Long term Lobster EA (Free) By :

This free EA aims for big profits from small capital. No martingale. No grid. No camping. It has a robust logic with tight stop loss. It integrates two strategies using ADX and ROC signals.

| Currency Pair | EURUSD |

| Time frame | 1H |

| Terminal | MT5 |

| Trading Style | No Martingale & No Grid |

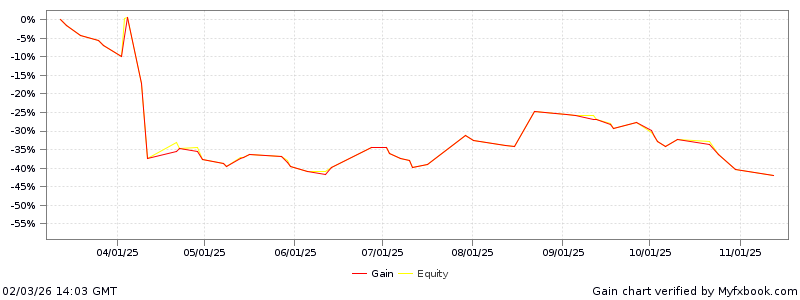

Live Performance Full Result with Myfxbook

FirstTrade:03/12/2025 00:00 LastUpdate:10/16/2025 14:18

| Total gain | -32% |

| Daily gain | -0.18% |

| Monthly gain | -5% |

| Drawdown | 43% |

| ProfitFactor | 0.6 |

| Pips | 229.8 |

| Currency | USD |

| Deposits | 300 |

| Profit | -97.05 |

| Balance | 202.95 |

| Equity | 202.95 |

| Interest | 0 |

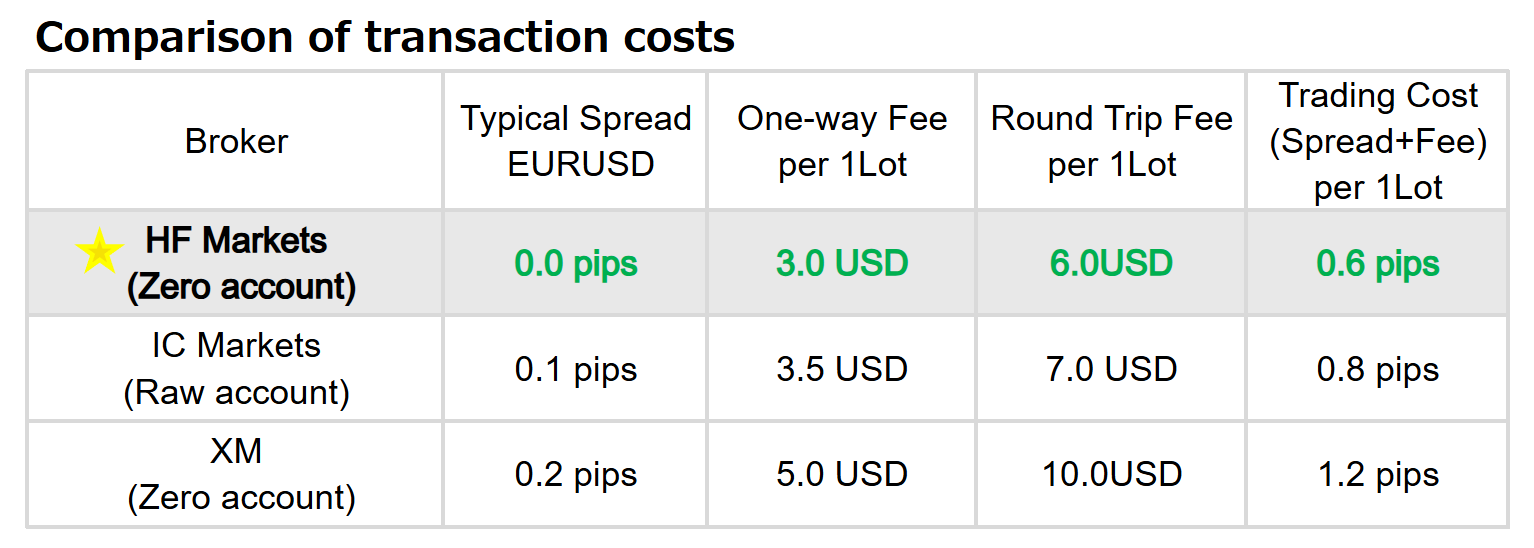

Broker : HF Markets

(REAL)

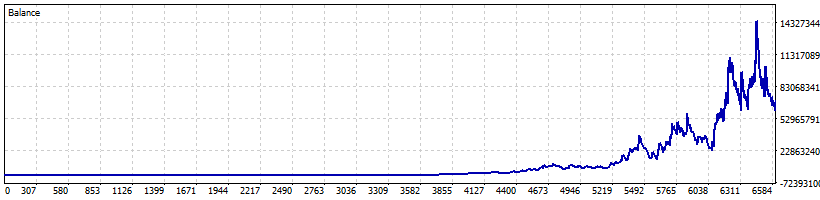

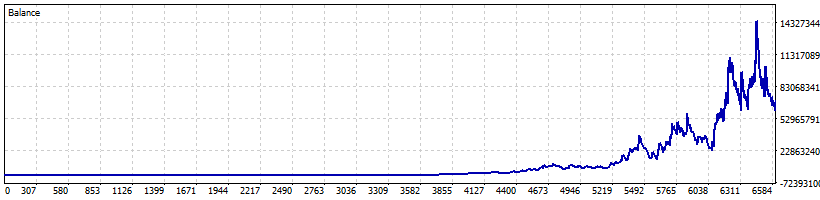

Backtesting

Test Period:2003.01.01 - 2025.03.05 (8099 days)

| Total Gain | 233813299.9% |

| Yearly Gain | 93.7% |

| Monthly Gain | 5.6% |

| Daily Gain | 0.18% |

| Relative Drawdown | 77.4% |

| Profit Factor | 1.11 |

| Currency | USD |

| Final Balance | 701440199.7 |

| Initial Deposit | 300 |

| Total Net Profit | 701439899.7 |

| Total Trades | 3288 |

| Ttimeframe | H1 |

Download This Free EA (Long term Lobster EA (Free))

Description

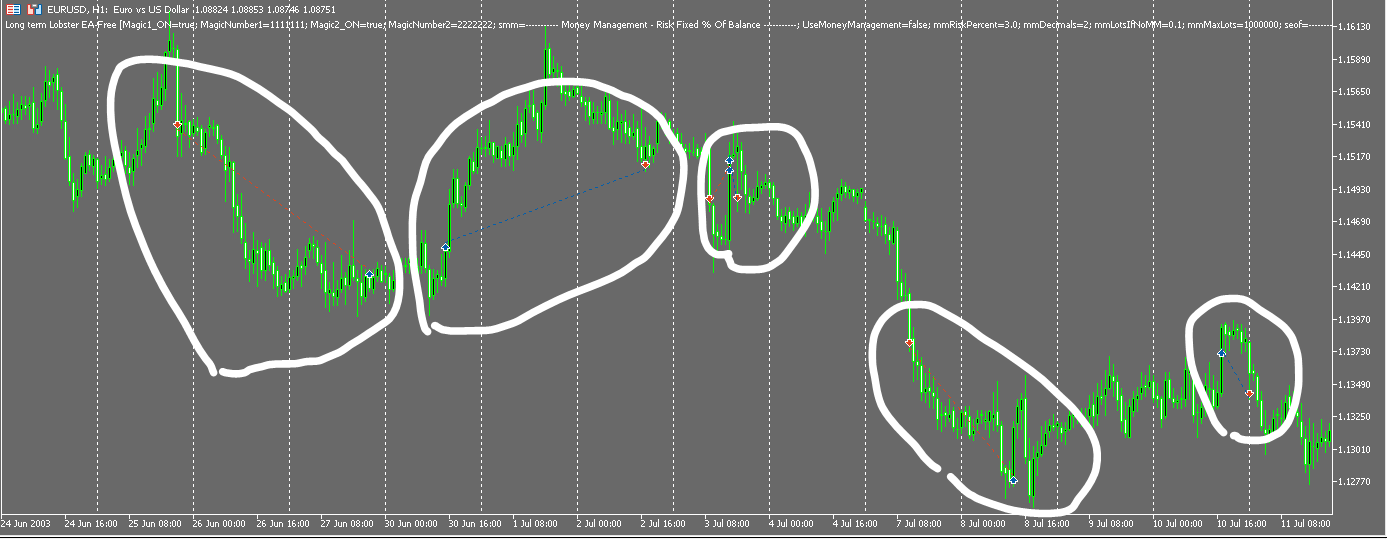

This EA is a multifunctional automated trading system that combines two distinct strategy logics to flexibly execute entries and exits in response to market conditions. Each strategy employs its own technical indicators to generate signals and strictly manages risk through precise entry price calculations and exit rules. Below is a detailed explanation of the system’s features and underlying mechanics.

1. Basic Structure and Parameter Settings

The EA operates by integrating two strategies—Strategy 1 and Strategy 2. Each strategy is assigned its own magic numbers and comments, ensuring that the signals generated remain distinct and independent.

-

Strategy 1:

This strategy focuses on ADX-based indicators, specifically monitoring the behavior of ADX DI Minus and ADX DI Plus. A long entry signal is generated when the ADX DI Minus is falling, while a short entry signal is triggered when the ADX DI Plus is falling. In addition, the system ensures that the Magic1 flag is enabled to validate the signal. -

Strategy 2:

The second strategy utilizes the Rate of Change (ROC) indicator to gauge market momentum. When ROC is rising, and Magic2 is enabled, a long entry signal is generated; conversely, a falling ROC produces a short entry signal. Each strategy operates independently, so if the conditions for one are met, the corresponding orders are executed.

2. Signal Generation and Entry Logic

The EA checks for signals at the open of each bar and automatically issues orders based on the conditions met by each strategy.

Entry Under Strategy 1

-

Entry Signal:

When the ADX DI Minus (or DI Plus) is falling and Magic1 is enabled, a corresponding long or short entry signal is produced. -

Entry Price Determination:

For a long entry, the system determines the entry price by referencing MTATR (a measure of the average range over a defined period). Upon the signal’s activation, a stop order is placed using the value derived from MTATR. -

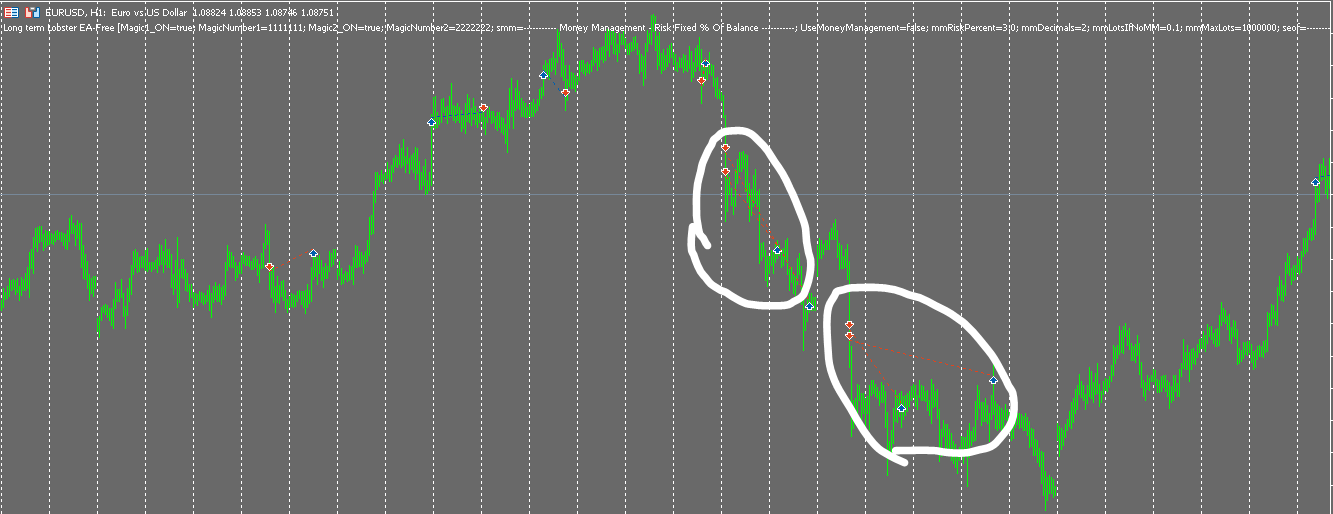

Validity Period and Risk Management:

Orders are set to remain valid for 102 bars, with mechanisms in place to prevent duplicate orders and to allow replacement of existing pending orders when necessary. Risk management is enforced by calculating stop loss and profit target levels using ATR. If the position reaches a predefined profit level, the EA automatically moves the stop loss to break even based on an ATR-derived coefficient. Additionally, a trailing stop is applied to safeguard gains, and an automatic exit rule is triggered after a specified number of bars to reduce exposure during volatile conditions.

Entry Under Strategy 2

-

Entry Signal:

When the ROC is rising and Magic2 is enabled, a long signal is generated; conversely, a falling ROC triggers a short signal. -

Entry and Risk Management:

In Strategy 2, the entry price is determined using the range provided by Bollinger Bands along with a predefined coefficient. Similar to Strategy 1, this strategy incorporates ATR-based calculations for stop loss and profit target settings. It also includes break-even adjustments and a trailing stop mechanism. However, Strategy 2 uses a different set of coefficients, enabling a more adaptable risk management approach tailored to the prevailing market conditions.

3. Trade Timing and Additional Conditions

The EA is capable of precise control over the timing of trades and adapts to various market environments.

-

Trading Time Restrictions:

The system can be configured to avoid trading during weekends or specific time periods (for example, from late Friday night to early Sunday morning), thereby reducing exposure during low liquidity periods. -

Intraday Exit Rules:

There are options to automatically close all positions at the end of the day or during specific times on Friday, minimizing the risk of adverse market movements. -

Other Trade Conditions:

Additional settings include limiting the deviation between the order price and the market price to a specified percentage and capping the maximum number of trades per day, all designed to prevent overexposure and unnecessary risk.

4. Comprehensive Risk Management and Automated Order Control

A key feature of this EA is its rigorous risk management and order control system.

-

ATR-Based Dynamic Settings:

For every entry, the system calculates stop loss and profit target levels dynamically using ATR, which allows the EA to adjust quickly to changing market volatility. -

Break-Even Move Functionality:

When a position reaches a certain profit threshold, the EA automatically shifts the stop loss to break even based on an ATR-derived coefficient, thus securing profits and minimizing potential losses. -

Trailing Stop Mechanism:

If the market moves favorably, a trailing stop is triggered automatically, ensuring that gains are locked in while allowing further upside potential. -

Automatic Exit Function:

Particularly in Strategy 1, an automatic exit rule is embedded, closing the position after a predefined number of bars. Strategy 2 similarly incorporates mechanisms to exit positions under certain conditions.

5. Conclusion

This EA combines a variety of technical indicators—such as ADX, ROC, MTATR, and Bollinger Bands—to accommodate diverse market scenarios with flexibility. In Strategy 1, the focus is on ADX-based signals and determining the long entry price using MTATR, while employing robust risk management through ATR-based stop loss, break-even adjustments, and trailing stops. Meanwhile, Strategy 2 leverages ROC signals and Bollinger Band ranges, with its own tailored risk management parameters. With additional features like trade timing restrictions and strict order validity periods, the system minimizes unnecessary risks and optimizes entry and exit timing. These comprehensive features make the EA a reliable and adaptable automated trading solution suitable for both novice and experienced traders.

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

Reviews

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4885) |

||||||||||||

Settings |

||||||||||||

| Expert: | Long term Lobster EA-Free | |||||||||||

| Symbol: | EURUSD | |||||||||||

| Period: | H1 (2003.01.01 - 2025.03.05) | |||||||||||

| Inputs: | Magic1_ON=true | |||||||||||

| MagicNumber1=1111111 | ||||||||||||

| Magic2_ON=true | ||||||||||||

| MagicNumber2=2222222 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=3.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.1 | ||||||||||||

| mmMaxLots=1000000 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=20:30 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 300.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 137562 | Ticks: | 31648191 | Symbols: | 1 | |||||||

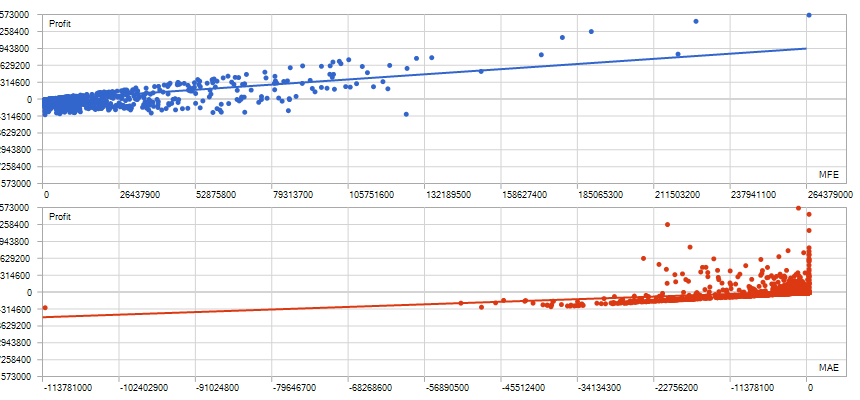

| Total Net Profit: | 701 439 899.70 | Balance Drawdown Absolute: | 38.25 | Equity Drawdown Absolute: | 46.27 | |||||||

| Gross Profit: | 7 284 462 362.08 | Balance Drawdown Maximal: | 837 410 482.16 (57.84%) | Equity Drawdown Maximal: | 877 888 321.35 (59.15%) | |||||||

| Gross Loss: | -6 583 022 462.38 | Balance Drawdown Relative: | 76.69% (4 377.41) | Equity Drawdown Relative: | 77.40% (4 496.85) | |||||||

| Profit Factor: | 1.11 | Expected Payoff: | 213 333.30 | Margin Level: | 188.47% | |||||||

| Recovery Factor: | 0.80 | Sharpe Ratio: | 1.75 | Z-Score: | -9.72 (99.74%) | |||||||

| AHPR: | 1.0059 (0.59%) | LR Correlation: | 0.67 | OnTester result: | 0 | |||||||

| GHPR: | 1.0045 (0.45%) | LR Standard Error: | 172 500 046.56 | |||||||||

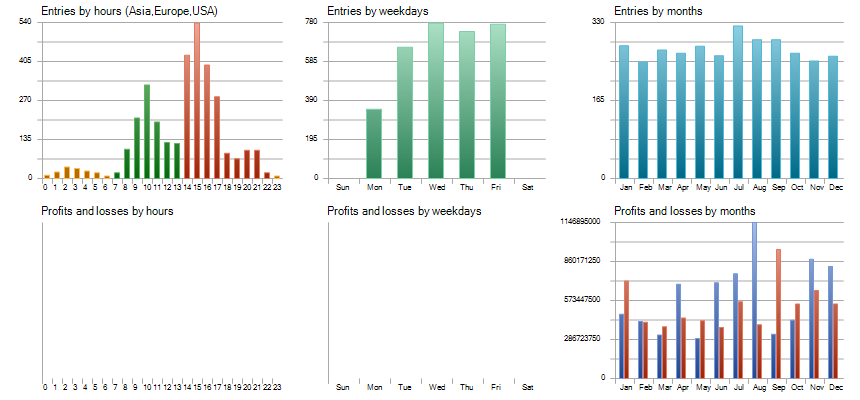

| Total Trades: | 3288 | Short Trades (won %): | 1549 (36.67%) | Long Trades (won %): | 1739 (33.18%) | |||||||

| Total Deals: | 6576 | Profit Trades (% of total): | 1145 (34.82%) | Loss Trades (% of total): | 2143 (65.18%) | |||||||

| Largest profit trade: | 220 842 416.16 | Largest loss trade: | -40 410 760.74 | |||||||||

| Average profit trade: | 6 361 975.86 | Average loss trade: | -2 994 182.95 | |||||||||

| Maximum consecutive wins ($): | 7 (68 115 380.90) | Maximum consecutive losses ($): | 17 (-125 586 881.19) | |||||||||

| Maximal consecutive profit (count): | 400 630 862.50 (4) | Maximal consecutive loss (count): | -457 379 420.60 (14) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

| Correlation (Profits,MFE): | 0.69 | Correlation (Profits,MAE): | 0.29 | Correlation (MFE,MAE): | -0.3220 | |||||||

|

||||||||||||

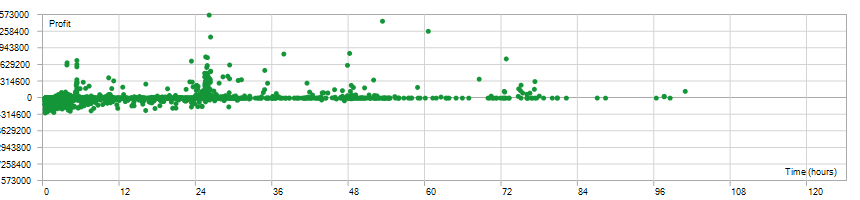

| Minimal position holding time: | 0:00:19 | Maximal position holding time: | 100:33:00 | Average position holding time: | 12:40:40 | |||||||

|

||||||||||||

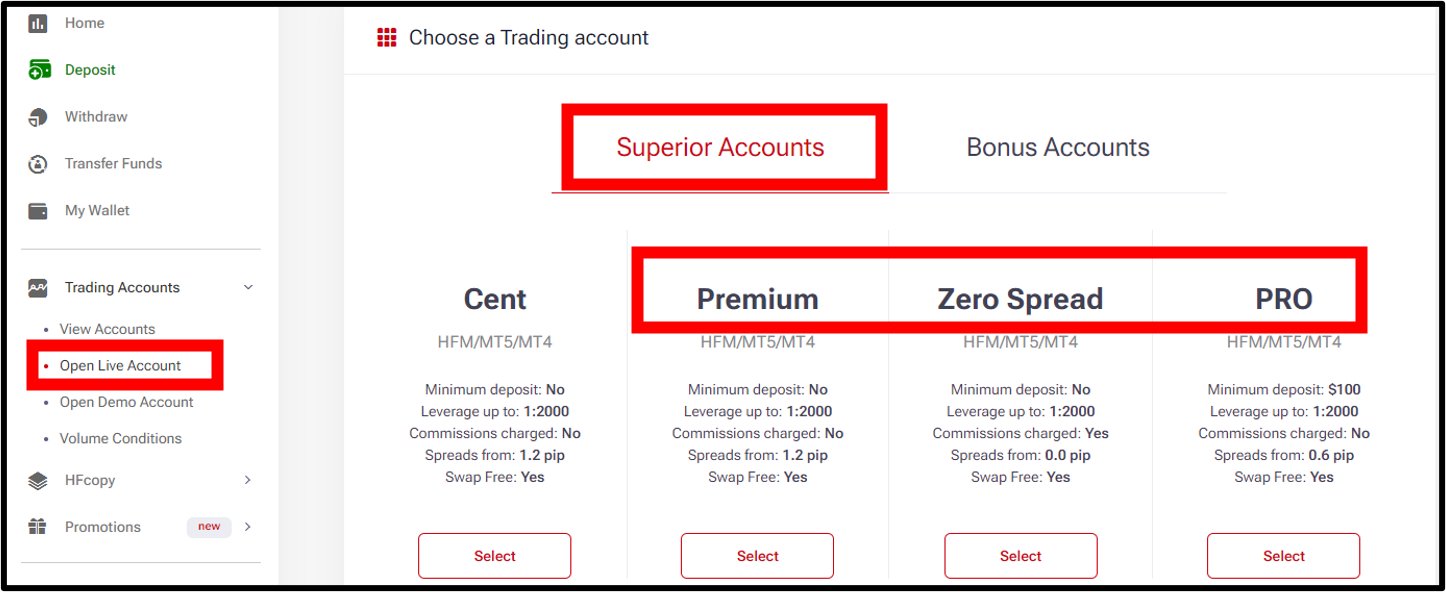

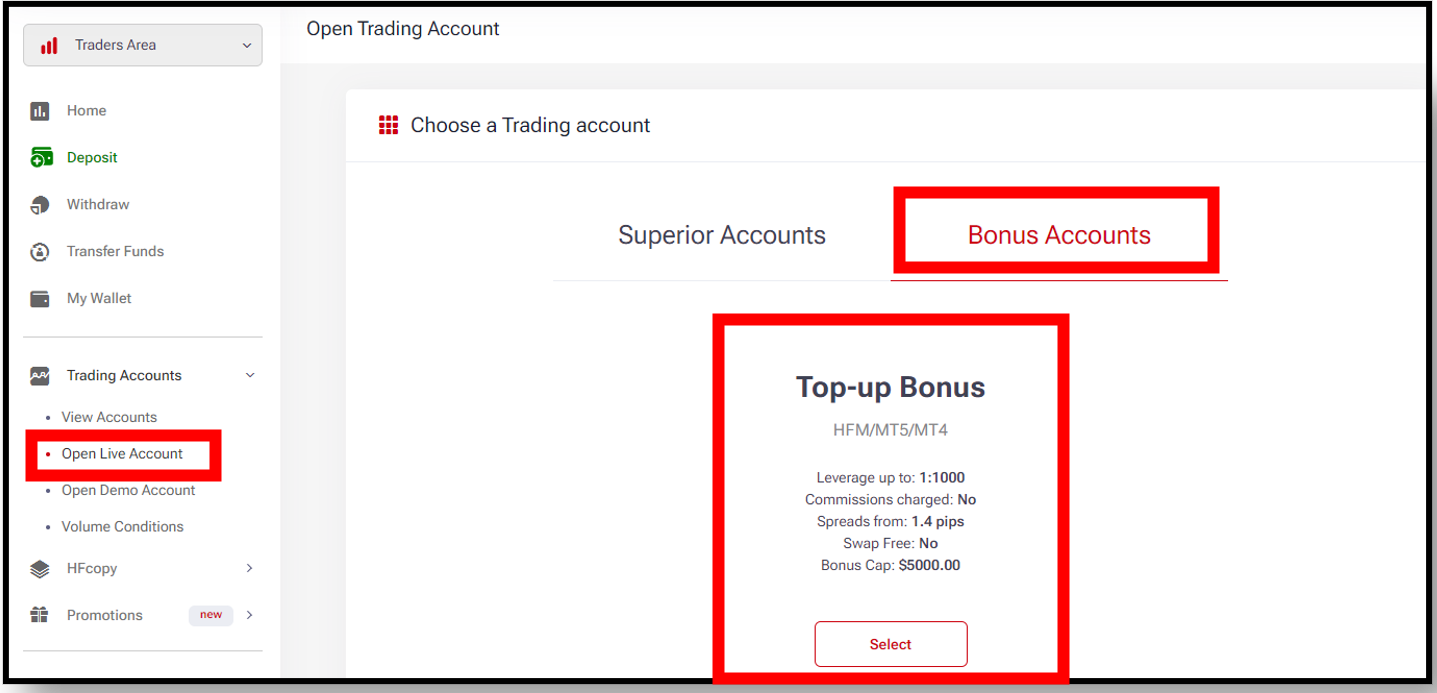

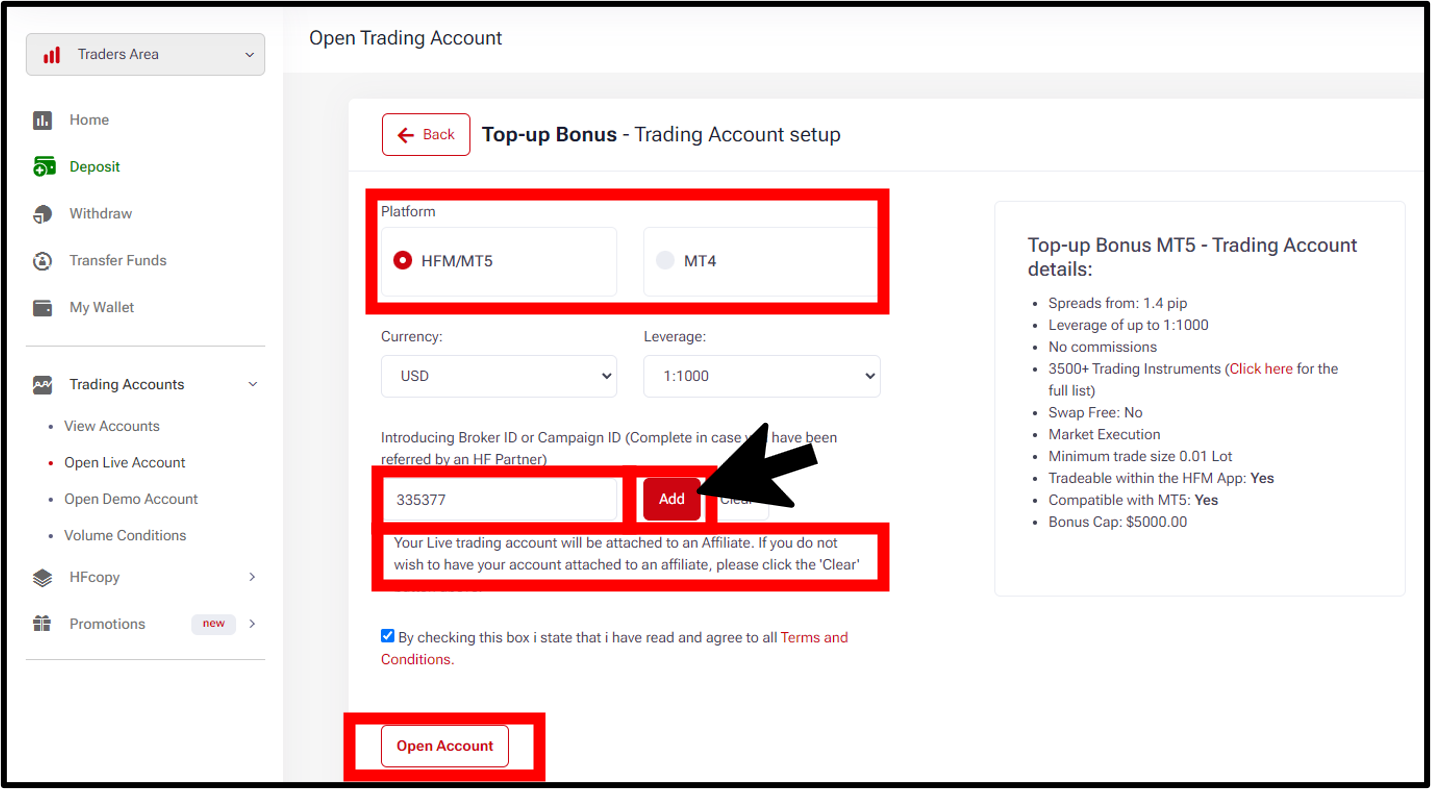

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Davi –

It’s good that such EAs are provided for free.

This avoids techniques such as martingale.

Free EAs –

Thank you for your Review!