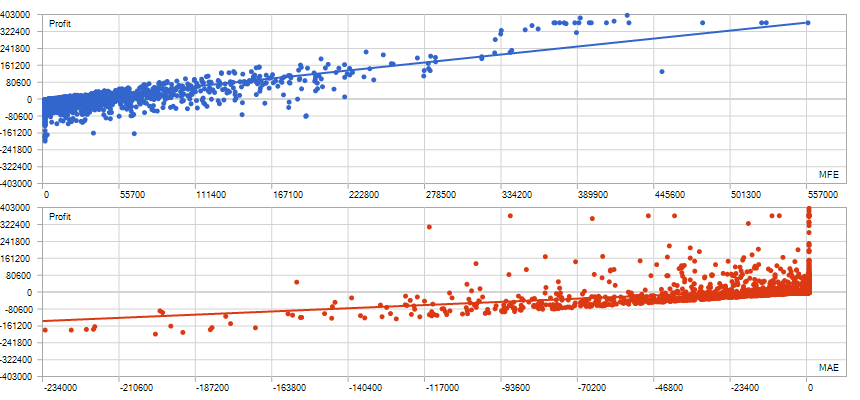

| Correlation (Profits,MFE): | 0.80 | Correlation (Profits,MAE): | 0.38 | Correlation (MFE,MAE): | -0.1085 | |||||||

|

||||||||||||

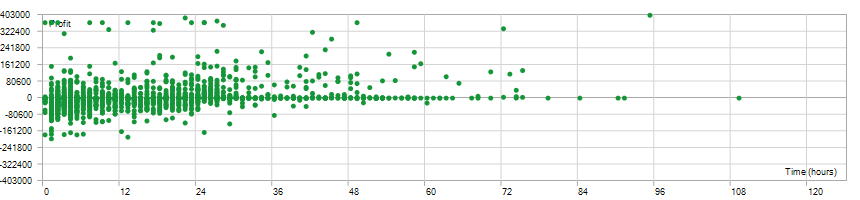

| Minimal position holding time: | 0:00:01 | Maximal position holding time: | 109:00:02 | Average position holding time: | 15:10:31 | |||||||

|

||||||||||||

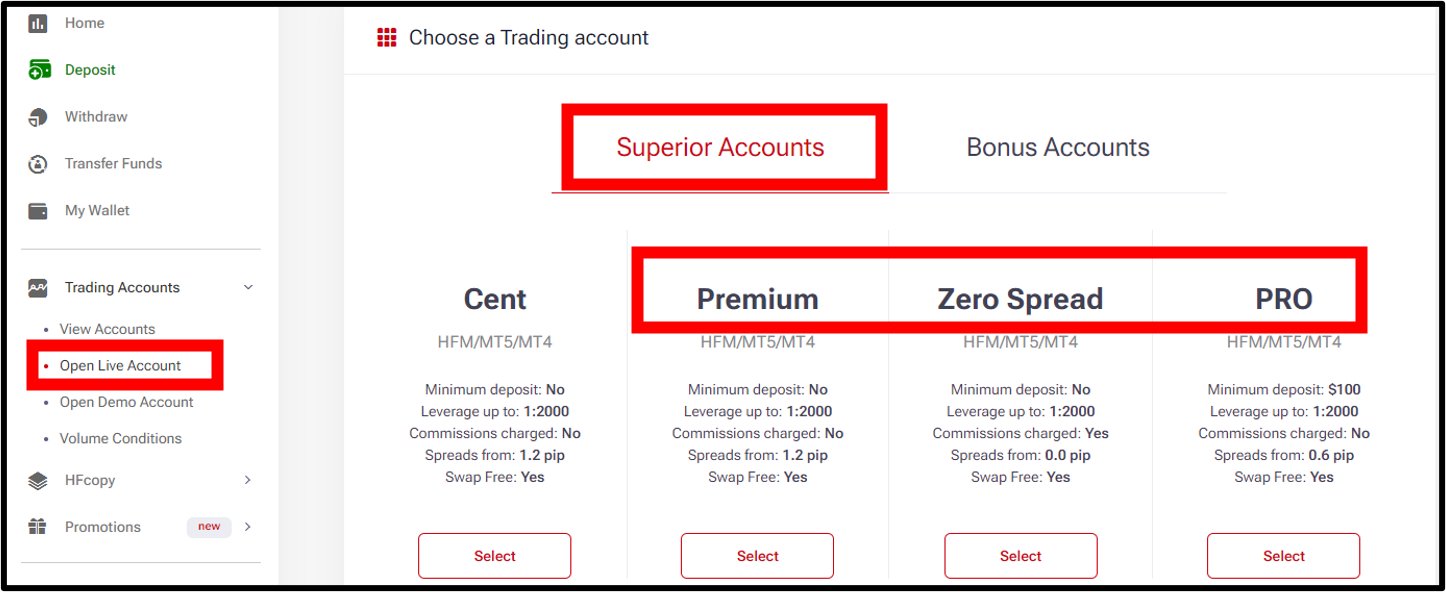

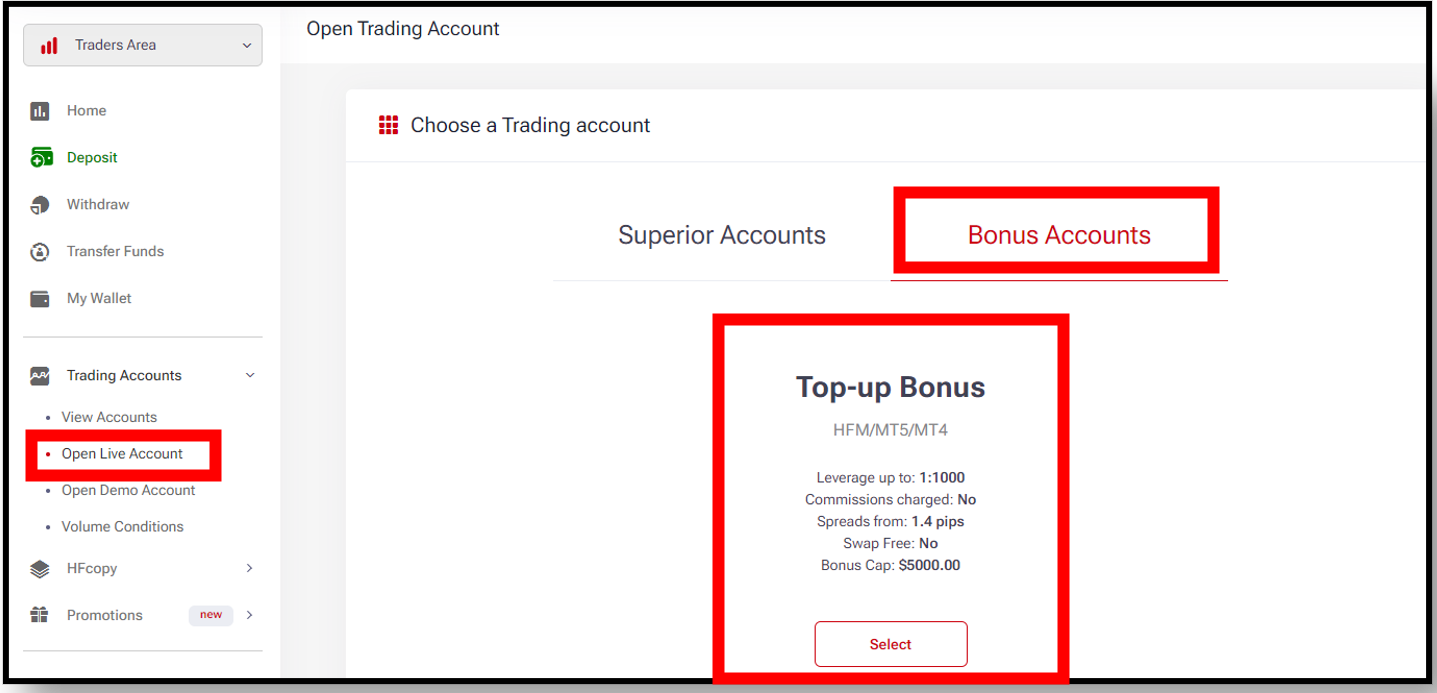

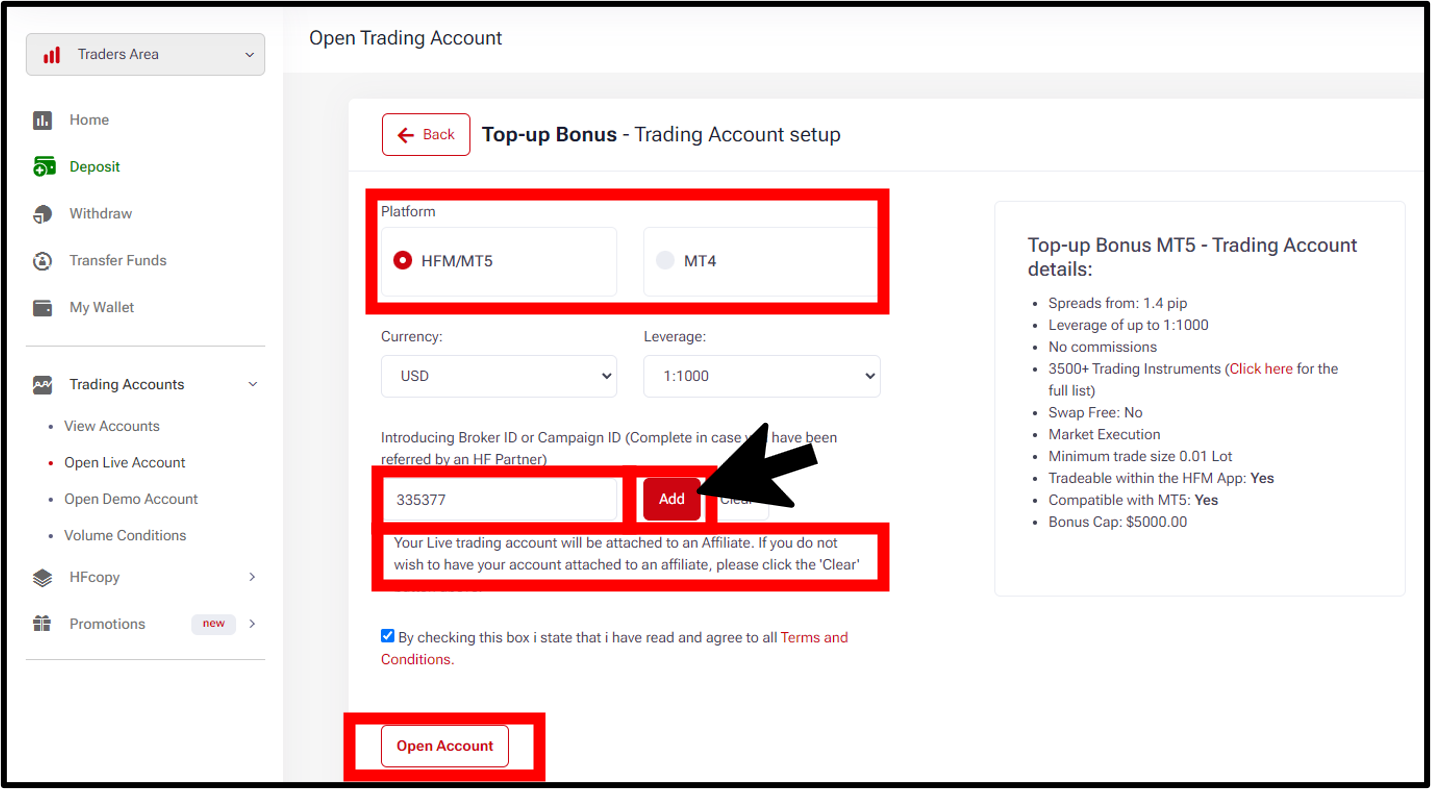

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Reviews

There are no reviews yet.