- Short-term contrarian EA

- Forward test results for over 1 year (real account

- Not a martingale EA

FOREX DIAMOND EA Basic Information

| Price | $237 |

| Currency Pair | GBPUSD, USDJPY, EURUSD, USDCHF |

| Time Frame | M15 |

| Trading Method | Scalping-Day Trading |

| Terminal | MT4 |

| Money Back Guarantee | 60-day money back guarantee. There are no refund conditions. |

It is developed by FX automater, and Wall Street Forex Robot is also famous as EA of the developer.

Many EA are high-risk and high-return martingale EA or scalping EA with small target pips.

On the other hand, FOREX DIAMOND EA does not belong to either of them. Therefore, it is easy to handle.

FOREX DIAMOND EA is not a type of EA that leaves a stunning impact. However, it is targeting profits of 10 pips or higher while cutting loss. It is a well-balanced EA.

Profitability / Drawdown

Broker:IC Markets(Real account)

Start Date:2019-4-8

Since the latter half of 2019, relatively large drawdowns have occurred several times. Therefore, it is better to be aware in advance that sometimes there are relatively large drawdowns.

Since the forward test started in April 2019, it has good results in real accounts. Although there is a period of stagnation, it is good to evaluate that showing rising profit curve in total.

With fixed 0.01 lot, the average monthly profit rate (single interest) of about 5% is a good level. The maximum drawdown value is about 20%, which is within the allowable range.

There are periods of drawdowns and stagnation, but overall good results.

Trading Method Analysis-Entry

FOREX DIAMOND EA is not simple because it uses multiple trading logics.

If dare to categorize, it’s a “short-term contrarian” type EA

It is not an EA with positions only in the direction of the trend.

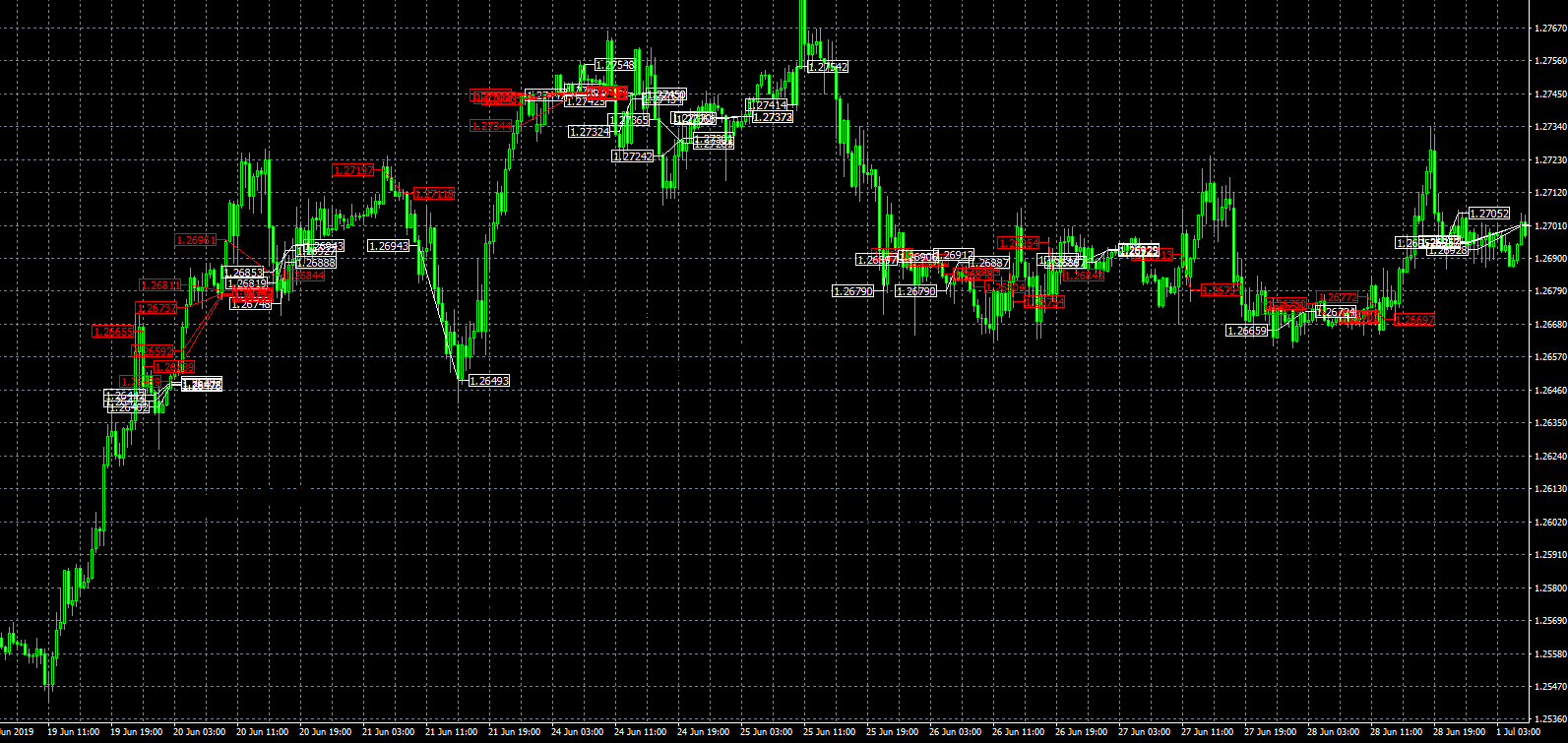

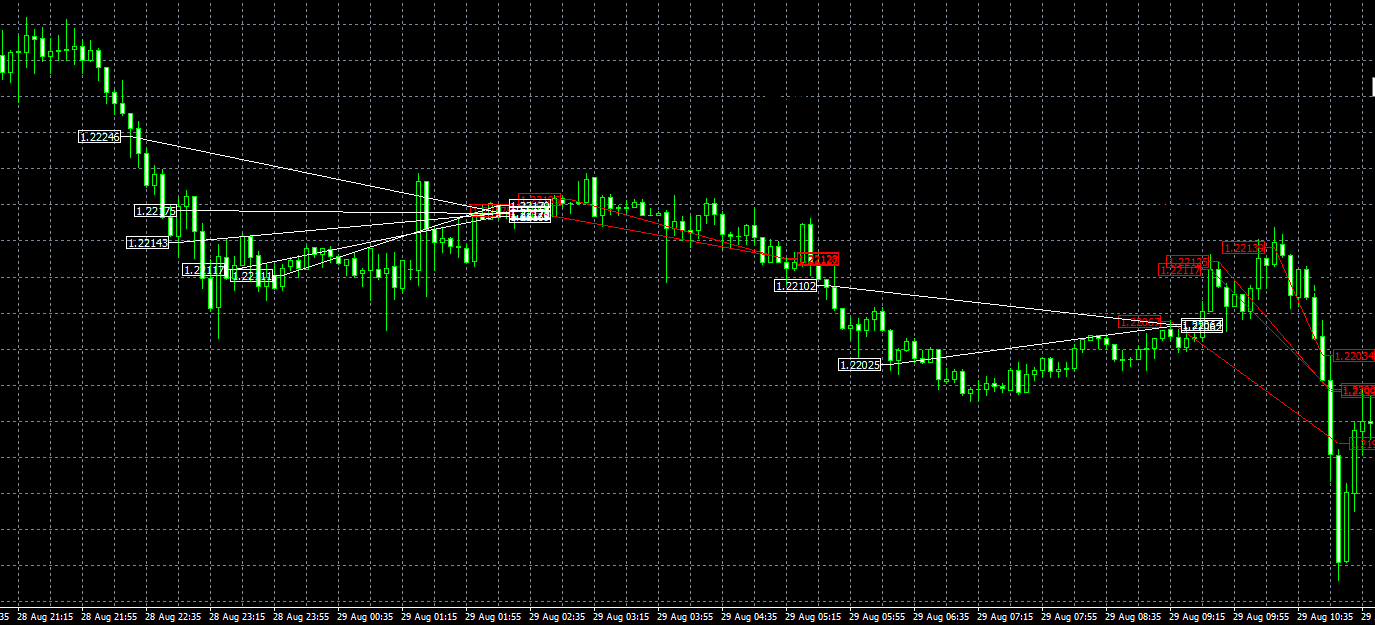

The left side of the MT4 transaction history chart below shows relatively strong uptrend, but you can see that it is making both buy and sell entries.

Also, in the range market on the right side, it make entry both Buy and Sell.

■GBPUSD 30M White=BUY Red=SELL

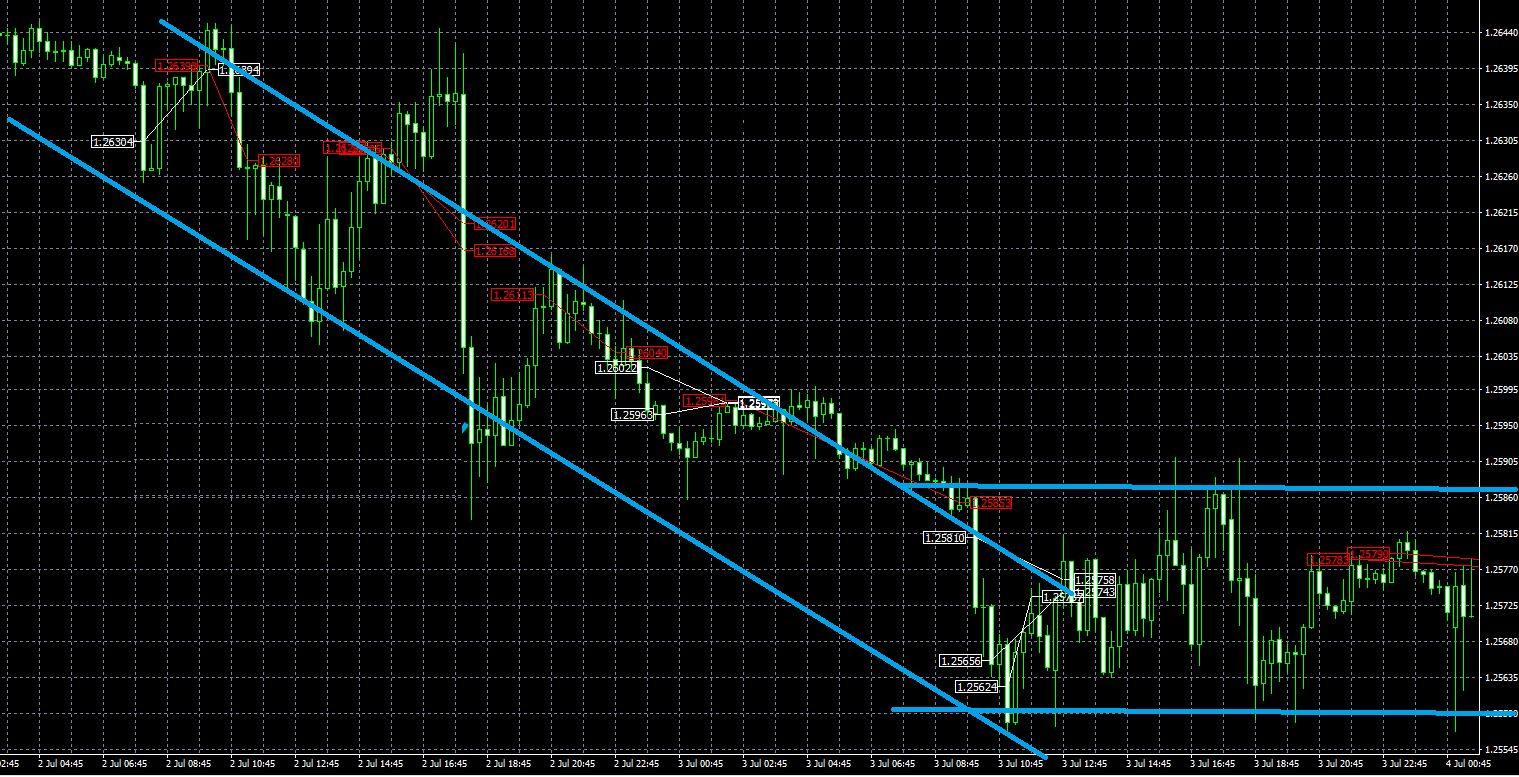

In addition, the following MT4 trading history chart shows the trading on the downtrend. (The channel line is drawn in blue)

■GBPUSD 15M White=BUY Red=SELL

Buy and sell entries are repeated along support line and resistance line of the trend (though they do not match neatly).

Trend follow EA generally make entries only in the direction of the trend.

On the other hand, FOREX DIAMOND EA also targets the rebound from the trend and make entries in the opposite direction of the trend.

Therefore, even in the trend market, it is targeting for both upward and downward price movements by the short-term contrarian strategy. So, the transaction frequency is high.

In addition, even in the range market, it make short-term contrarian entry.

In the MT4 transaction history chart below, you can see how it is responding well to the range market and making profit.

■GBPUSD 15M White=BUY Red=SELL

As for the contrarian EA, the range market is better than the trend market, so it can be said that FOREX DIAMOND EA is also better at the range market.

Trading Method Analysis-Grid trade

There is no answer to the question of which is better, trend-following EA or contrarian EA. Both have advantages and disadvantages.

Generally, trend-following EA tends to be weak in the range market, and contrarian EA tends to be weak in the trend market. Therefore, both have good and bad periods.

Grid trading has been adopted for FOREX DIAMOND EA, probably to increase the win rate and reduce the bad periods.

Grid trading is a method of repeating additional entries in the direction of the first entry when the price moves unfavorably.

With additional entries, it can make profit even if the price does not return to the first entry point. Therefore, the winning rate goes up.

Also, if wait until the point where profitable for first entry, it can increase the profit.

The following MT4 transaction history chart shows that it is making additional entries.

You can see that even if the price goes backwards from the first entry, additional entries make profit in total.

■GBPUSD 5M White=BUY Red=SELL

However, although the grid trading can increase the winning rate, the number of positions increases, so the risk naturally rises. If prices move in negative direction, relatively large drawdown will occur.

There is a high-risk grid trade EA that repeats additional entries until the account collapses.

On the other hand, in the case of FOREX DIAMOND EA, although grid trading is performed, loss cut is executed relatively early. So the series of trades is not high risk.

In the MT4 transaction history chart below, you can see the loss cut after making several Buy entries.

■GBPUSD 5M White=BUY Red=SELL

Additionally, FOREX DIAMOND EA imposes a maximum limit of four additional entries, totaling a maximum of five positions. Importantly, it does not operate as a martingale EA, meaning the lot size for additional entries does not increase. This prevents the accumulation of excessively large lot sizes.

Furthermore, grid trading is not executed on every occasion. Loss cuts are often implemented with a single position without the need for additional entries.

It appears that additional entries are only initiated when the EA logic determines a high probability of success.

In the MT4 trading history chart provided, the price rose following a Sell entry on the right side. However, a loss cut was executed with a single position without the need for additional entries.

■GBPUSD 5M White=BUY Red=SELL

Judging these comprehensively, the risk per trade is not too large.

However, it is better to be aware in advance that if it execute loss cut with multiple positions, relatively large drawdown will occur.

Trading Method Analysis-Take profit / Stop Loss

FOREX DIAMOND EA executes position closures, including take profit and loss cuts, based on internal logic rather than a fixed pip width.

As a result, the distance in pips for both take profit and loss cuts varies depending on the prevailing conditions. Typically, take profit ranges from 11 to 15 pips, while loss cuts span from 30 to 45 pips across various scenarios.

Occasionally, albeit infrequently, it has achieved take profits of 100 pips and loss cuts of 220 pips.

On average, profitable trades yield around 12 pips, while losing trades result in an average loss of approximately -24 pips. Consequently, the EA aims to accumulate total profits with a high winning rate, despite the occasional occurrence of larger loss cuts compared to take profits.

The equilibrium among take profit, loss cuts, and winning rate is crucial. FOREX DIAMOND EA proves profitable over the long term, indicating no significant concerns.

However, it’s noteworthy that, on average, the loss cut is approximately twice the size of the take profit.

Trading Method Analysis – Frequency

Simply calculating, about 2100 entries per year, 175 entries per month, 8.8 entries per day.

Even if you think of grid trade as a series of trades, trade about 4 to 5 times per day

Regardless of the trend market or range market, it will make entry both by Sell and Buy, so the trading frequency will be high.

The number of transactions for each currency pair in the forward test is as follows.

■ Number of transactions / profit and loss by currency pair (2019-4-8 ~ 2020-4-29)

| Currency pair | Number of transactions | Percentage of transactions | Pips | Profit and loss(A$) | Win rate(%) |

| GBPUSD | 1743 | 83% | 2,164 | 177 | 73% |

| USDJPY | 353 | 17% | 881 | 103 | 74% |

| Total | 2,096 | 100% | 3,045 | 280 |

About 80% of the number of transactions is GBPUSD, the remaining 20% is USDJPY

EURUSD and USDCHF are also eligible currency pairs, but they have not been traded so far in the forward test.

Forward Test Environment

The forward testing environment for FOREX DIAMOND EA reflects real account results.

While price movements may appear identical, variations in execution, such as slippage, exist between demo and real accounts. Consequently, even when using the same EA, results may differ between the two environments.

FOREX DIAMOND EA has substantiated its capabilities through published results from real accounts. This provides confidence that profits can indeed be generated in real account settings. However, it’s crucial to operate with a broker offering narrow spreads and low commissions for optimal performance.

Back Test Result

| Start Date | 1999-01-04 | 2018-02-01 |

| 228months | ||

| Initial Balance | 2,500 | |

| Lot Size | Fixed 0.1 lot | |

| Final Balance | 116,126 | |

| Total profit | 113,626 | |

| Total rate of return | 4645.0% | |

| Monthly rate of return (compound) | 1.7% | |

| Monthly rate of return (single) | 19.9% | |

| Relative max drawdown | 15.8% | |

| Maximal drawdown | 1,887 | Ratio to initial balance75.5% |

| Profit factor | 158.0% | |

| Profit trades (% of total) | 78.1% | |

| Total trades | 29,144 | |

Backtesting should only serve as a reference point.

This EA has a back-test record spanning approximately 20 years. With an initial balance of $2500 and fixed operation at 0.1 lots, achieving an average monthly profit rate (single interest) of around 20% and a maximum drawdown of about 16% are commendable outcomes. It’s essential to note that these are solely results from backtesting.

In practical terms, operating with 0.1 lots would yield approximately $500 per month on average, while operating with a minimum of 0.01 lots would result in about $50 per month. However, these figures are averages and subject to variation over time.

The maximum drawdown of 16% reflects the result after profits have been accrued and the balance has increased.

The absolute maximum drawdown is $1887, roughly 75% of the initial balance. This implies that if such a drawdown were to occur immediately after starting, the account would be in a somewhat precarious position.

Therefore, it’s advisable to operate with smaller lot sizes than indicated by the backtesting, even if it means sacrificing some profit potential for increased safety.

By adjusting the lot size to one-third of the backtest value, the expected maximum drawdown can be reduced to approximately 25%. For instance, using around 0.03 to 0.04 lots with a balance of $2500, or a minimum of 0.01 lots with a balance of about $700, would achieve this. While this adjustment might lower the anticipated average monthly profit rate to around 5%, it still represents a satisfactory performance level.

Based on the backtesting findings, employing a ratio of 0.01 lots per $700 in balance, you might opt to adjust the lot size according to your account balance.

Summary of FOREX DIAMOND EA

This EA operates on high-frequency trading principles, generating profit by entering short-term contrarian positions regardless of whether the market is trending or ranging.

It aims to secure profits of at least 10 pips while implementing loss-cutting measures. This feature makes it a valuable component of FOREX DIAMOND EA, as it is relatively easy to manage mentally.

It’s crucial to acknowledge the potential for significant loss cuts due to its grid trading strategy involving multiple positions. However, by appropriately adjusting the lot size, the risk of severe damage to your account is minimized.

While there have been instances of substantial loss cuts, the EA’s high win rate has resulted in long-term profitability, making it a promising option. Nevertheless, in the short term, there can be considerable fluctuations in profit and loss. Therefore, to realize gains, it’s necessary to operate this EA over an extended period.

If viewed from a long-term perspective, it may prove worthwhile to utilize this EA.

FOREX DIAMOND EA [Official Page][/su_column]

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.