Gold Galaxy Express EA (Free) By :

This EA trades XAUUSD on a 1-hour chart, uses strict risk management, avoids high-risk methods, and aims for stable, long-term growth, even from small capital.

| Currency Pair | XAUUSD |

| Time frame | 1H |

| Terminal | MT5 |

| Trading Style | No Martingale & No Grid |

Forward test is not conducted.

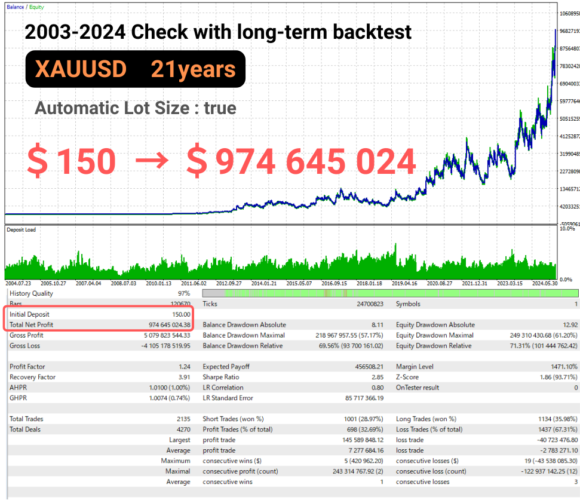

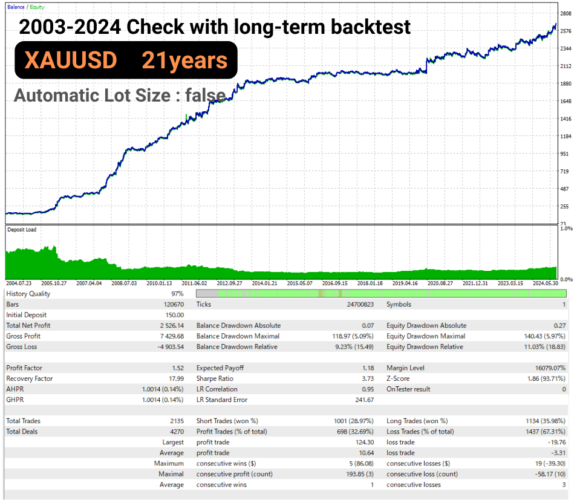

Backtesting

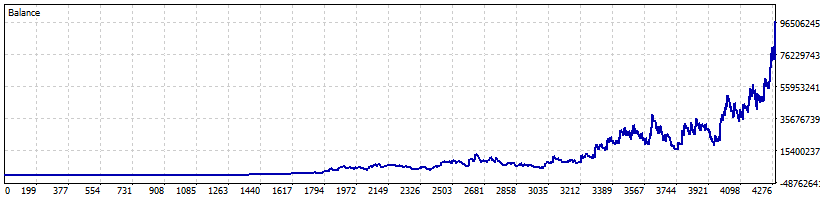

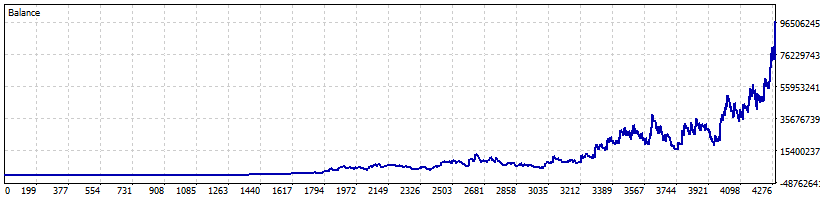

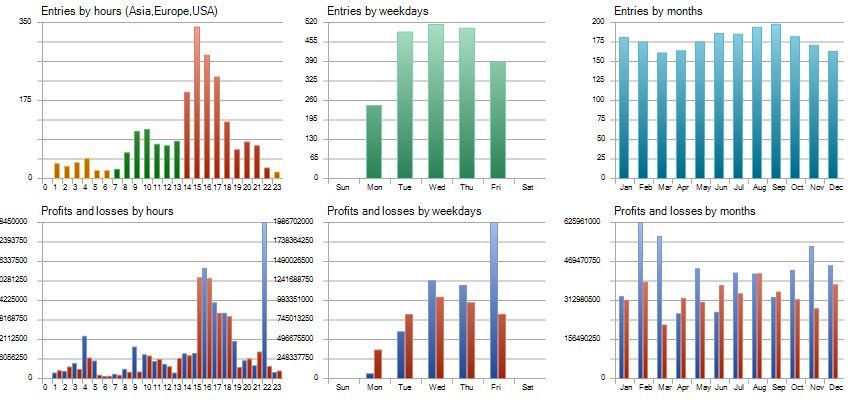

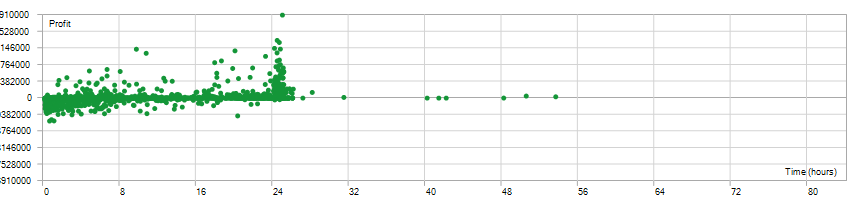

Test Period:2003.01.06 - 2025.03.20 (8109 days)

| Total Gain | 649763349.6% |

| Yearly Gain | 102.6% |

| Monthly Gain | 6% |

| Daily Gain | 0.19% |

| Relative Drawdown | 71.3% |

| Profit Factor | 1.24 |

| Currency | USD |

| Final Balance | 974645174.38 |

| Initial Deposit | 150 |

| Total Net Profit | 974645024.38 |

| Total Trades | 2135 |

| Ttimeframe | H1 |

Download This Free EA (Gold Galaxy Express EA (Free))

Description

Target Currency Pair and Timeframe

The target currency pair is XAUUSD (Gold/US Dollar).

The timeframe used is 1-hour.

This EA can be operated with a small amount of capital, starting from as little as $50. It includes a compounding feature designed to efficiently grow assets over time. By emphasizing risk management, it aims for stable, long-term returns.

Main Features of the EA

This EA focuses on risk management and is equipped with features that aim for solid and efficient profit generation. Below are its main characteristics:

- No Martingale & No Grid Trades: It does not employ high-risk Martingale or Grid strategies. Every position is protected by a stop loss, which avoids excessive risks and ensures stable trading.

- Compounding Feature: It can automatically adjust lot sizes based on account equity, enabling compounding. This allows efficient capital growth and the potential for significant profits even starting with a small amount.

- Breakout Detection: Equipped with a trading logic that captures market breakouts. It can adapt to both long and short positions, maximizing profit opportunities.

Overview of the Trading Strategy

This EA uses specific indicators to detect market breakouts and execute entries and exits.

Logic Overview

- Indicators Used: Bulls Power, Bears Power

- Entry Conditions: Long entries are generated based on specified conditions that produce buy signals, while short entries mirror these conditions to produce sell signals.

- Exit Strategies: Utilizes trailing stops and ATR-based stop losses. By employing diverse stop-loss methods, it minimizes risk while maximizing profits.

Parameter Settings

Money Management Parameters

This EA includes flexible money management features to optimize lot size and reduce risk.

- “Use Money Management” parameter:

Setting this to true enables the EA to automatically adjust lot sizes according to account balance.

If set to false, trading will be conducted at a fixed lot size specified by “mmLotsIfNoMM”. - “mmRisk Percent” parameter:

When “UseMoneyManagement” is set to true, this parameter adjusts risk based on a percentage. A recommended value is around 0.5–2.0%. - “mmDecimal” parameter:

When “UseMoneyManagement”: true is enabled, this parameter defines the decimal precision for lot size adjustments.

Setting it to 1 adjusts to one decimal place (e.g., 0.1 → 0.2), while setting it to 2 adjusts to two decimal places, making it compatible with many brokers that handle XAUUSD. - “mmMaxLots” parameter:

Specifies the maximum lot size available. The lot size will not exceed this value.

Exit Settings Under Specific Conditions

Flexible settings are available to avoid risk at the Friday market close.

- ExitOnFriday: Determines whether to close all positions on Friday.

- FridayExitTime: Allows setting the Friday close time in 24-hour format to reduce market risk.

Conclusion

This EA is designed to capture breakouts in the XAUUSD market and aims for long-term profitability while controlling risk. By combining multiple trading logics and money management functions, it is suitable for traders of all levels, from beginners to advanced users. Starting with a small amount of capital and leveraging compounding, it provides support for efficient asset growth over time.

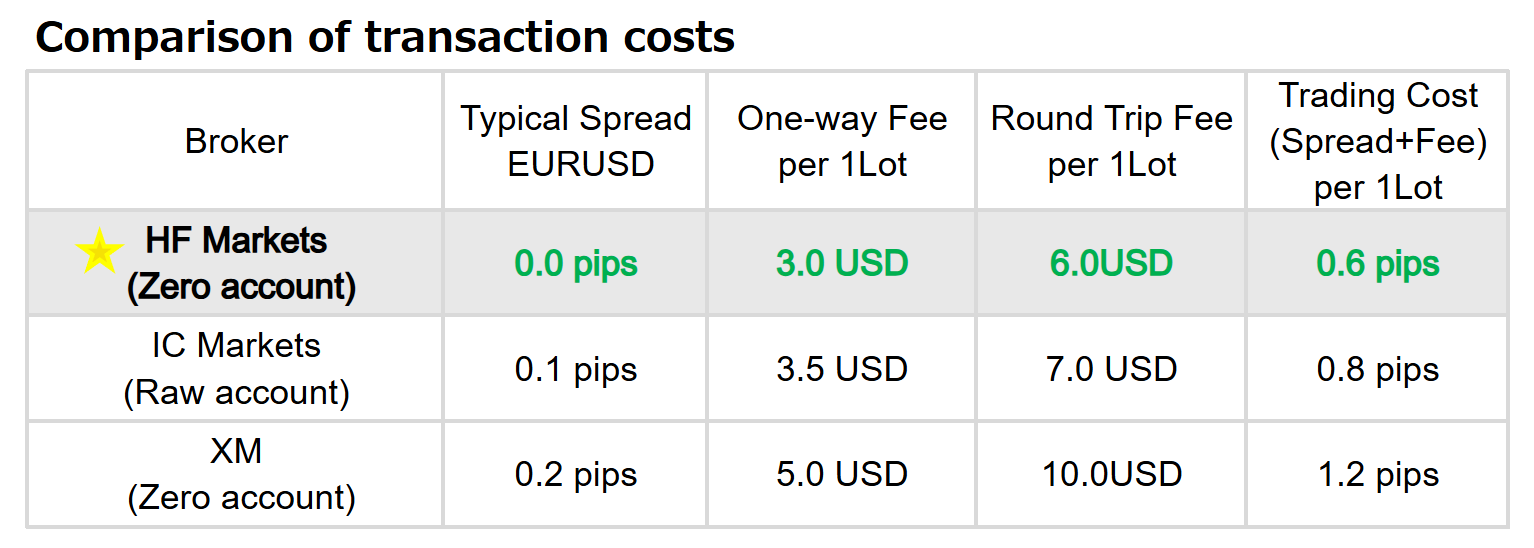

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4885) |

||||||||||||

Settings |

||||||||||||

| Expert: | Gold Galaxy Express | |||||||||||

| Symbol: | XAUUSD | |||||||||||

| Period: | H1 (2003.01.06 - 2025.03.20) | |||||||||||

| Inputs: | MagicNumber=11111 | |||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=0.5 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=10000000 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=22:00 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 150.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 97% | |||||||||||

| Bars: | 120670 | Ticks: | 24700823 | Symbols: | 1 | |||||||

| Total Net Profit: | 974 645 024.38 | Balance Drawdown Absolute: | 8.11 | Equity Drawdown Absolute: | 12.92 | |||||||

| Gross Profit: | 5 079 823 544.33 | Balance Drawdown Maximal: | 218 967 957.55 (57.17%) | Equity Drawdown Maximal: | 249 310 430.68 (61.20%) | |||||||

| Gross Loss: | -4 105 178 519.95 | Balance Drawdown Relative: | 69.56% (93 700 161.02) | Equity Drawdown Relative: | 71.31% (101 444 762.42) | |||||||

| Profit Factor: | 1.24 | Expected Payoff: | 456 508.21 | Margin Level: | 1471.10% | |||||||

| Recovery Factor: | 3.91 | Sharpe Ratio: | 2.85 | Z-Score: | 1.86 (93.71%) | |||||||

| AHPR: | 1.0100 (1.00%) | LR Correlation: | 0.80 | OnTester result: | 0 | |||||||

| GHPR: | 1.0074 (0.74%) | LR Standard Error: | 85 717 366.19 | |||||||||

| Total Trades: | 2135 | Short Trades (won %): | 1001 (28.97%) | Long Trades (won %): | 1134 (35.98%) | |||||||

| Total Deals: | 4270 | Profit Trades (% of total): | 698 (32.69%) | Loss Trades (% of total): | 1437 (67.31%) | |||||||

| Largest profit trade: | 145 589 848.12 | Largest loss trade: | -40 723 476.80 | |||||||||

| Average profit trade: | 7 277 684.16 | Average loss trade: | -2 783 271.10 | |||||||||

| Maximum consecutive wins ($): | 5 (420 962.20) | Maximum consecutive losses ($): | 19 (-43 538 085.30) | |||||||||

| Maximal consecutive profit (count): | 243 314 767.92 (2) | Maximal consecutive loss (count): | -122 937 142.25 (12) | |||||||||

| Average consecutive wins: | 1 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

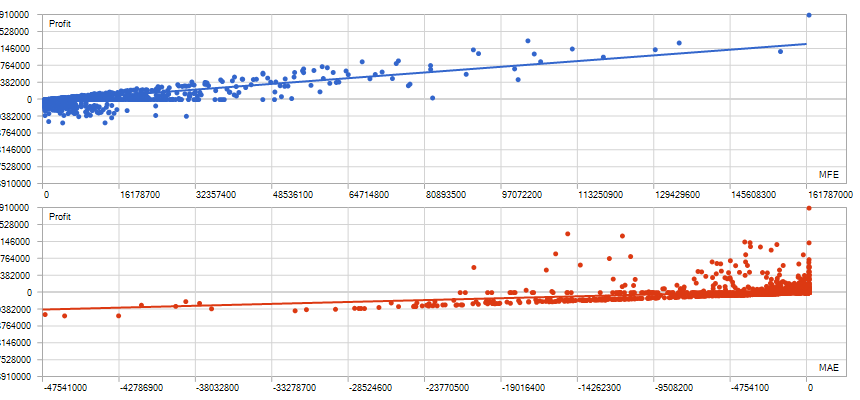

| Correlation (Profits,MFE): | 0.79 | Correlation (Profits,MAE): | 0.34 | Correlation (MFE,MAE): | -0.1531 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:00:19 | Maximal position holding time: | 53:28:20 | Average position holding time: | 8:29:09 | |||||||

|

||||||||||||

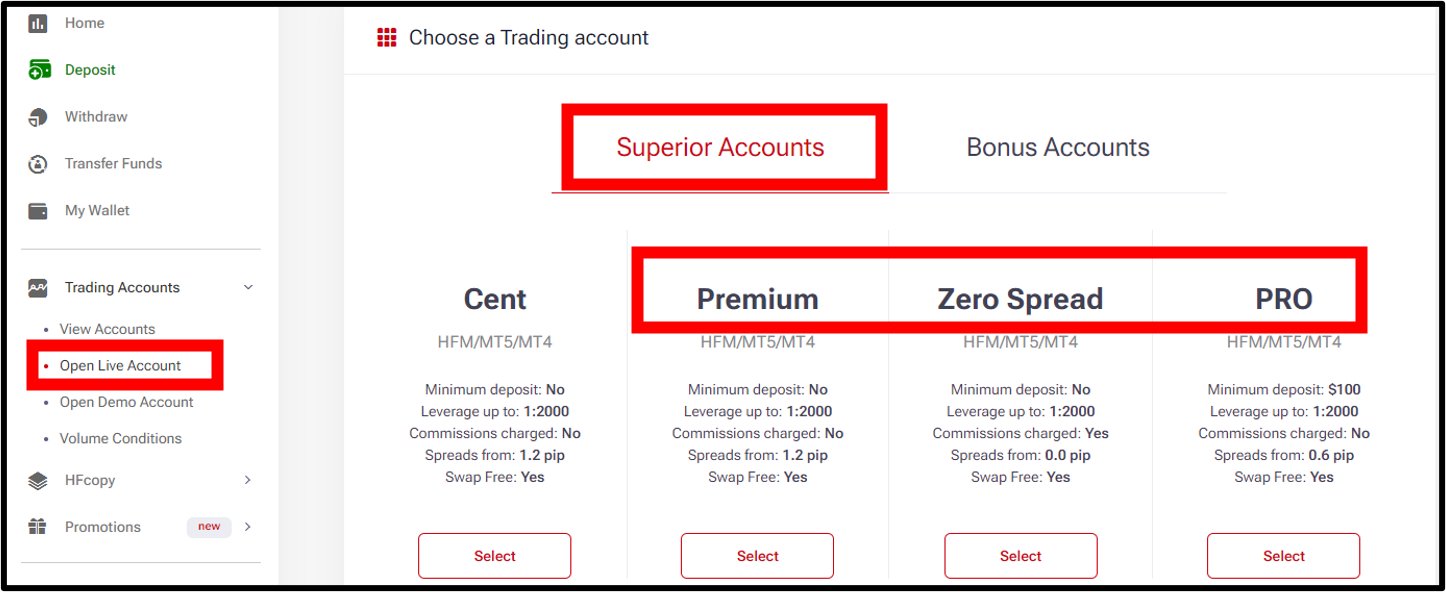

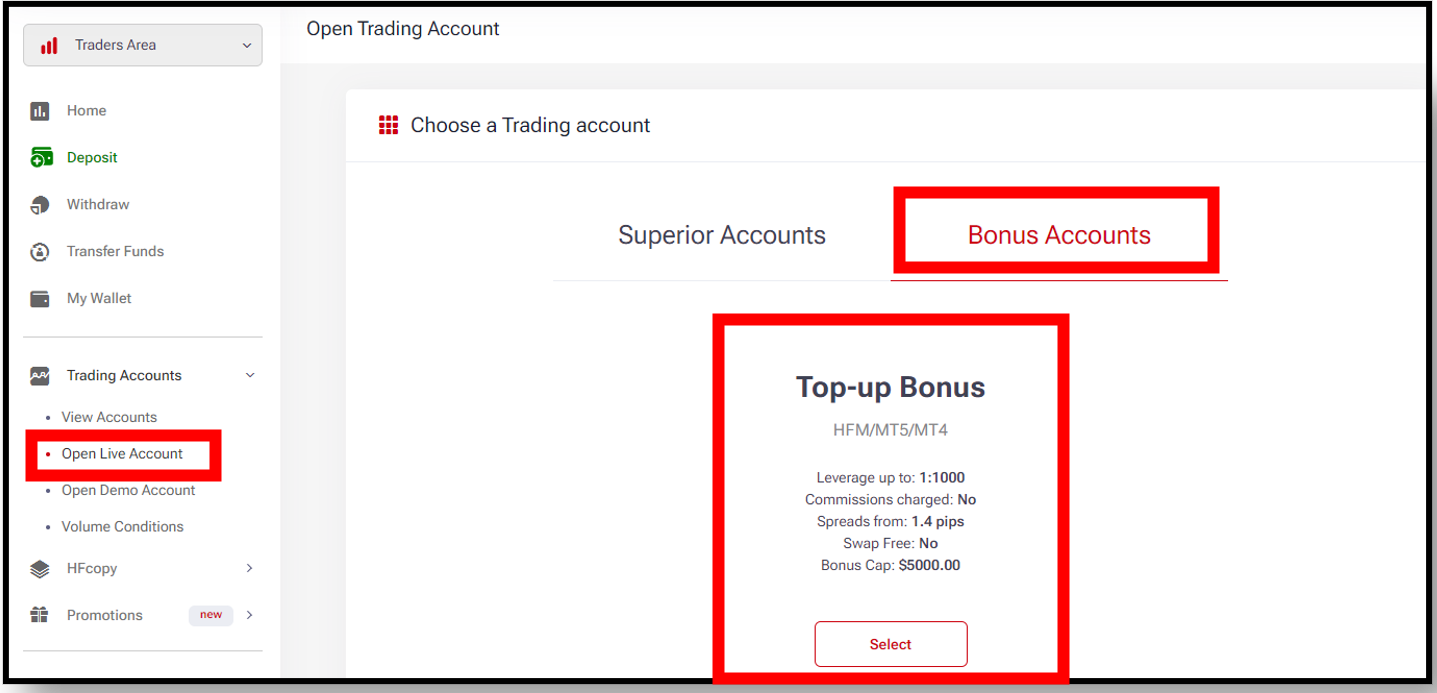

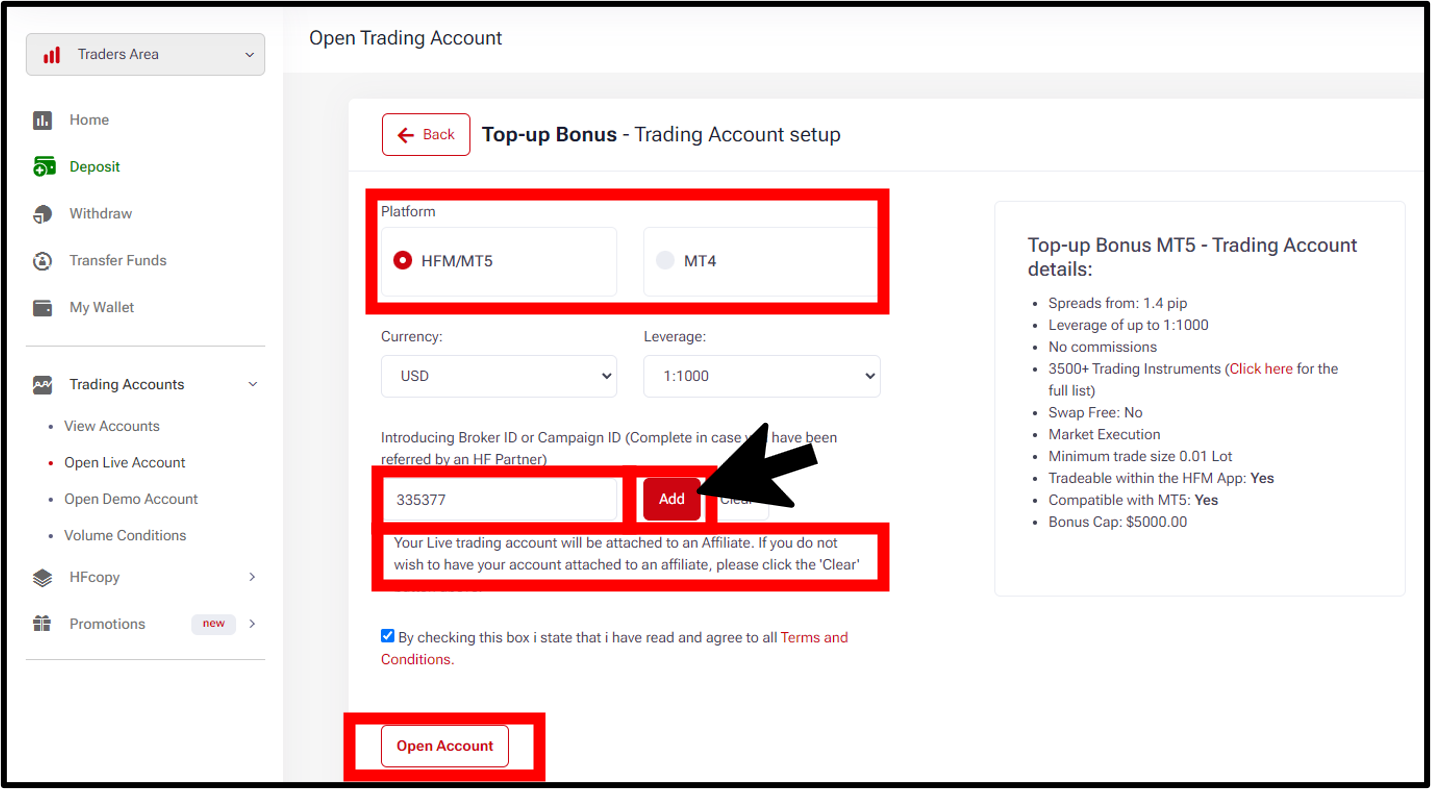

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Reviews

There are no reviews yet.