Big Forex Truck EA (Free) By :

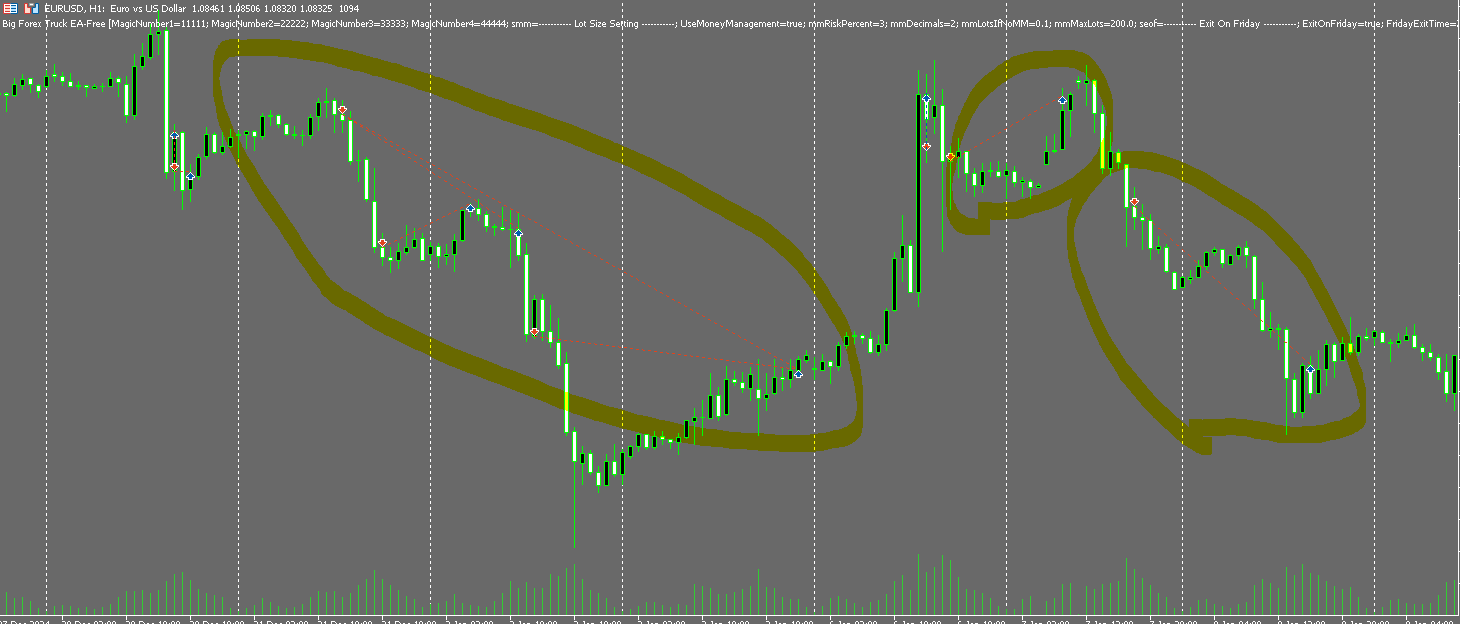

This EURUSD trading strategy integrates four distinct methods—Bollinger Bands breakout, trend-following with Bulls Power and Aroon indicators, etc. It employs ATR-based stop losses, dynamic profit targets, trailing stops, and break-even adjustments to manage risk and ensure consistent profitability across varying market conditions.

| Currency Pair | EURUSD |

| Time frame | 1H |

| Terminal | MT5 |

| Trading Style | No Martingale & No Grid |

Forward test is not conducted.

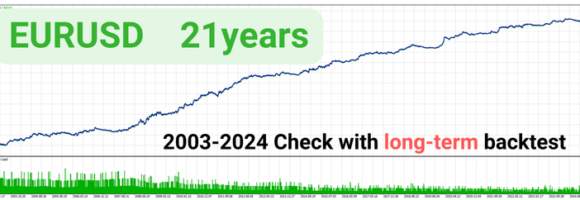

Backtesting

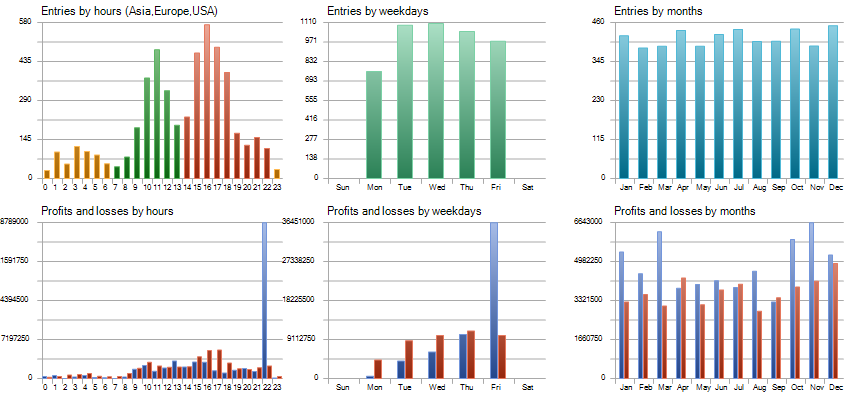

Test Period:2003.01.01 - 2025.03.05 (8099 days)

| Total Gain | 1209877.1% |

| Yearly Gain | 52.8% |

| Monthly Gain | 3.5% |

| Daily Gain | 0.12% |

| Relative Drawdown | 82.1% |

| Profit Factor | 1.27 |

| Currency | USD |

| Final Balance | 12099771.12 |

| Initial Deposit | 1000 |

| Total Net Profit | 12098771.12 |

| Total Trades | 4980 |

| Ttimeframe | H1 |

Download This Free EA (Big Forex Truck EA (Free))

Description

This trading strategy is designed for the EURUSD currency pair, combining multiple distinct methods to diversify risk and maximize profit opportunities.

Strategy Overview

The Expert Advisor (Big Forex Truck EA) consists of four different logic sets, each with its unique entry and exit criteria. This diversified approach enables the strategy to adapt effectively to various market conditions, aiming for consistent performance.

Strategy 1: Bollinger Bands Breakout

– Utilizes Bollinger Bands (periods 52, deviations 2.1 and 2.5) to enter trades when the closing price breaks above or below the bands.

– Positions are managed using ATR-based stop losses and predefined profit targets.

– Once a certain profit threshold is reached, the stop loss is moved to break-even.

Strategy 2: Bulls Power and Aroon Indicator Trend-Following

– Enters positions when Bulls Power indicates bullish momentum and the Aroon indicator’s up or down lines start declining from their peaks.

– Uses a fixed percentage stop loss and sets a profit target of 112 pips.

– Implements break-even adjustments after achieving a specific profit, reducing risk.

– Secures profits using a trailing stop.

Strategy 3: ADX and Weighted Moving Average Reversal

– Targets entry points after strong trends identified by the ADX indicator, specifically when prices cross weighted moving averages.

– Losses and profit targets are dynamically set based on ATR, adjusting flexibly according to market volatility.

– Quickly responds to rapid market shifts by taking reversal positions.

Strategy 4: Trend Entry using Linear Weighted Moving Average and ADX

– Combines linear weighted moving average breakouts with trend confirmation via the ADX indicator to determine market direction.

– Trades with the trend, capitalizing on short-term momentum.

– Moves positions to break-even after reaching certain profit levels, minimizing losses.

Risk Management and Exit Strategy

– Employs ATR-based stop losses to ensure appropriate risk management according to market volatility.

– Profit targets and break-even adjustments ensure secure profits and mitigate risks.

– Closes all positions at the end of the week (Friday evening) to avoid weekend market risk.

By integrating these multiple strategies, the EA can flexibly adapt to market volatility and various trading environments, enhancing profit consistency. Furthermore, the strategies complement each other, allowing for performance stability; if one strategy performs poorly under specific market conditions, others can compensate, thereby increasing overall reliability.

Parameter Settings

Money Management Parameters

This EA includes flexible money management features to optimize lot size and reduce risk.

- “Use Money Management” parameter:

Setting this to true enables the EA to automatically adjust lot sizes according to account balance.

If set to false, trading will be conducted at a fixed lot size specified by “mmLotsIfNoMM”. - “mmRisk Percent” parameter:

When “UseMoneyManagement” is set to true, this parameter adjusts risk based on a percentage. A recommended value is around 0.5–2.0%. - “mmDecimal” parameter:

When “UseMoneyManagement”: true is enabled, this parameter defines the decimal precision for lot size adjustments.

Setting it to 1 adjusts to one decimal place (e.g., 0.1 → 0.2), while setting it to 2 adjusts to two decimal places, making it compatible with many brokers that handle XAUUSD. - “mmMaxLots” parameter:

Specifies the maximum lot size available. The lot size will not exceed this value.

Exit Settings Under Specific Conditions

Flexible settings are available to avoid risk at the Friday market close.

- ExitOnFriday: Determines whether to close all positions on Friday.

- FridayExitTime: Allows setting the Friday close time in 24-hour format to reduce market risk.

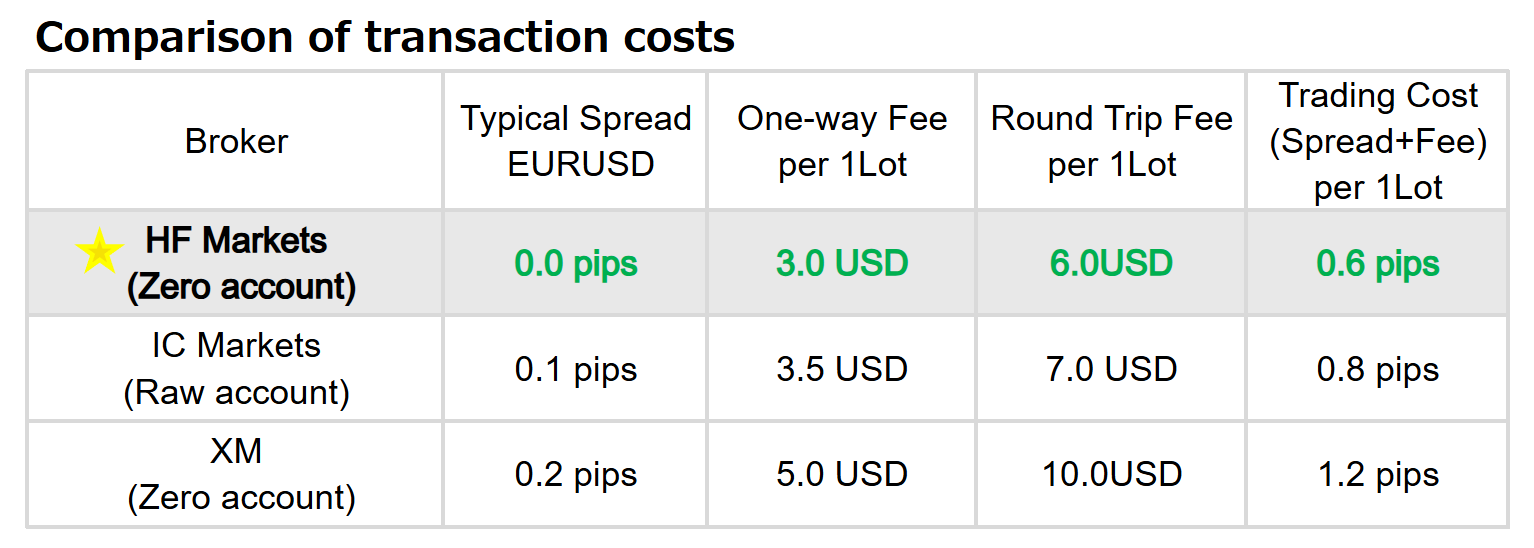

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4885) |

||||||||||||

Settings |

||||||||||||

| Expert: | Big Forex Truck EA-Free | |||||||||||

| Symbol: | EURUSD | |||||||||||

| Period: | H1 (2003.01.01 - 2025.03.05) | |||||||||||

| Inputs: | MagicNumber1=11111 | |||||||||||

| MagicNumber2=22222 | ||||||||||||

| MagicNumber3=33333 | ||||||||||||

| MagicNumber4=44444 | ||||||||||||

| smm=----------- Lot Size Setting ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=3 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.1 | ||||||||||||

| mmMaxLots=200.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=22:00 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 1 000.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

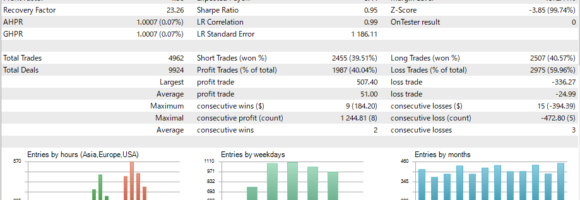

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 137562 | Ticks: | 388331 | Symbols: | 1 | |||||||

| Total Net Profit: | 12 098 771.12 | Balance Drawdown Absolute: | 296.61 | Equity Drawdown Absolute: | 308.01 | |||||||

| Gross Profit: | 57 678 928.88 | Balance Drawdown Maximal: | 1 915 926.96 (28.39%) | Equity Drawdown Maximal: | 2 085 824.61 (30.24%) | |||||||

| Gross Loss: | -45 580 157.76 | Balance Drawdown Relative: | 81.59% (6 340.73) | Equity Drawdown Relative: | 82.14% (6 557.37) | |||||||

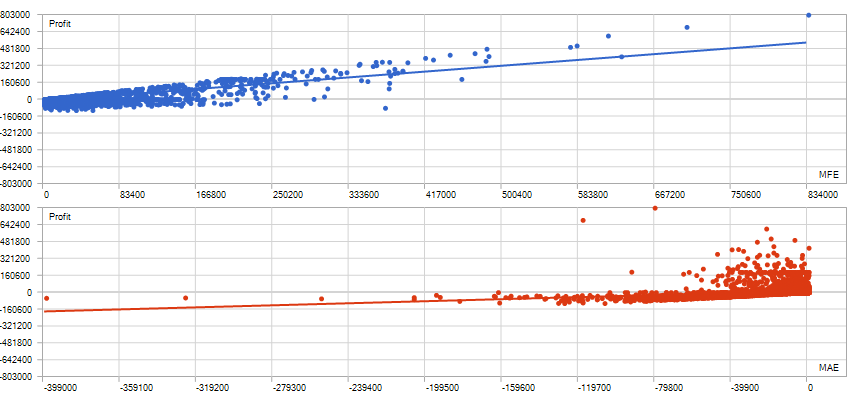

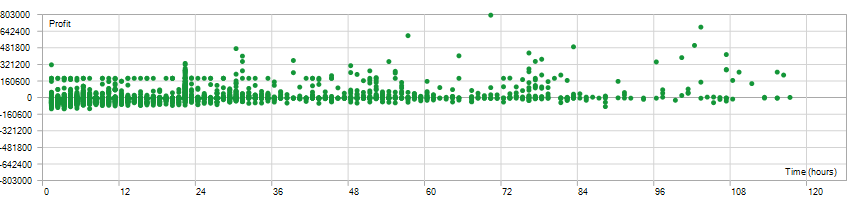

| Profit Factor: | 1.27 | Expected Payoff: | 2 429.47 | Margin Level: | 239.88% | |||||||

| Recovery Factor: | 5.80 | Sharpe Ratio: | 0.77 | Z-Score: | -7.24 (99.74%) | |||||||

| AHPR: | 1.0026 (0.26%) | LR Correlation: | 0.90 | OnTester result: | 0 | |||||||

| GHPR: | 1.0019 (0.19%) | LR Standard Error: | 1 975 502.70 | |||||||||

| Total Trades: | 4980 | Short Trades (won %): | 2465 (29.61%) | Long Trades (won %): | 2515 (30.74%) | |||||||

| Total Deals: | 9960 | Profit Trades (% of total): | 1503 (30.18%) | Loss Trades (% of total): | 3477 (69.82%) | |||||||

| Largest profit trade: | 801 200.00 | Largest loss trade: | -104 600.00 | |||||||||

| Average profit trade: | 38 375.87 | Average loss trade: | -12 779.47 | |||||||||

| Maximum consecutive wins ($): | 8 (2 137 740.99) | Maximum consecutive losses ($): | 24 (-726 053.94) | |||||||||

| Maximal consecutive profit (count): | 2 137 740.99 (8) | Maximal consecutive loss (count): | -726 053.94 (24) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 4 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

| Correlation (Profits,MFE): | 0.79 | Correlation (Profits,MAE): | 0.26 | Correlation (MFE,MAE): | -0.1754 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:59:57 | Maximal position holding time: | 117:00:00 | Average position holding time: | 15:14:49 | |||||||

|

||||||||||||

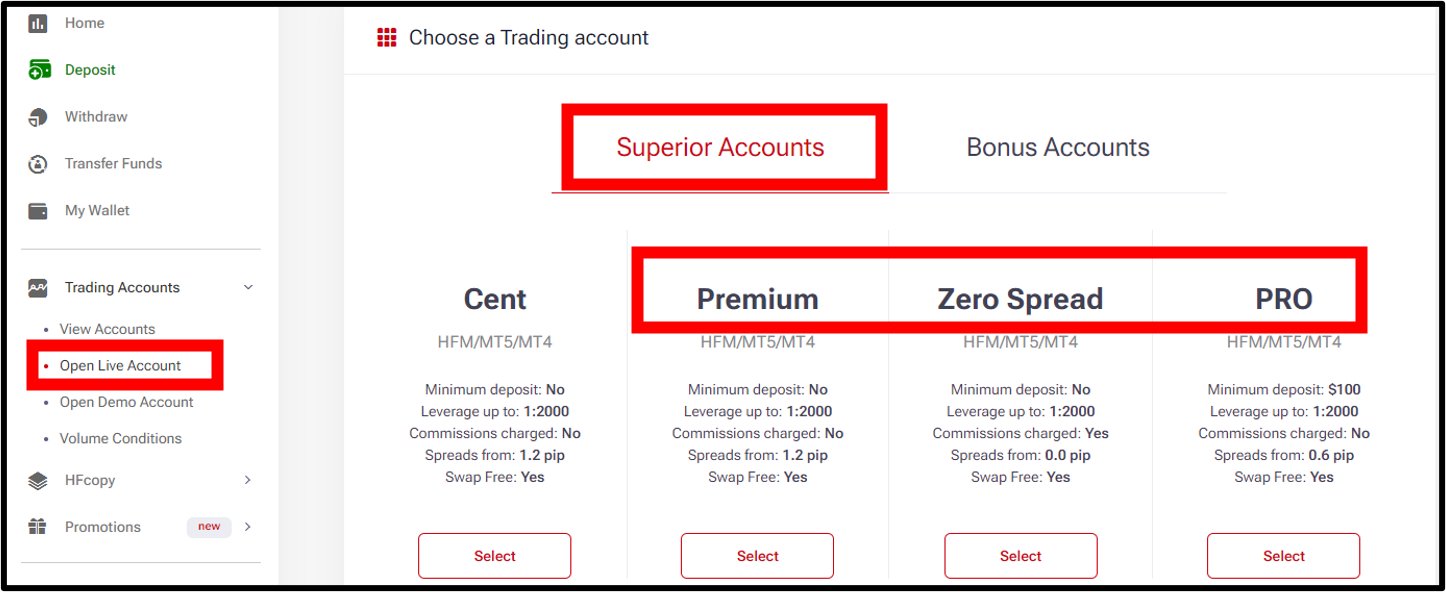

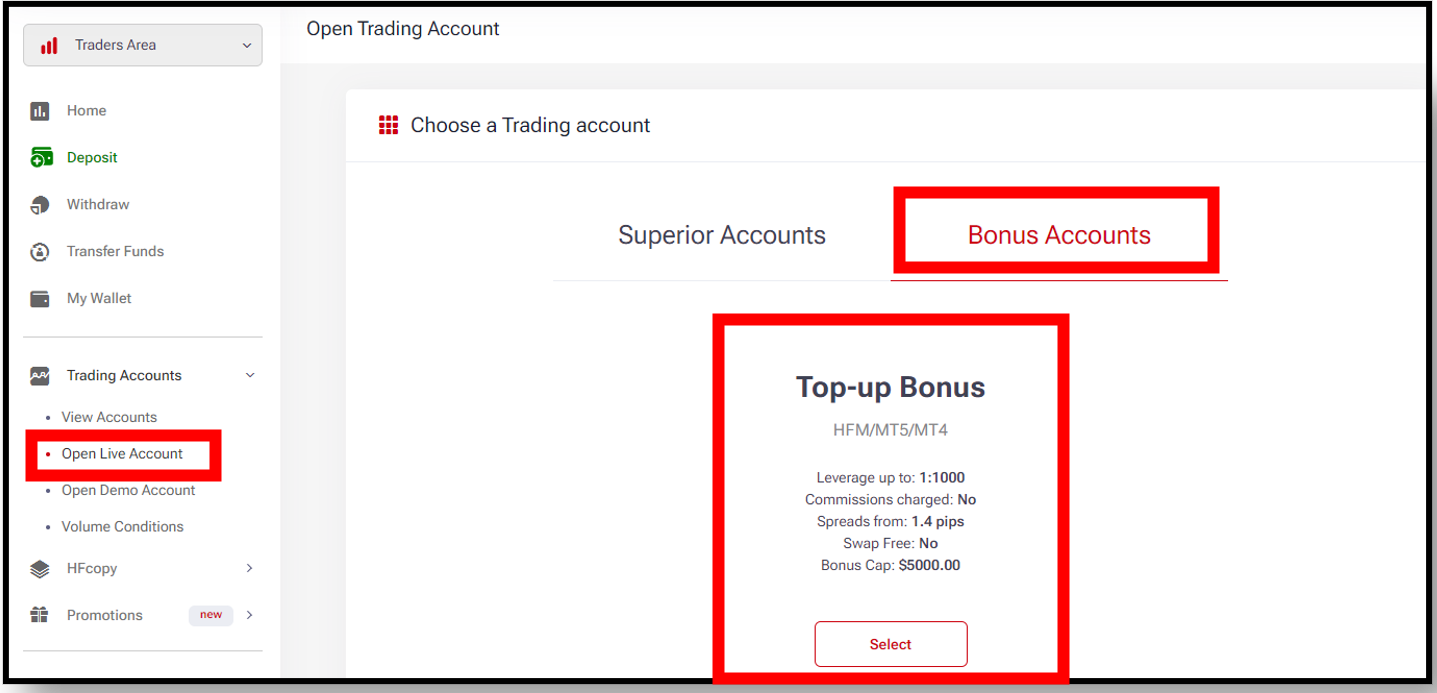

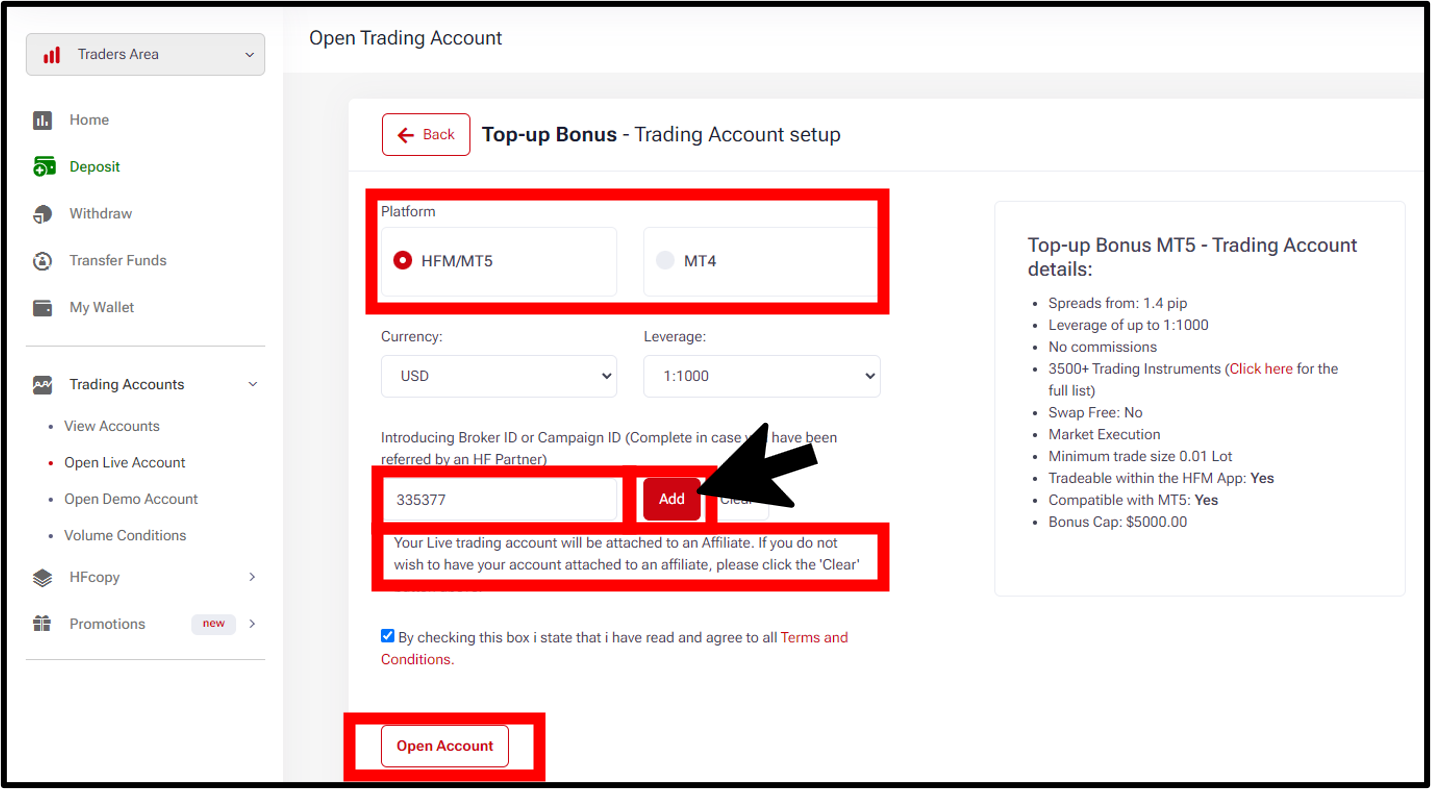

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Reviews

There are no reviews yet.