Success with forex is not easy. In fact, more than 90% of traders are losing.Many people have busy lives and don’t have time to trade.

If you can’t succeed in manual trading, you can use an automated trading system (EA: Expert Advisor) or leave the trade to other traders with PAMM.

Investing in PAMM is not very common, but it has many advantages compared to operating an EA. Just like an EA, you can invest in strategies with high performance.

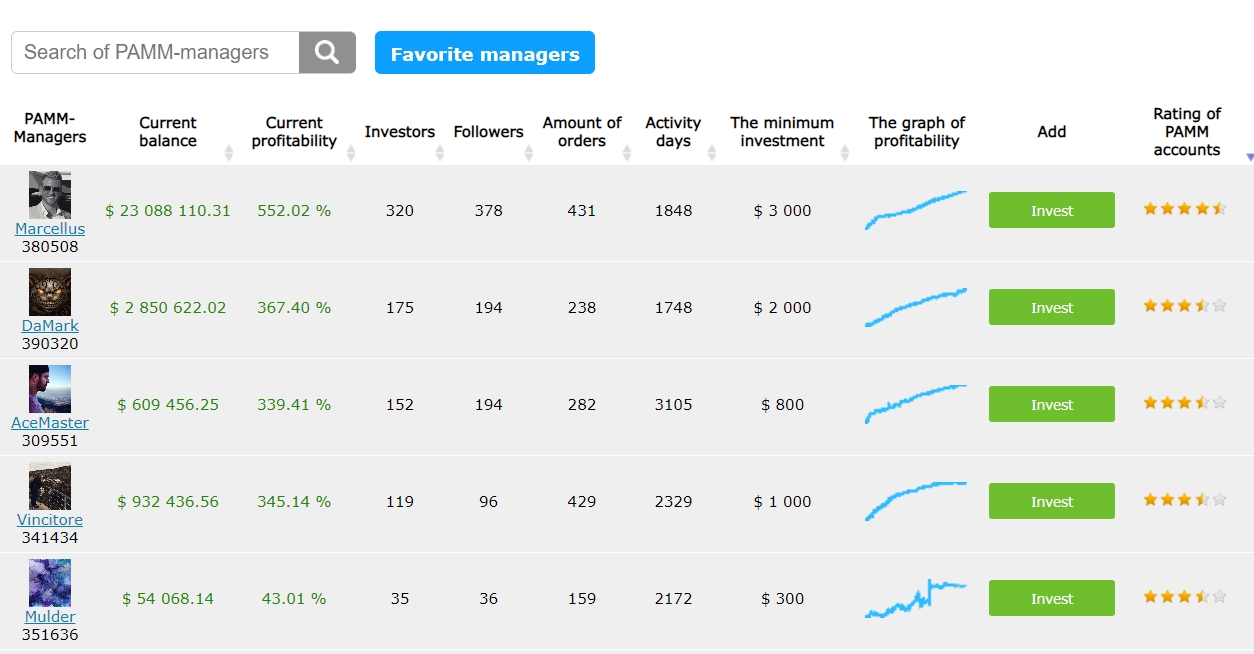

Below is a screenshot of a broker’s website that provides PAMM services.(AccentForex)

This page explains in detail the advantages and disadvantages of EA and PAMM. It should be a good reference on whether to invest.

Features of EA(Expert Advisor)

What is EA?

EA (Expert advisor) is an automated trading system that runs on the MetaTrader (MT4 or MT5) terminal.

![]()

Automated trading is also possible on terminals such as Ctrader and NinjaTrader.

However, MT4 and MT5 are the most popular automated trading environments.

The EA will automatically determine entry and exit timing.

Cost to operate EA

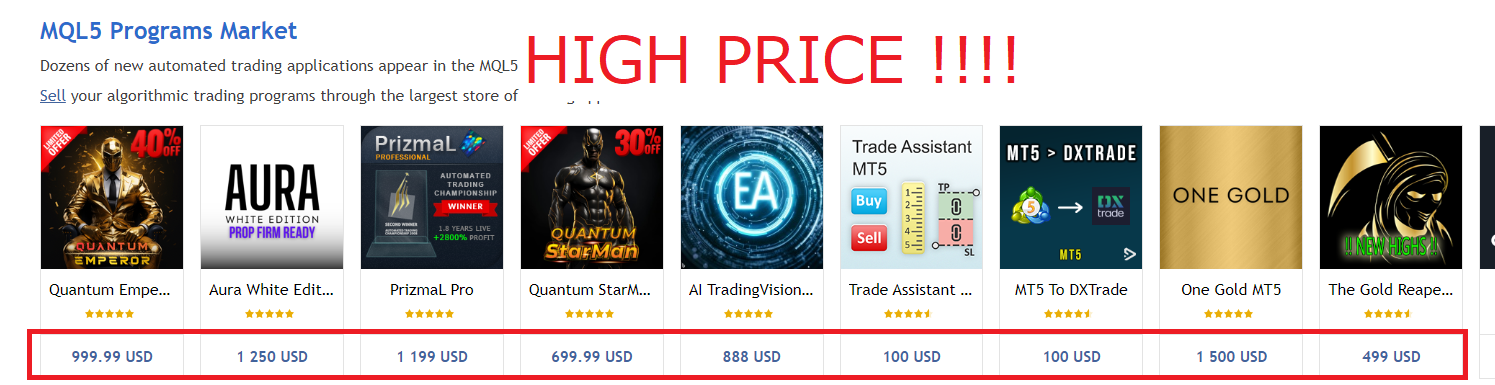

The purchase price of EA depends on the thing, but most of them are 200USD-500USD.

EA can be purchased at the MQL5 Store or the sales page of each vendor.

(This site distributes EA for free.)

In addition, to operate EA, it is necessary to operate a computer with MT4 or MT5 for 24 hours.

There are the following disadvantages when a home computer is operated for 24 hours.

Disadvantages of full PC operation

- If communication failure occurs due to power down or network malfunction, there is a risk that the EA will not move and large loss will occur.

- If you run your computer for 24 hours, your electricity bill will increase

- If PC is moved for 24 hours, the deterioration will be faster and replacement will be required sooner.

There are many disadvantages to running EA on your PC.

Therefore, to run EA, it is common to use a rental server called VPS (Virtual Private Server).

To use the rental server, a monthly fee of about 20USD to 40USD is required.

Are there any profitable EAs?

I have actually confirmed the performance of more than a few hundred EAs.

For your reference, I have created an “EA Review Article” for a famous EA.

Some EAs may continue to win, but if you want to use them, you need to be aware of the following weak points of EAs.

EA weaknesses

- An EA that uses single logic will give good results only within a certain period of time. However, there is a possibility of losing when the market movement changes.

- EA results vary greatly depending on the operating environment and settings. Therefore, the same result as the developer test may not be obtained. (Especially, the scalping EA is greatly affected by slippage, etc. The results vary greatly depending on the broker and VPS used.)

Summary of EA

Disadvantages of EA

- It is a little difficult to prepare for operation. EA purchase, MT4 set, parameter setting, VPS rental, etc.

- The purchase cost is high.

- When using VPS, fixed monthly fee is incurred. If EA does not make profits that exceed the VPS fee, profits will be negative, so it is necessary to trade with a slightly larger fund volume.

- Especially in the case of the scalping EA, the result varies depending on the operating environment, so there is a risk that the result will not be known until it is used.

Advantages of EA

- You can customize the lot size and risk by adjusting the parameters yourself.

- All profits gained from trading are yours.

Compared to the PAMM account, which will be explained in detail later, automatic trading using EA is a little more difficult.

Features of PAMM

What is PAMM?

In PAMM, trading managers and investors can make a profit together.

The manager decides in advance the distribution of profits between himself and the investor.

Profit sharing to investors = 70%: Profit sharing to managers = 30%

Profit sharing to investors = 80%: Profit sharing to managers = 20%

After trading, if profits are generated, profits are distributed to managers and investors according to the distribution ratio.

Conversely, if loss occurs, it will be distributed to the manager and investors.

Costs of PAMM investment

Once you deposit into PAMM account, you just have to wait for the profit / loss to be allocated based on the manager’s trading results.

Profits are distributed to managers according to the profit distribution ratio, but it is a great advantage that no other costs or labor is required.

(Note that there is no fixed cost, but of course there is a risk of losing the funds you have deposited.)

Cost benefits of PAMM

- No need to purchase software like EA

- No fixed costs such as VPS rental fees

- No need for a PC for chart analysis and trading

- Just deposit money into PAMM account on your smartphone

- No need to set VPS & MT4

Summary of PAMM

PAMM has some disadvantages, but I think the benefits are greater than EA.

Disadvantages of PAMM

- In the case of a PAMM-provided broker that does not display the trade history, it is difficult to verify the trading method. Even if the profit and loss graph looks good, it may actually use a very high-risk approach.

- Even if you make a withdrawal request, you cannot withdraw immediately. (In many cases, withdrawals can only be processed every 1 to 2 weeks in order to protect managers’ trading activities. This is because withdrawals that exceed the free margin cannot be made realistically while holding positions.)

- For better or worse, you can’t intervene your discretion in trading. The transaction is completely left to the judgment of the PAMM manager.

Advantages of PAMM

- There is no fixed cost or labor. Once you deposit, you don’t have to do anything. This is the biggest advantage of PAMM.

- The results published by the broker are reflected directly in your account. So, it is possible to make investment decisions by predicting expected values from past results.

In EA, the seller’s forward test shows good results, but when you actually use it, you may lose.

On the other hand, in PAMM, the results of managers and users are the same. (managers get rewards based on the profit share, but the transaction results are the same.)

If you want to know more about how PAMM works, please refer to the article “What is PAMM? Detailed explanation“.

Summary of comparison between PAMM and EA

Both PAMM and EA have advantages and disadvantages.

PAMM does not require fixed costs or labor, and can be profitable.

On the other hand, EA has “interestingness” that allows you to customize the transaction yourself.

However, it is necessary to be prepared for the possibility of losing funds in all EA, PAMM, and manual trades.

Once we understand this risk, we need to invest money while verifying which method has the highest expectations.

If you invest in a good PAMM manager or EA, you might see significant profits in the future.

Reference) PAMM brokers list and reviews (profitability, safety)

Optimize Your Trading Environment with a World-Class FX Broker: IC Markets

To fully leverage the free EA provided on our site, it’s essential to choose a top-tier broker. IC Markets delivers an exceptional trading experience through ultra-low spreads, lightning-fast execution, and a highly reliable trading infrastructure, earning the trust of professionals and beginners worldwide.

- Ultra-Low Spreads from 0.0 pips & Prime Liquidity: Enjoy deep liquidity sourced from top-tier interbank providers, ensuring consistently competitive spreads.

- Lightning-Fast Execution & Stability: With servers located in key financial hubs (London, New York, Tokyo), experience seamless, high-speed execution.

- Trust & Transparency: Fully licensed and regulated by reputable authorities, IC Markets provides a secure and transparent trading environment.

By registering with IC Markets through our special link, you unlock optimal trading conditions perfectly suited to enhance your strategies and get the most out of our free EA.