There are EA sellers who appeal as “Holy Grail EA with a win rate of 90% or more”.

But be careful, because the seller of such an EA is likely to be a scam.

This is because the high win rate is not directly related to the profitability of the EA, and it is completely wrong to evaluate the performance of the EA by the win rate.

In this article, we will explain in detail why the performance of the EA should not be determined by the winning rate alone, and how to avoid buying a scam EA.

Backtest example of EA with high winning rate and EA with low winning rate

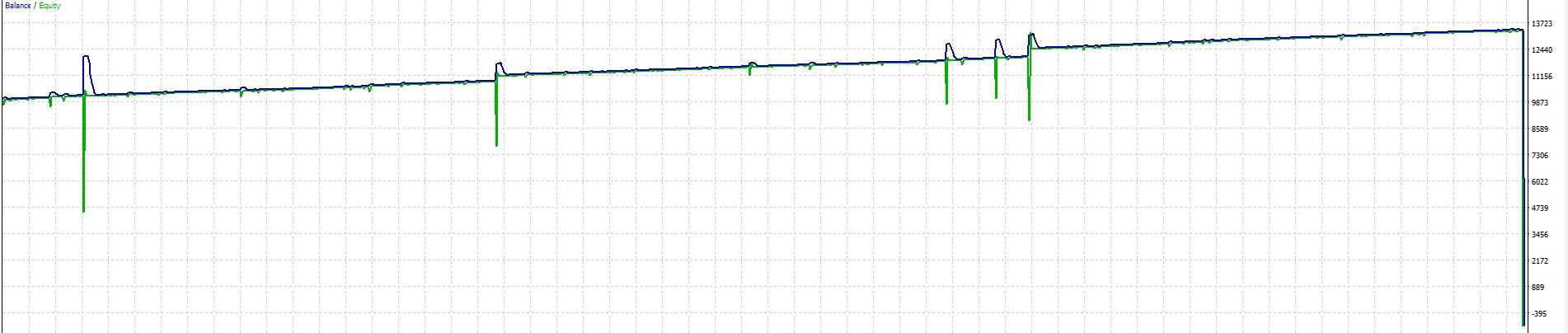

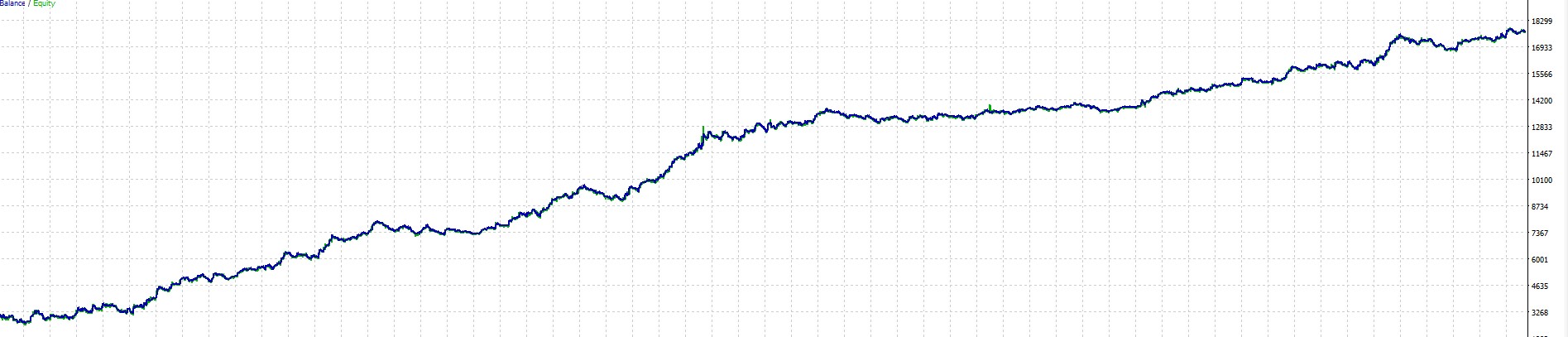

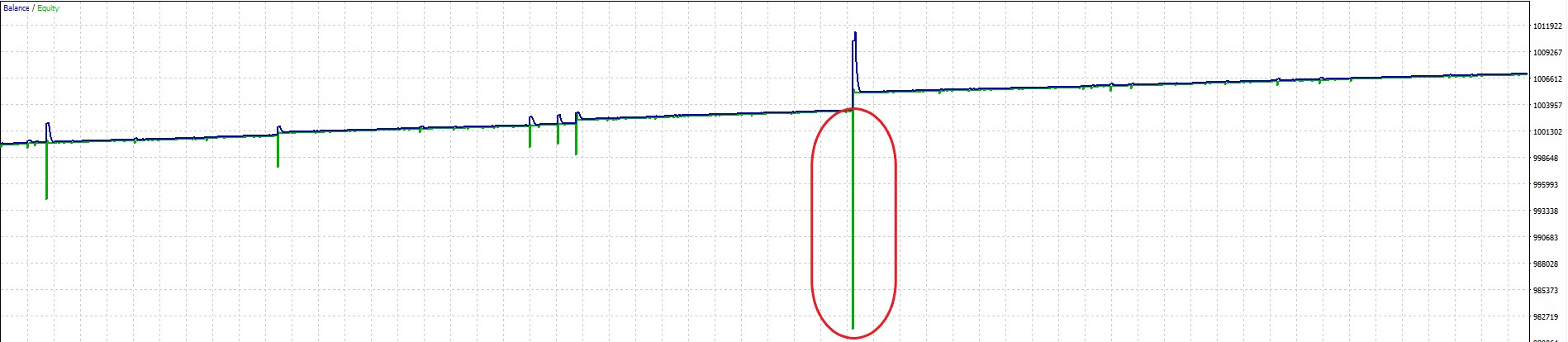

Backtest results of an EA with a winning rate of 67%

The winning rate is high at 67%, but the balance of 10,000 USD becomes zero in an instant.

It’s the worst performance.

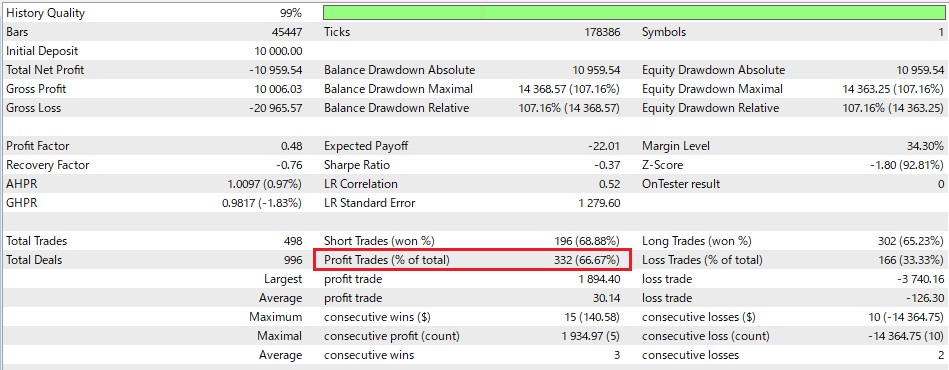

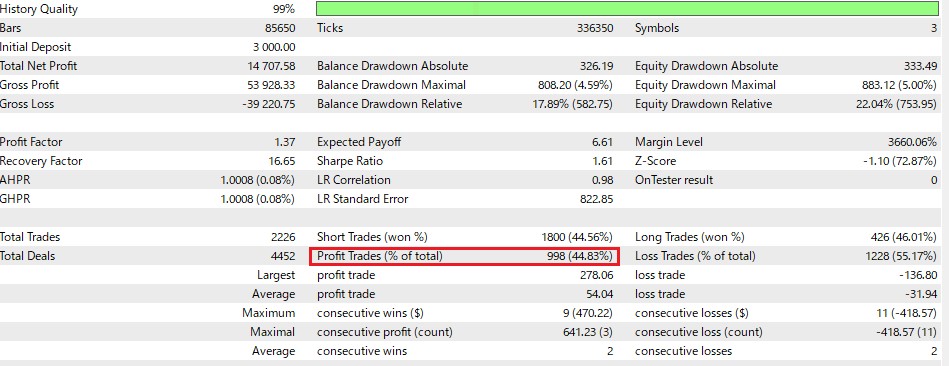

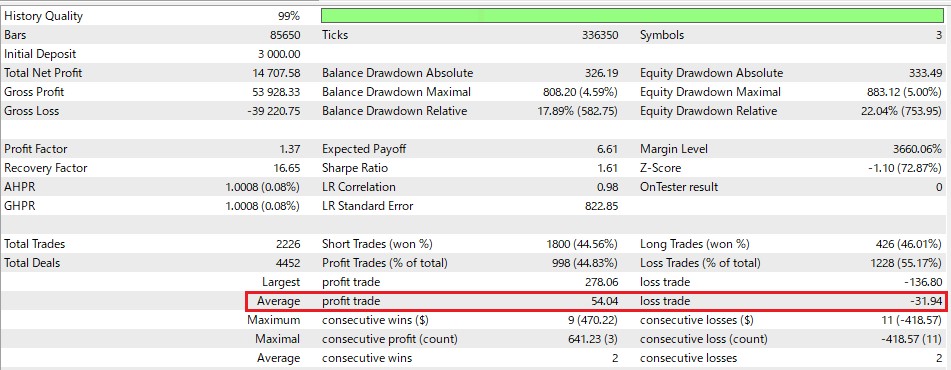

Backtest results of an EA with a winning rate of 45%

Although the win rate is less than 50%, it shows good performance.

From this example, you can see that you should not only focus on the winning rate when choosing an EA.

EA’s win rate does not take into account the risk reward ratio.

One of the main reasons why you shouldn’t just focus on the EA’s high win rate is that it doesn’t take into account the risk-reward ratio.

A high win rate means that the EA can generate more winning trades than losing trades.

However, the win rate does not tell you anything about the amount of loss and the amount of profit.

For example, let’s compare two EAs.

EA(A) win rate = 80%

EA(B) win rate = 60%

Which EA would you buy?

At first glance, it may seem that EA(A) is a better choice because it has a higher win rate.

However, EA (B) may actually perform better.

Suppose that the average win pips and average loss pips of the two EAs are less than

EA A (A) has an average win of 10 pips and an average loss of 50 pips

EA B(B) has an average win of 50 pips and an average loss of 10 pips

Suppose the EA trades 100 times,

EA (A) Profit=-20pips

(10pips*80 – 50pips*20 = -20pips)

EA (B) Profit=+100pips

(50pips*60 – 50pips*40 = +100pips)

In this example, EA (A) has a higher win rate, but EA (B) gives better results.

As you can see, there is no direct relationship between the high win rate and the EA’s performance.

EA(A) has a higher win rate, but the risk-reward ratio is negative because the loss pips are much larger compared to the winning pips.

On the other hand, EA(B) has more wins than losses, so it has a positive risk-reward ratio.

The high win rate of the EA is meaningless unless it is evaluated together with the risk-reward ratio.

EA’s win rate alone does not tell us about drawdowns

One of the most important factors to consider when evaluating an EA is the drawdown.

Drawdown refers to the decrease in the account balance from the peak to the bottom during the trading period.

A high win rate does not necessarily mean that the EA has a low drawdown.

Even if the EA has a high win rate, there may be a large drawdown. This can be a risk for your trading account.

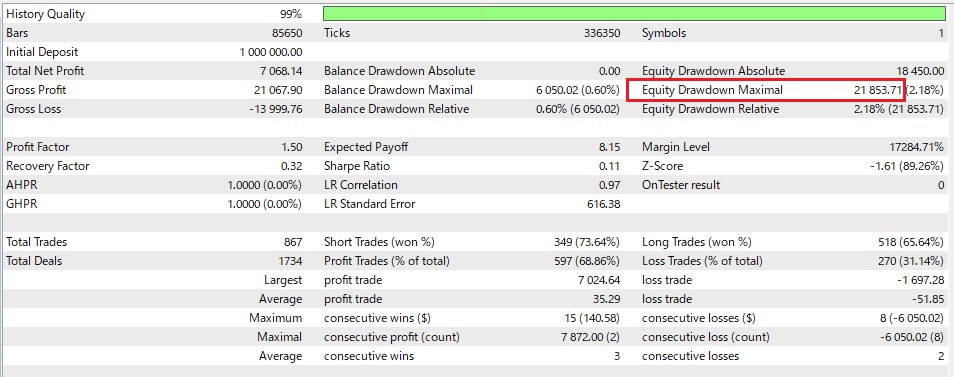

In particular, the equity drawdown should be checked with caution.

The equity drawdown also includes the loss of open positions held.

In the backtest example below, the win rate is close to 70%, but there is an equity drawdown of 21,853 USD.

Even though the initial lot size is fixed at 0.01 lots, it is a very risky trade for such a large drawdown to occur.

There are EAs that do not set a stop loss and hold a position until they finally get a winning trade. Such EAs naturally have a higher win rate.

However, since there is no stop loss, a large equity drawdown will occur if the price goes against the direction of the position.

However, the win rate does not decrease even in the event of a large equity drawdown.

However, if the equity drawdown becomes larger, a stop-out will occur and the account balance will be 0.

EAs with a high win rate may use methods that do not set a stop loss, such as grid trading and martingale EA.

EAs with high win rates may be curve-fitting

Curve fitting is a common pitfall when evaluating EAs.

Curve fitting refers to the practice of optimizing the EA’s parameters to perfectly fit historical price data, resulting in impressive backtesting results.

However, such parameters optimized in the past market do not always work well in real-time trading.

Sellers who tout EA’s high win rate may be setting a curve fitting trap.

Such EAs can perform very poorly in real-time trading.

Therefore, it is important to be wary of EA sellers who only emphasize high win rates.

How to determine if an EA with a high win rate is really a good EA?

As already explained, an EA with a high win rate is not necessarily a good EA.

Here are some things you should check:

Check the risk reward ratio

Check the average loss pips and the average win pips.

Be careful if the average loss pips is unusually large.

One losing trade can wipe out the profits that the EA has accumulated so far.

equity drawdown

It is also important to check if the equity drawdown has become very large.

Even if the win rate is high, a very large equity drawdown can result in significant losses.

To check the risk reward ratio on the MT5 backtest screen, compare “profit trade” and “loss trade”.

Check “whether there is sufficient trading performance in the forward test”

In order to verify whether an EA with a high win rate really produces good results, it is important to check whether there is a sufficient trading record in the forward test.

Since the results of the backtest are applied to historical quotes, the EA’s parameters can be adjusted to minimize the number of occurrences of losses.

EAs, especially those with a very high win rate, can increase their profits by simply avoiding losses a few times.

However, this is something that can be done because it is a past market.

Forward testing is a real-time quote.

Curve fitting does not work in the forward test.

The focus should be on the profitability of forward testing, not just backtesting.

You should also pay attention to the number of trades in the forward test.

EAs with a high win rate have a low probability of incurring losses in the first place. Therefore, when the number of trades is low, it tends to perform very well.

However, as the number of trades increases, there is a possibility that your account may suddenly lose a lot of money.

If the EA has more than 500 trades in the forward test and more than 100 losing trades, the performance of the EA can be understood to some extent

Conclusion of EA with high win rate

For people who are just starting automatic trading, an EA with a high winning rate may seem attractive.

However, win rate should not be the only deciding factor when choosing an EA.

The winning rate is just one way to analyze the EA’s trading method, and does not measure the profitability or risk of the EA.

However, there are some EA sellers who exaggerate the high winning rate. Be careful of EA sellers like this.

Look beyond win rates and make more informed decisions. This will help you avoid falling prey to misleading marketing tactics.

For example, it is important to evaluate winning rate in combination with risk reward ratio.

Also, an EA with a very high winning rate may have a hidden possibility of a large equity drawdown.

You should check how the EA performs after a large number of trades in a forward test.

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.