Gold Crab Robot EA (Free) By :

Gold Crab Robot is a hedging-capable EA specialized for XAUUSD on the H1 chart. Combining three proven signal sets with various indicators, it automates dynamic entries and risk management according to market conditions.

| Currency Pair | XAUUSD |

| Time frame | 1H |

| Terminal | MT5 |

| Trading Style | No Martingale & No Grid |

Forward test is not conducted.

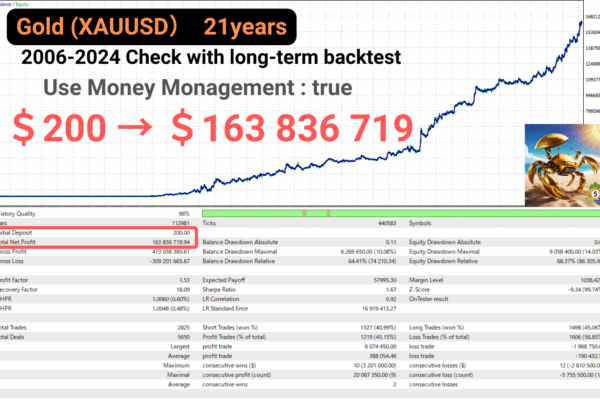

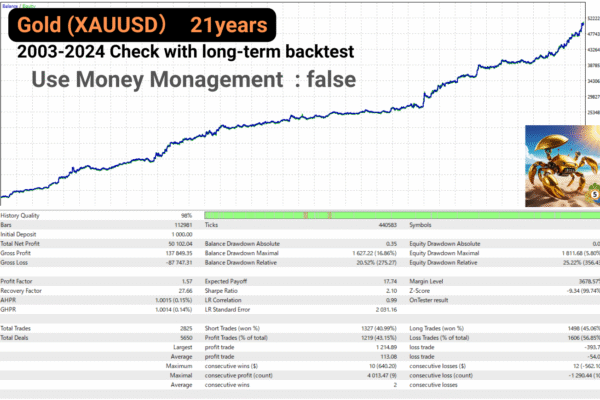

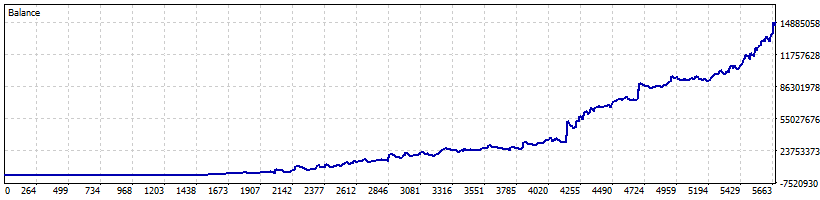

Backtesting

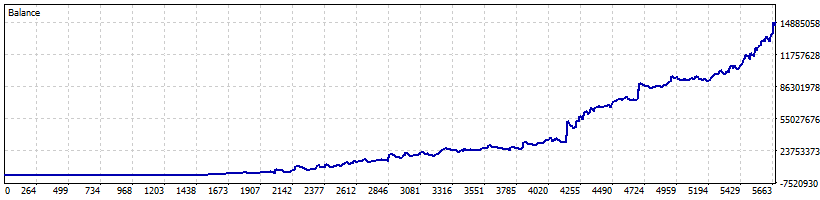

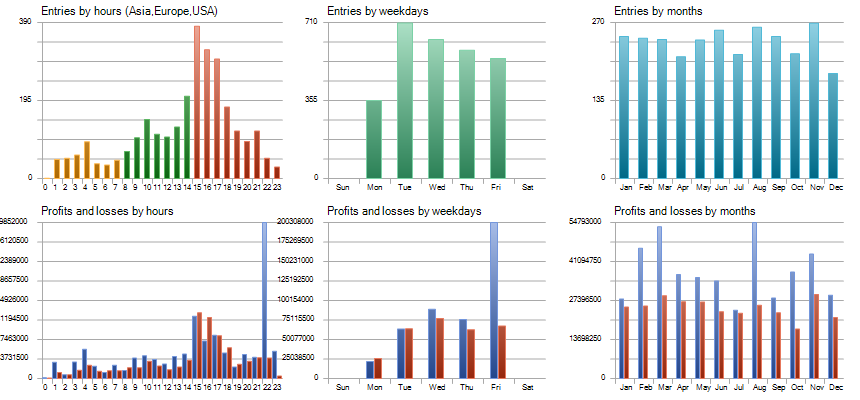

Test Period:2006.01.01 - 2025.05.10 (7069 days)

| Total Gain | 75211298.7% |

| Yearly Gain | 101.1% |

| Monthly Gain | 5.9% |

| Daily Gain | 0.19% |

| Relative Drawdown | 70.3% |

| Profit Factor | 1.5 |

| Currency | USD |

| Final Balance | 150422797.34 |

| Initial Deposit | 200 |

| Total Net Profit | 150422597.34 |

| Total Trades | 2828 |

| Ttimeframe | H1 |

Download This Free EA (Gold Crab Robot EA (Free))

Description

Features of Gold Crab Robot

Gold Crab Robot is a hedging-capable EA specialized for XAUUSD on the H1 chart. Combining three proven signal sets with various indicators, it automates dynamic entries and risk management according to market conditions.

This EA offers an excellent risk-reward ratio and supports fully automatic lot sizing. With long-term operation, it aims to turn modest starting capital into significant profits.

■ Triple-Signal Framework

Signal ①: Aroon Cross + ATR Break

- Catches trend reversals when the Aroon Up line crosses the Aroon Down line

- Places entry stop orders based on the prior weekly high/low, offset by an ATR-based multiplier

- Dynamically adjusts Stop Loss, Profit Target, and Trailing Stop using ATR coefficients

Signal ②: Offset Aroon + Bollinger-Band Width Ratio

- Uses an offset Aroon cross from past bars as the trigger

- References the Bollinger-Band Width Ratio to initiate stop orders during volatility expansions

- Offers extensive customization of holding period, SL/TP levels, and trailing-stop settings

Signal ③: Ichimoku Kijun-Sen Cross + DeMarker Filter

- Combines an Ichimoku Kijun-Sen cross signal with DeMarker momentum filtering

- Employs fixed-pip stop orders alongside ATR-based trailing stops

- Automatically closes positions after a predefined number of bars

■ Indicators Used

- Aroon: Early detection of trend strength and turning points

- ATR/MTATR: Real-time measurement of market volatility

- BB Width Ratio: Captures band expansion and contraction phases

- Ichimoku: Multi-dimensional trend analysis

- DeMarker: Supplemental filter for overbought/oversold conditions

■ Backtest

- Long-Term Backtests: Confirmed stable performance on H1 data from the mid-2000s through early 2025

- Broker-Agnostic: Compatible with a wide range of brokers and environments without special filters

Conclusion

Gold Crab Robot integrates “trend reversals,” “volatility breakouts,” and “momentum continuation” into one cohesive system, delivering smart entries and robust risk management. It’s ideal for traders seeking automated gold-market strategies that leverage today’s volatility while keeping per-trade risk tightly controlled.

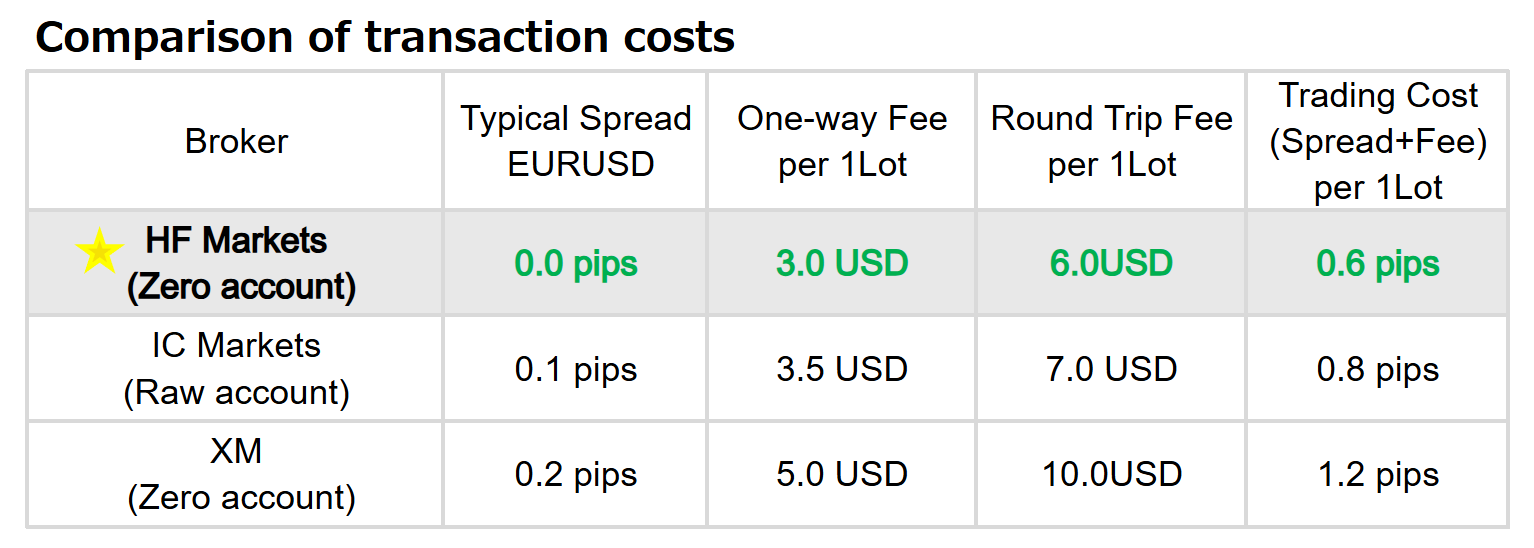

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4885) |

||||||||||||

Settings |

||||||||||||

| Expert: | Gold Crab Robot | |||||||||||

| Symbol: | XAUUSD | |||||||||||

| Period: | H1 (2006.01.01 - 2025.05.10) | |||||||||||

| Inputs: | MagicNumber1=11111 | |||||||||||

| MagicNumber2=22222 | ||||||||||||

| MagicNumber3=33333 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=0.5 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=22:00 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 200.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 98% | |||||||||||

| Bars: | 112981 | Ticks: | 24449875 | Symbols: | 1 | |||||||

| Total Net Profit: | 150 422 597.34 | Balance Drawdown Absolute: | 0.11 | Equity Drawdown Absolute: | 0.00 | |||||||

| Gross Profit: | 451 060 390.96 | Balance Drawdown Maximal: | 6 279 650.00 (12.01%) | Equity Drawdown Maximal: | 9 061 900.00 (16.58%) | |||||||

| Gross Loss: | -300 637 793.62 | Balance Drawdown Relative: | 66.60% (74 660.15) | Equity Drawdown Relative: | 70.31% (86 353.74) | |||||||

| Profit Factor: | 1.50 | Expected Payoff: | 53 190.45 | Margin Level: | 920.04% | |||||||

| Recovery Factor: | 16.60 | Sharpe Ratio: | 2.11 | Z-Score: | -9.42 (99.74%) | |||||||

| AHPR: | 1.0060 (0.60%) | LR Correlation: | 0.90 | OnTester result: | 0 | |||||||

| GHPR: | 1.0048 (0.48%) | LR Standard Error: | 17 045 306.41 | |||||||||

| Total Trades: | 2828 | Short Trades (won %): | 1327 (40.77%) | Long Trades (won %): | 1501 (44.30%) | |||||||

| Total Deals: | 5656 | Profit Trades (% of total): | 1206 (42.64%) | Loss Trades (% of total): | 1622 (57.36%) | |||||||

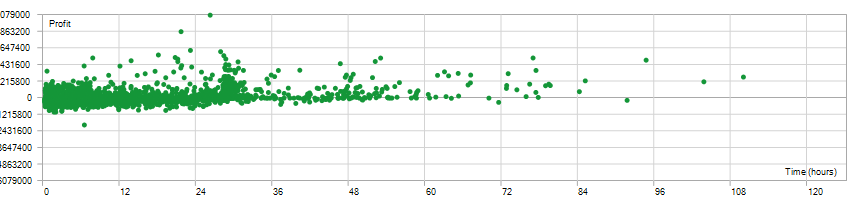

| Largest profit trade: | 6 074 450.00 | Largest loss trade: | -1 968 750.00 | |||||||||

| Average profit trade: | 374 013.59 | Average loss trade: | -183 343.41 | |||||||||

| Maximum consecutive wins ($): | 9 (20 066 850.00) | Maximum consecutive losses ($): | 12 (-2 810 500.00) | |||||||||

| Maximal consecutive profit (count): | 20 066 850.00 (9) | Maximal consecutive loss (count): | -5 755 500.00 (10) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

| Correlation (Profits,MFE): | 0.83 | Correlation (Profits,MAE): | 0.31 | Correlation (MFE,MAE): | -0.0924 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:00:01 | Maximal position holding time: | 109:41:20 | Average position holding time: | 12:19:25 | |||||||

|

||||||||||||

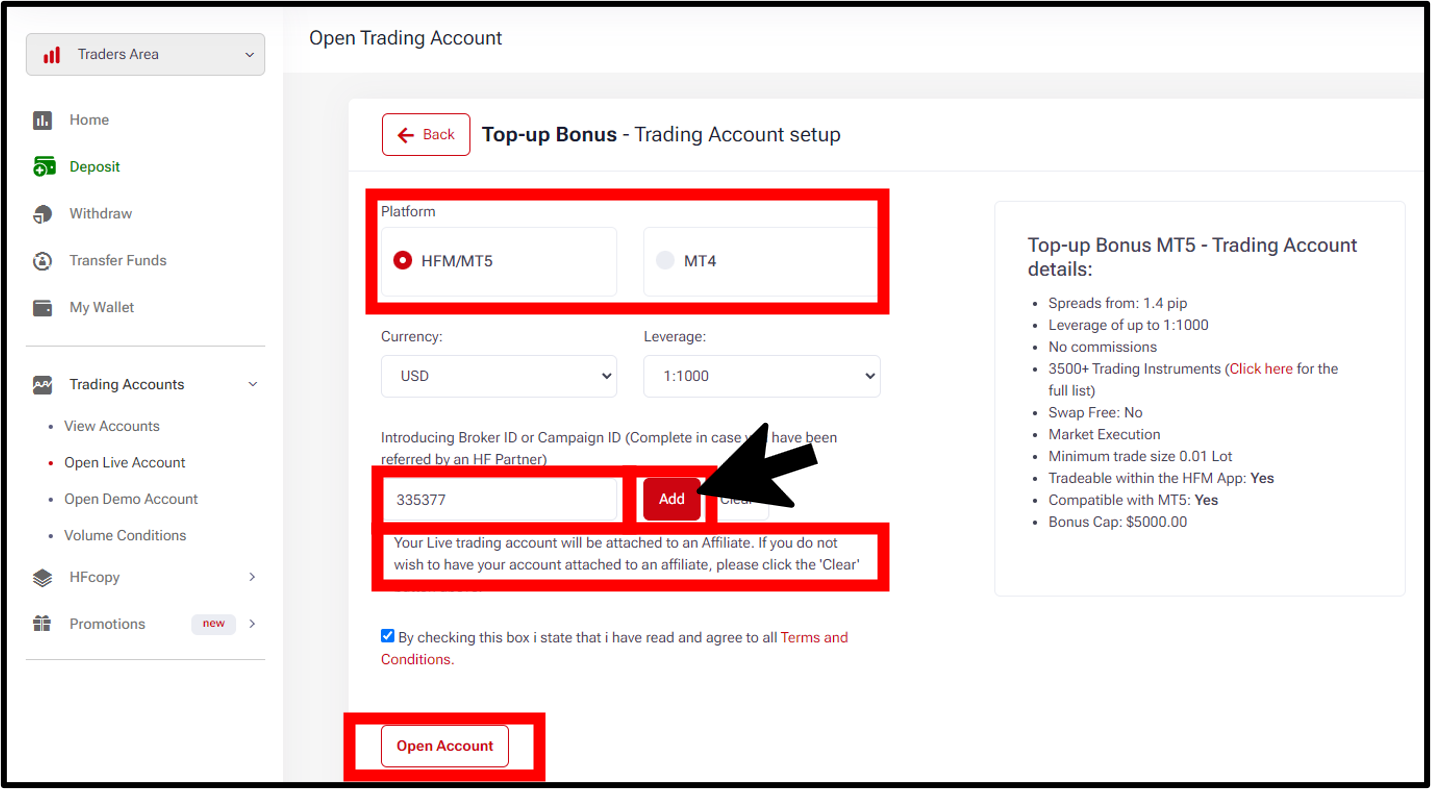

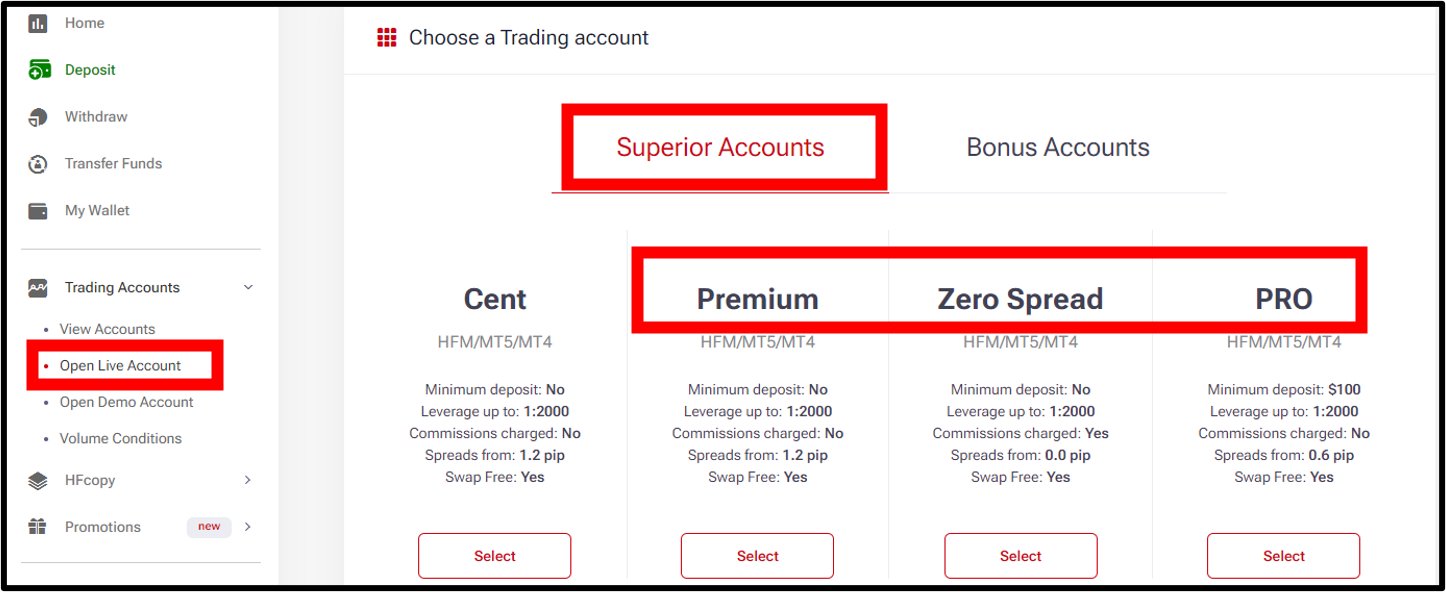

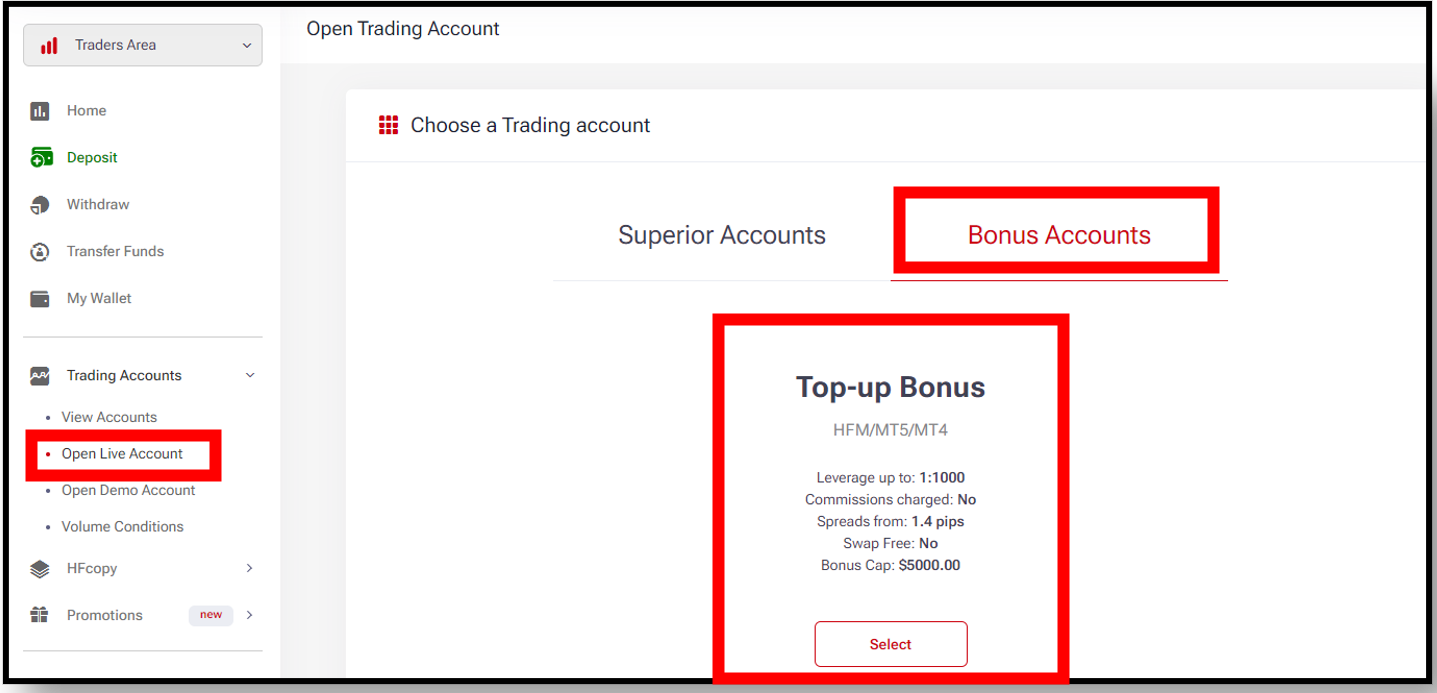

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.