JP_Storm (Free EA) By :

No martingale. No grid.This EA leverages indicators: Williams %R, LinReg, HeikenAshi, and Bollinger Bands for entries while using ATR stop losses and trailing stops to manage risk.

| Currency Pair | USDJPY |

| Time frame | 1H |

| Terminal | MT5 |

| Trading Style | No Martingale & No Grid |

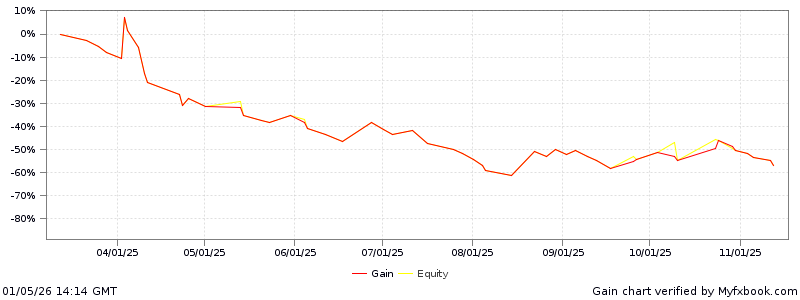

Live Performance

FirstTrade:03/12/2025 00:00 LastUpdate:10/16/2025 14:21

| Total gain | -55% |

| Daily gain | -0.36% |

| Monthly gain | -11% |

| Drawdown | 64% |

| ProfitFactor | 0.5 |

| Pips | -1115.7 |

| Currency | USD |

| Deposits | 300 |

| Profit | -84.07 |

| Balance | 65.93 |

| Equity | 65.93 |

| Interest | 0 |

Broker : HF Markets

(REAL)

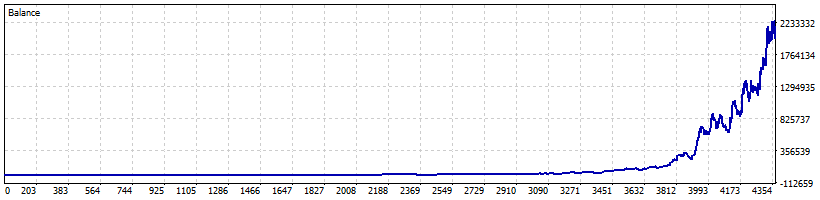

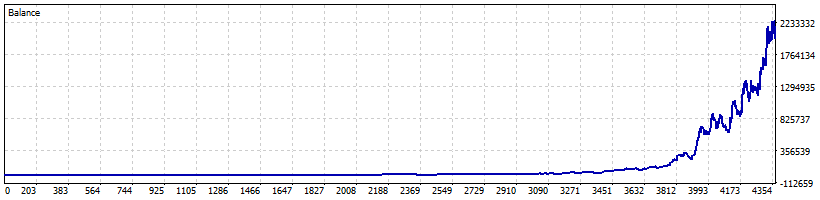

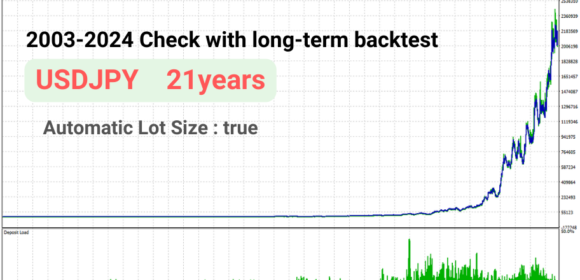

Backtesting

Test Period:2003.01.01 - 2025.03.05 (8099 days)

| Total Gain | 728370.9% |

| Yearly Gain | 49.3% |

| Monthly Gain | 3.3% |

| Daily Gain | 0.11% |

| Relative Drawdown | 59.5% |

| Profit Factor | 1.49 |

| Currency | USD |

| Final Balance | 2185412.78 |

| Initial Deposit | 300 |

| Total Net Profit | 2185112.78 |

| Total Trades | 2174 |

| Ttimeframe | H1 |

Download This Free EA (JP_Storm (Free EA))

Description

This EA is a high-functioning automated trading program that integrates multiple algorithms to flexibly adapt to market movements. Below is a detailed explanation of its features and mechanisms.

1. Multi-Layered Strategy Structure

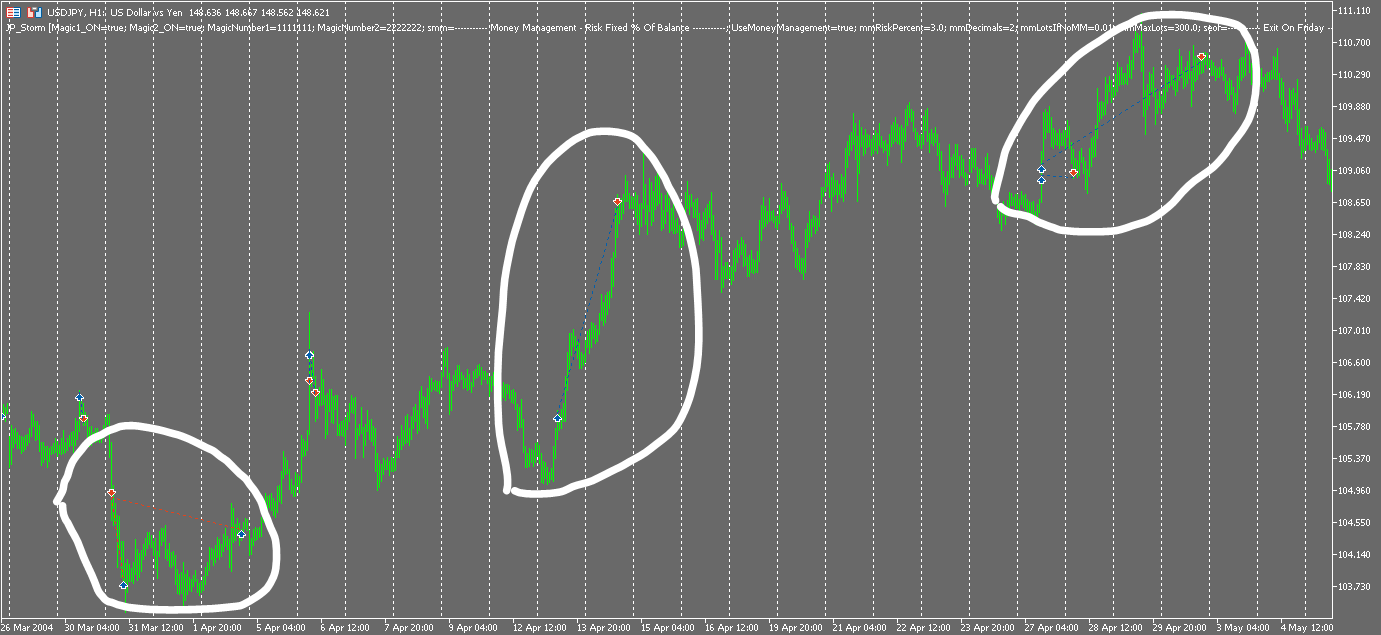

The EA combines two main strategies (Strategy1 and Strategy2), each using different technical indicators and logic to generate entry signals.

- Strategy 1:

This approach focuses on the movements of the Williams %R indicator, referencing recent chart price ranges and HeikenAshi highs/lows to detect bullish or bearish signals. When a signal is generated, an order is placed with a defined validity period, and risk management is enforced through stop losses and profit targets calculated based on ATR (Average True Range). - Strategy 2:

Here, the trend is identified using the slope of a linear regression (LinReg) on the chart. Additionally, the median range derived from Bollinger Bands is used to compute the entry price. This strategy incorporates ATR-based risk management along with a trailing stop to protect gains, ensuring a well-controlled entry condition.

2. Entry Signals and Position Management

The EA checks for entry signals at the opening of each bar and executes orders immediately upon signal confirmation.

- Timing of Entry:

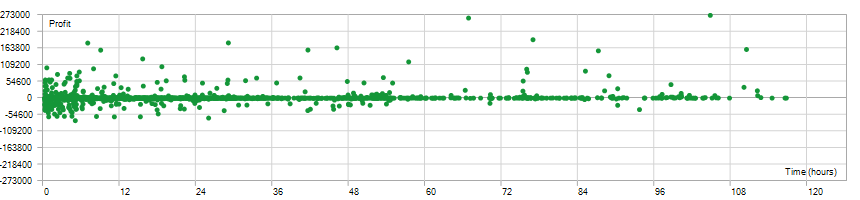

Once the conditions of either strategy are met, an order is automatically executed based on historical highs, lows, and range data. Each order remains active for several bars, ensuring that the position is established only during the favorable period identified by the strategy. - Risk Management:

Every order comes with stop loss and profit target settings that are dynamically calculated using the ATR, thereby maintaining a balanced risk/reward ratio. Additionally, a trailing stop mechanism kicks in once the position moves favorably, helping to secure profits. - Order Handling Rules:

The system prevents duplicate orders from the same signal and is designed to replace pending orders when necessary. This flexibility allows the EA to respond efficiently to sudden market changes.

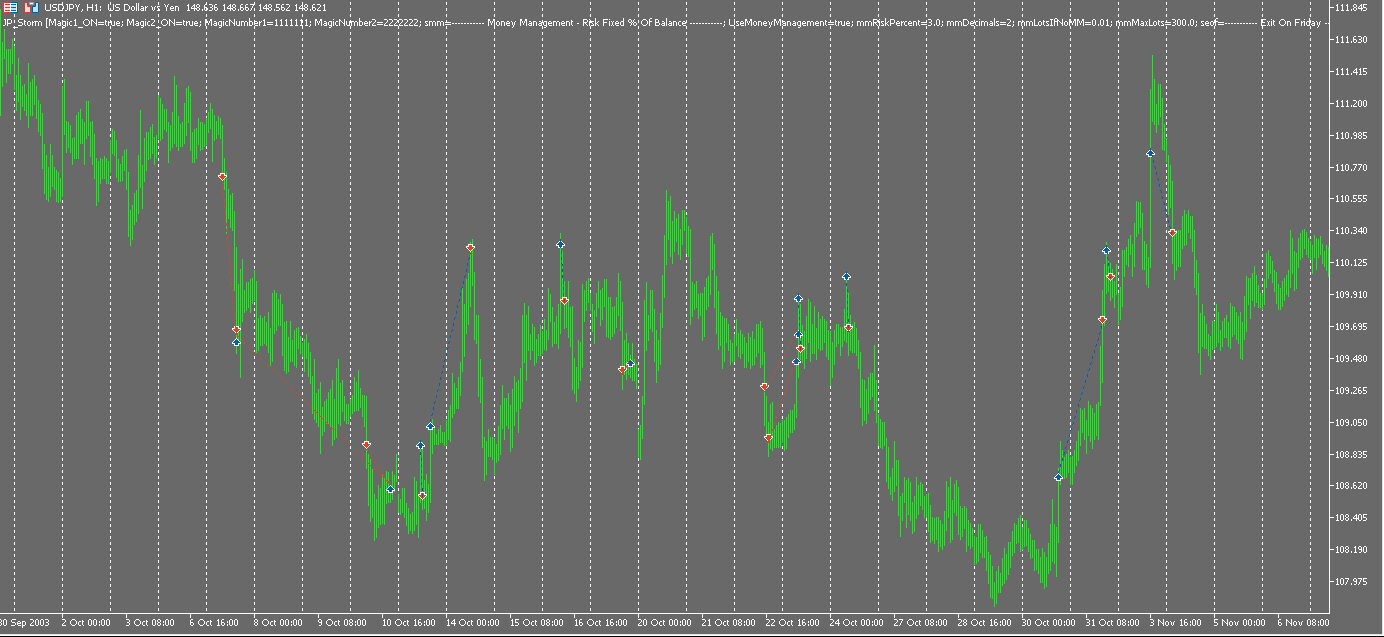

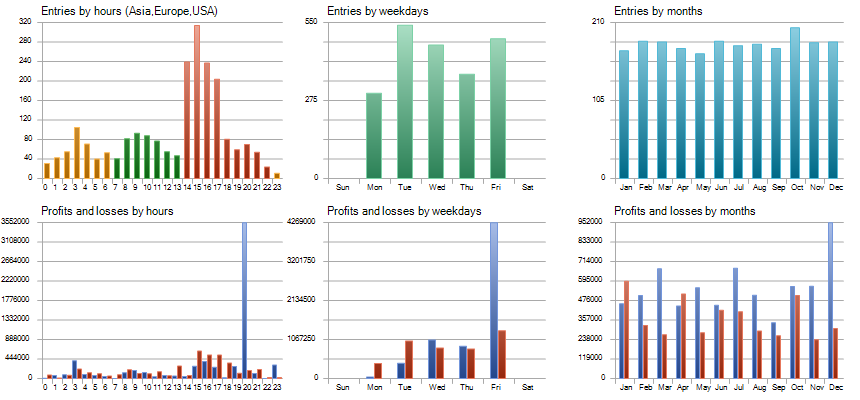

3. Time and Market Filtering Features

The EA is equipped with various options to precisely control the timing of trade execution.

- Trading Restrictions on Specific Periods:

Certain settings are designed to prevent trading during weekends or specific hours when market liquidity is typically lower. This helps mitigate unexpected risks during volatile periods. - End-of-Day Exit Rules:

The EA can automatically close positions at the end of the trading day or at a specific time on Fridays, ensuring that no unnecessary overnight risk is taken. - Time-Restricted Signal Generation:

With the ability to limit signal generation to specific times, the EA avoids entries during low-volatility periods, thereby optimizing trade conditions.

4. Price Calculation and Use of Market Ranges

The EA employs a combination of data from HeikenAshi candles, maximum historical ranges, and Bollinger Bands to calculate the optimal entry price.

- Use of HeikenAshi:

By smoothing out price fluctuations, HeikenAshi highs and lows help identify more stable entry points in the market trend. - Reference to Maximum Range:

The EA adjusts entry prices based on the widest price range observed over a predetermined period, thereby enhancing the reliability of the entry signal. - Application of Bollinger Bands:

By incorporating the median or central range of the Bollinger Bands, the system adapts to the market’s volatility, reducing excessive risk while improving entry precision.

5. Comprehensive Risk Management and Flexible Operation

The EA rigorously manages risk and return on every trade through multiple parameter settings.

- ATR-Based Stop Loss and Profit Targets:

Utilizing the ATR, the EA dynamically adjusts stop loss and profit target levels to match current market conditions, ensuring adaptive risk management. - Trailing Stop Functionality:

Once a trade reaches a favorable level, the trailing stop is automatically activated to secure profits while allowing the position to benefit from further market movement. - Order Validity and Duplication Prevention:

Each order is valid for a set number of bars, and the system is designed to update or replace orders as conditions change, allowing it to handle rapid market movements effectively.

Overall Assessment

This EA is designed to integrate multiple technical indicators and entry strategies, enabling it to adapt flexibly to market trends and volatility. By combining various strategies, it reduces the reliance on a single indicator, thereby diversifying risk and potentially enhancing overall trading performance. Its comprehensive risk management, including ATR-based stop losses, profit targets, and trailing stops, along with precise time-filtering features, makes it a valuable tool for traders ranging from beginners to advanced.

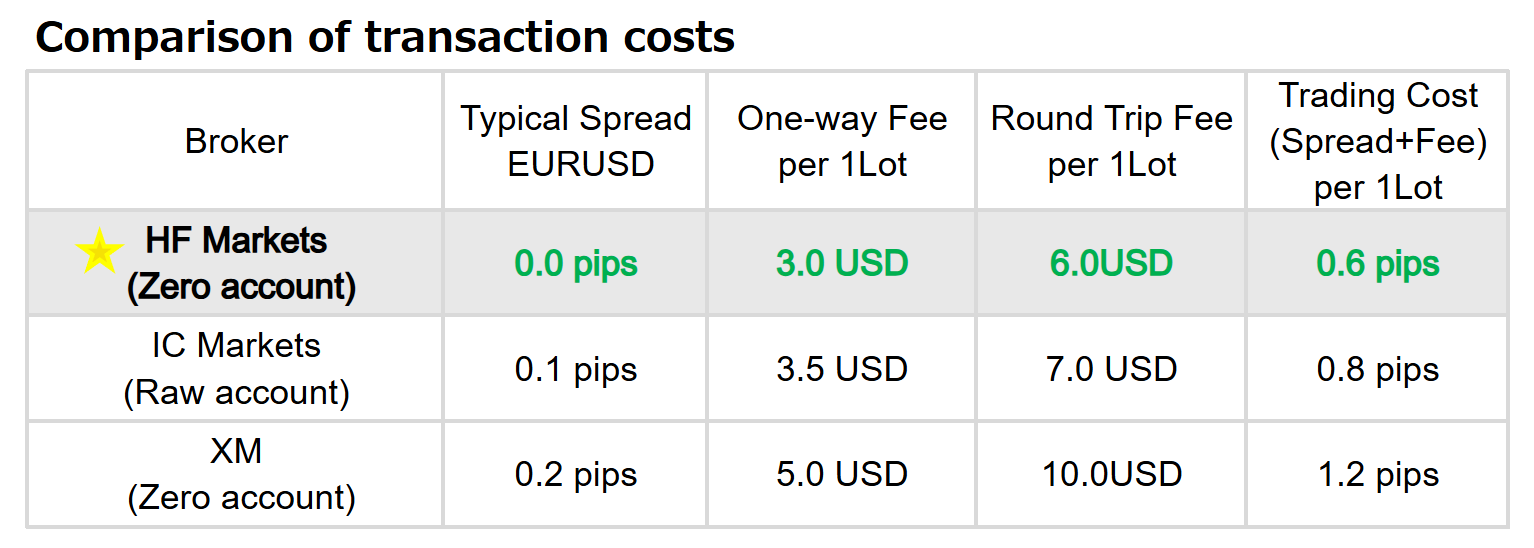

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4885) |

||||||||||||

Settings |

||||||||||||

| Expert: | JP_Storm | |||||||||||

| Symbol: | USDJPY | |||||||||||

| Period: | H1 (2003.01.01 - 2025.03.05) | |||||||||||

| Inputs: | Magic1_ON=true | |||||||||||

| Magic2_ON=true | ||||||||||||

| MagicNumber1=1111111 | ||||||||||||

| MagicNumber2=2222222 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=3.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=300.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=20:30 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 300.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 137489 | Ticks: | 31494741 | Symbols: | 1 | |||||||

| Total Net Profit: | 2 185 112.78 | Balance Drawdown Absolute: | 122.39 | Equity Drawdown Absolute: | 123.44 | |||||||

| Gross Profit: | 6 680 132.18 | Balance Drawdown Maximal: | 307 687.34 (22.15%) | Equity Drawdown Maximal: | 444 692.75 (18.16%) | |||||||

| Gross Loss: | -4 495 019.40 | Balance Drawdown Relative: | 58.09% (4 573.99) | Equity Drawdown Relative: | 59.46% (4 990.50) | |||||||

| Profit Factor: | 1.49 | Expected Payoff: | 1 005.11 | Margin Level: | 240.46% | |||||||

| Recovery Factor: | 4.91 | Sharpe Ratio: | 1.62 | Z-Score: | -4.80 (99.74%) | |||||||

| AHPR: | 1.0051 (0.51%) | LR Correlation: | 0.56 | OnTester result: | 0 | |||||||

| GHPR: | 1.0041 (0.41%) | LR Standard Error: | 300 411.24 | |||||||||

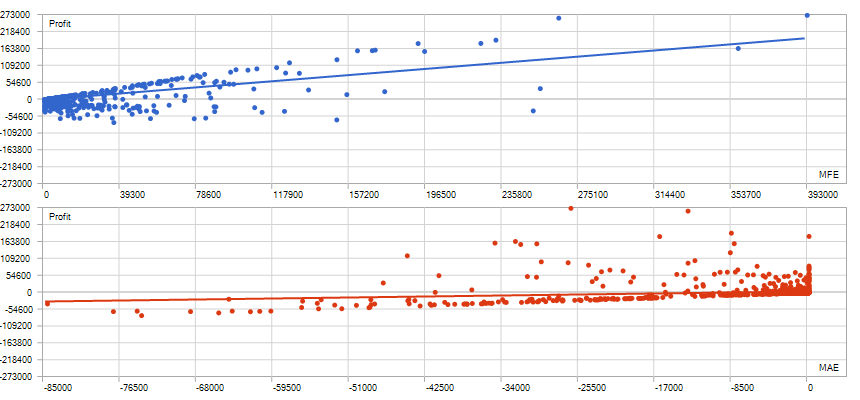

| Total Trades: | 2174 | Short Trades (won %): | 1132 (34.45%) | Long Trades (won %): | 1042 (39.83%) | |||||||

| Total Deals: | 4348 | Profit Trades (% of total): | 805 (37.03%) | Loss Trades (% of total): | 1369 (62.97%) | |||||||

| Largest profit trade: | 271 582.35 | Largest loss trade: | -74 683.74 | |||||||||

| Average profit trade: | 8 298.30 | Average loss trade: | -3 220.98 | |||||||||

| Maximum consecutive wins ($): | 6 (2 435.70) | Maximum consecutive losses ($): | 16 (-187.98) | |||||||||

| Maximal consecutive profit (count): | 352 071.59 (4) | Maximal consecutive loss (count): | -302 861.93 (9) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

| Correlation (Profits,MFE): | 0.67 | Correlation (Profits,MAE): | 0.19 | Correlation (MFE,MAE): | -0.4222 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:00:19 | Maximal position holding time: | 116:25:40 | Average position holding time: | 18:23:08 | |||||||

|

||||||||||||

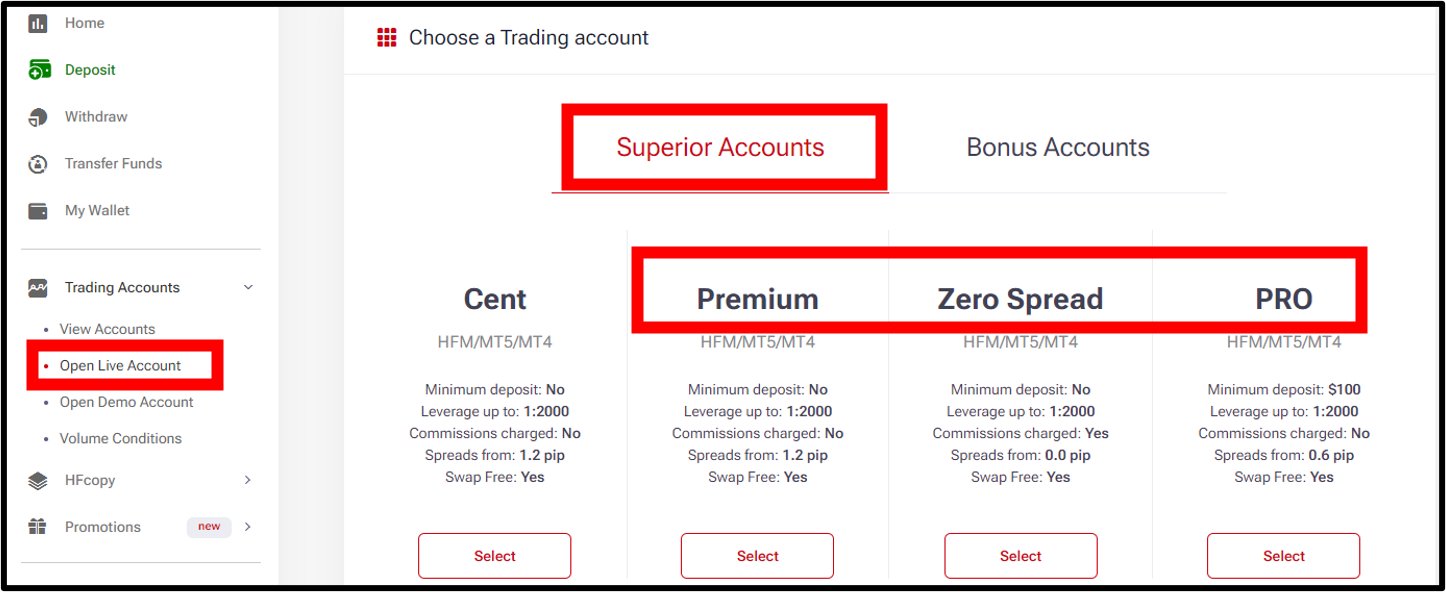

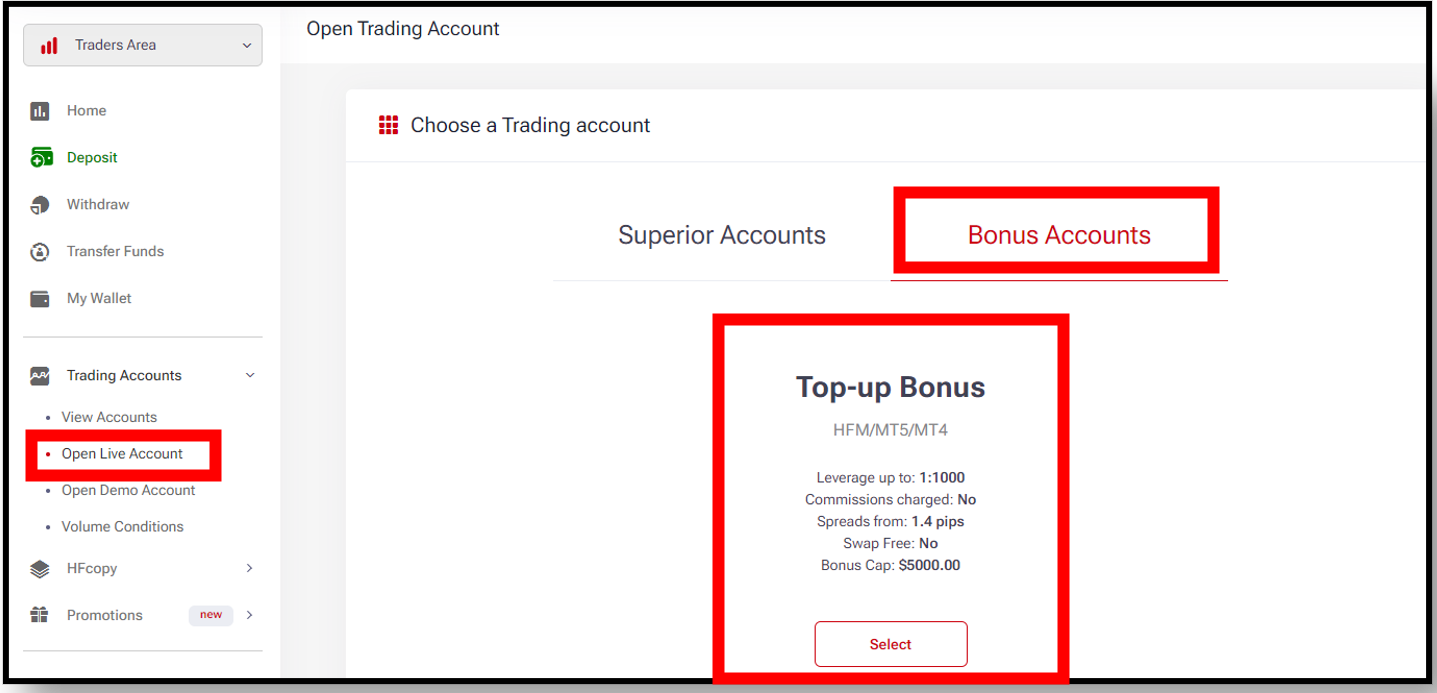

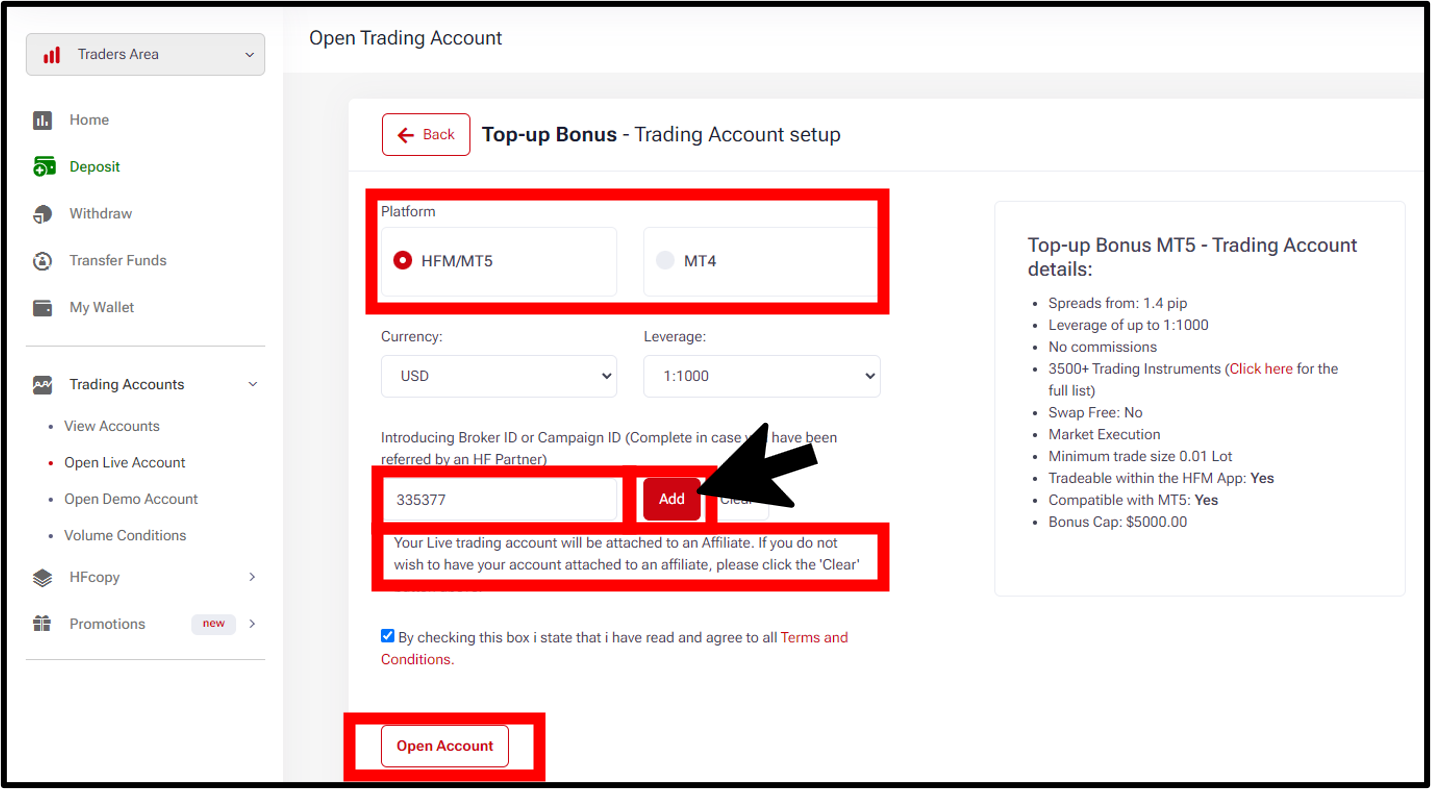

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Be sure to enter 335377 as the Introducing Broker ID.

Press the “Add” button.

Reviews

There are no reviews yet.